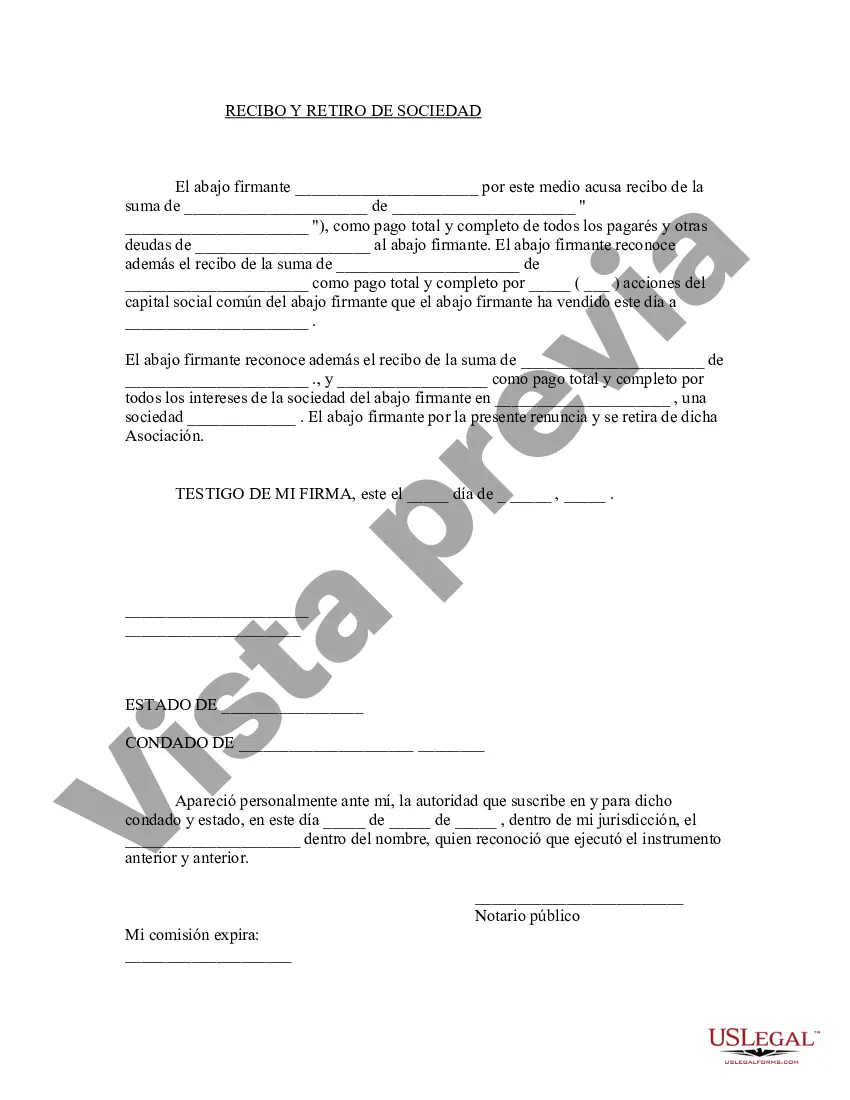

Santa Clara California Receipt and Withdrawal from Partnership can refer to the legal process and documentation involved when an individual or entity receives or withdraws from a partnership in Santa Clara, California. When a partner joins a partnership in Santa Clara, California, a receipt is usually issued to acknowledge their contribution to the partnership. This receipt is a legal document that outlines the partner's financial or non-financial contribution, including assets, capital, or other resources. On the other hand, a withdrawal from a partnership occurs when a partner decides to cease their involvement in the business. This process often involves the settlement of financial matters, including the distribution of assets, liabilities, profits, and losses. The withdrawal may be voluntary, such as when a partner retires or pursues other business ventures, or it may be involuntary due to death or dissolution of the partnership. There can be different types of Santa Clara California Receipt and Withdrawal from Partnership, including: 1. Capital Contribution Receipt: This receipt is issued when a partner contributes capital to the partnership. It outlines the partner's financial investment and the corresponding ownership interest in the partnership. 2. Asset Contribution Receipt: If a partner contributes assets, such as equipment, real estate, or intellectual property, to the partnership, an asset contribution receipt is issued. This document details the transferred assets and their valuation. 3. Profit and Loss Distribution Agreement: When a partner decides to withdraw from the partnership, a profit and loss distribution agreement is typically formulated. This agreement outlines how the partner's share of profits and losses will be distributed among the remaining partners or specified in the partnership agreement. 4. Partnership Dissolution Agreement: In case the entire partnership is dissolved, either voluntarily or involuntarily, a partnership dissolution agreement is prepared. This document outlines the terms of dissolution, including the division of partnership assets, settlement of liabilities, and termination of the partnership. 5. Retirement or Resignation Agreement: When a partner decides to retire or resign from the partnership, a retirement or resignation agreement is often created. This agreement defines the partner's rights, responsibilities, and obligations upon exit, including any financial settlements or ongoing obligations. In summary, Santa Clara California Receipt and Withdrawal from Partnership encompass various legal documents and processes involved when a partner joins or withdraws from a partnership based in Santa Clara, California. These include receipts for capital and asset contributions, agreements related to profit and loss distribution, partnership dissolution, and retirement or resignation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Santa Clara California Recepción Y Retiro De La Sociedad?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life situation, locating a Santa Clara Receipt and Withdrawal from Partnership suiting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Santa Clara Receipt and Withdrawal from Partnership, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Santa Clara Receipt and Withdrawal from Partnership:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Santa Clara Receipt and Withdrawal from Partnership.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!