San Jose, California Receipt and Withdrawal from Partnership: Explained Partnerships form an integral part of the business landscape in San Jose, California. Operating a partnership involves the mutual agreement between two or more individuals or entities to work together and share the profits, losses, and responsibilities. However, circumstances may arise where one partner decides to leave the partnership, resulting in the need for a detailed San Jose, California receipt and withdrawal process. In this article, we will delve into the various aspects of receipt and withdrawal from partnership, highlighting the different types and essential points to consider. Types of San Jose, California Receipt and Withdrawal from Partnership: 1. Voluntary Withdrawal: Voluntary withdrawal from a partnership occurs when a partner voluntarily decides to terminate their involvement in the business. This could result from personal reasons, financial considerations, or a desire to pursue other opportunities. 2. Involuntary Withdrawal: In some cases, partners may be forced to leave the partnership against their will. This typically occurs when a partner breaches the terms of the partnership agreement or engages in unethical or illegal activities. In such instances, the remaining partners may take legal action to remove the offending member. 3. Retirement: Retirement-based withdrawal occurs when a partner reaches a pre-determined age or fulfills certain criteria outlined in the partnership agreement, signaling their intention to exit the business and retire. Receipt and Withdrawal Process: 1. Partnership Agreement: It is crucial to have a well-drafted partnership agreement that outlines the terms and conditions for receipt and withdrawal. The agreement should include provisions for voluntary and involuntary withdrawal scenarios, retirement, and the distribution of assets, liabilities, and profits. 2. Partner Notification: The withdrawing partner should notify the remaining partners about their intention to leave the partnership. This serves as an opportunity for all parties involved to discuss the implications, negotiate terms, and find a resolution. 3. Valuation of Partnership: If the retiring or withdrawing partner has a financial stake in the partnership, a professional valuation of the business's assets and liabilities may be required. This valuation helps determine the value of the withdrawing partner's share and facilitates an equitable distribution. 4. Legal Documentation: Once both parties reach an agreement on the terms of withdrawal, it is essential to document the agreement through legal means. This ensures clarity, prevents disputes, and protects the interests of all parties involved. 5. Asset Distribution: After withdrawal, the partnership assets should be distributed according to the agreement. This may involve transferring assets to the remaining partners, selling assets, or dividing them based on predetermined guidelines. 6. Dissolution of Partnership: In certain cases, complete dissolution of the partnership may be necessary. This typically occurs when there are no remaining partners or when all parties agree that the business is no longer viable. Dissolution involves fulfilling legal requirements, settling any remaining liabilities, and closing relevant business accounts. In conclusion, San Jose, California receipt and withdrawal from partnership involves a comprehensive process that requires careful consideration and documentation. Whether it is voluntary or involuntary withdrawal, retirement-based exit, or partnership dissolution, partners must adhere to the terms outlined in the partnership agreement, value the business's assets, and navigate the legal aspects to ensure a smooth transition.

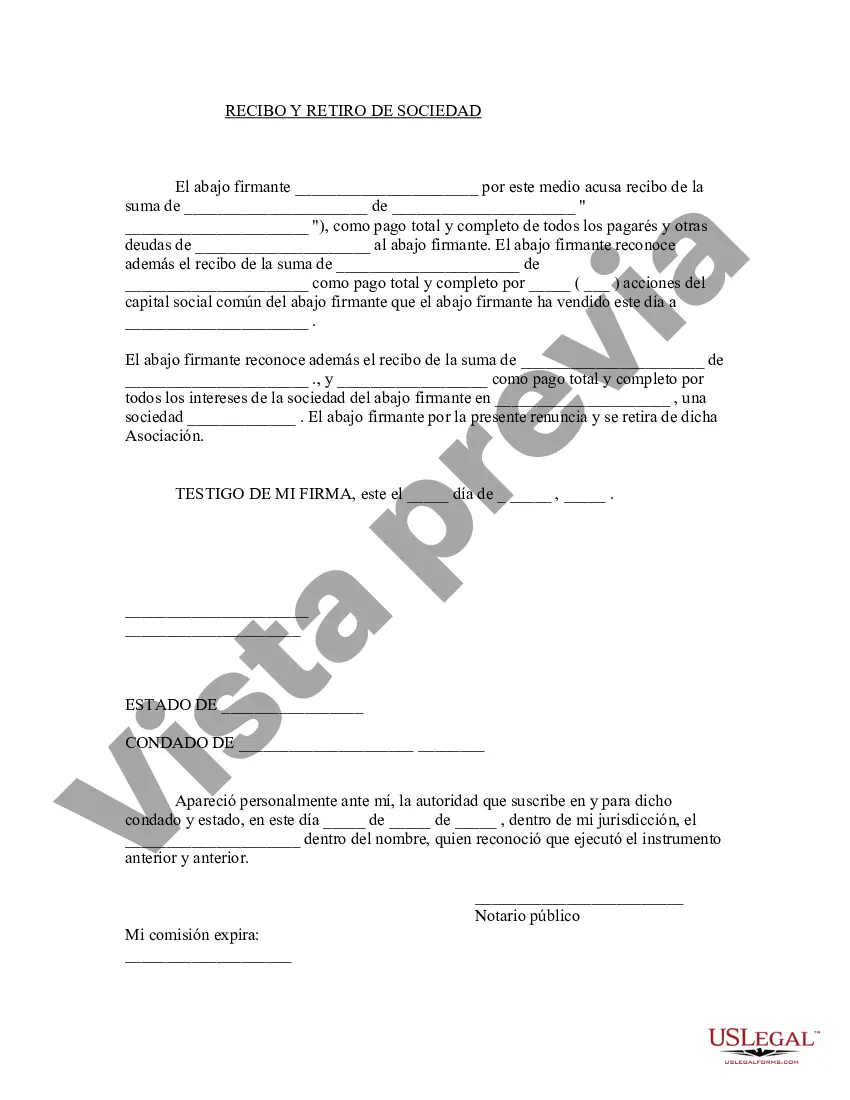

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out San Jose California Recepción Y Retiro De La Sociedad?

Preparing paperwork for the business or personal needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate San Jose Receipt and Withdrawal from Partnership without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid San Jose Receipt and Withdrawal from Partnership on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the San Jose Receipt and Withdrawal from Partnership:

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any use case with just a few clicks!