Travis Texas Receipt and Withdrawal from Partnership: A Comprehensive Guide Introduction: Travis Texas Receipt and Withdrawal from Partnership refer to the process of documenting and acknowledging the receipt of funds or assets by an individual or entity involved in a partnership in the state of Texas. This procedure allows a partner to withdraw from a partnership, either through the distribution of their share of profits or the transfer of their interest in the partnership. Importance and Legal Framework: The receipt and withdrawal process in Travis Texas has a significant impact on the finances, ownership structure, and legal obligations within a partnership. It is essential to adhere to the relevant regulations outlined in the Texas Business and Commerce Code, as well as any partnership agreement or contract in place. Types of Travis Texas Receipt and Withdrawal from Partnership: 1. Profit Distribution: When partners wish to distribute profits, the Travis Texas Receipt and Withdrawal form is used to document the amount each partner is entitled to receive. This process ensures transparency and accountability in profit sharing. 2. Transfer of Partnership Interest: In situations where a partner intends to transfer their interest in the partnership to another individual or entity, a specific Travis Texas Receipt and Withdrawal form is used. This document evidences the transfer of rights, obligations, and ownership in the partnership. 3. Retirement or Resignation: If a partner decides to retire or resign from the partnership, the Travis Texas Receipt and Withdrawal process formally acknowledges their withdrawal. It may involve the settlement of their accounts, distribution of assets, and the redistribution of ownership and management responsibilities among the remaining partners. 4. Dissolution of the Partnership: In cases where a partnership is dissolved, all partners must undergo the Travis Texas Receipt and Withdrawal process. This type of receipt and withdrawal documentation ensures the fair allocation of assets, liabilities, and any remaining partnership funds among the partners. 5. Admission of New Partners: When a new partner joins an existing partnership, the Travis Texas Receipt and Withdrawal process facilitates the proper acknowledgment of their contribution, investment, and entitlements. This helps to maintain transparency and ensure a smooth transition for all parties involved. Conclusion: Travis Texas Receipt and Withdrawal from Partnership is a crucial procedure that allows partners to manage their financial interests, transfer ownership rights, redistribute profits, and ensure the smooth functioning of a partnership. Understanding the different types and the legal framework surrounding these procedures is essential to maintain compliance and avoid any disputes or complications.

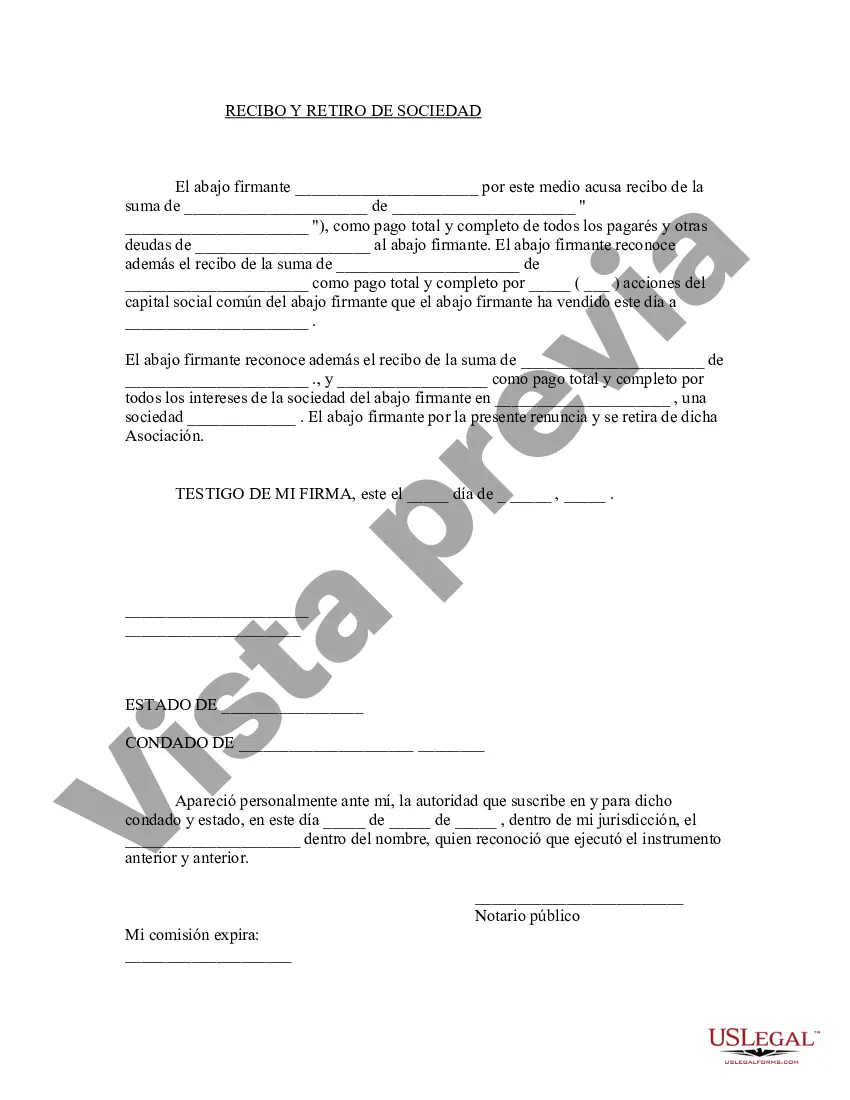

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Travis Texas Recepción Y Retiro De La Sociedad?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, locating a Travis Receipt and Withdrawal from Partnership suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. In addition to the Travis Receipt and Withdrawal from Partnership, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Travis Receipt and Withdrawal from Partnership:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Travis Receipt and Withdrawal from Partnership.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!