Wayne Michigan Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Recepción Y Retiro De La Sociedad?

A document procedure consistently accompanies any legal action you undertake.

Establishing a business, submitting or accepting a job proposal, transferring ownership, and numerous other life scenarios require you to prepare formal documentation that varies across the nation. That is why consolidating everything in one location is immensely beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents. On this platform, you can effortlessly locate and download a document for any personal or business need utilized in your area, including the Wayne Receipt and Withdrawal from Partnership.

Finding templates on the platform is incredibly straightforward. If you already have a membership to our service, Log In to your account, search for the sample using the search bar, and click Download to save it on your device. After that, the Wayne Receipt and Withdrawal from Partnership will be accessible for further use in the My documents section of your profile.

Utilize it as necessary: print it or fill it out digitally, sign it, and send it where required. This is the most straightforward and dependable method to obtain legal documents. All the samples available in our library are expertly drafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Ensure you have accessed the correct page with your local form.

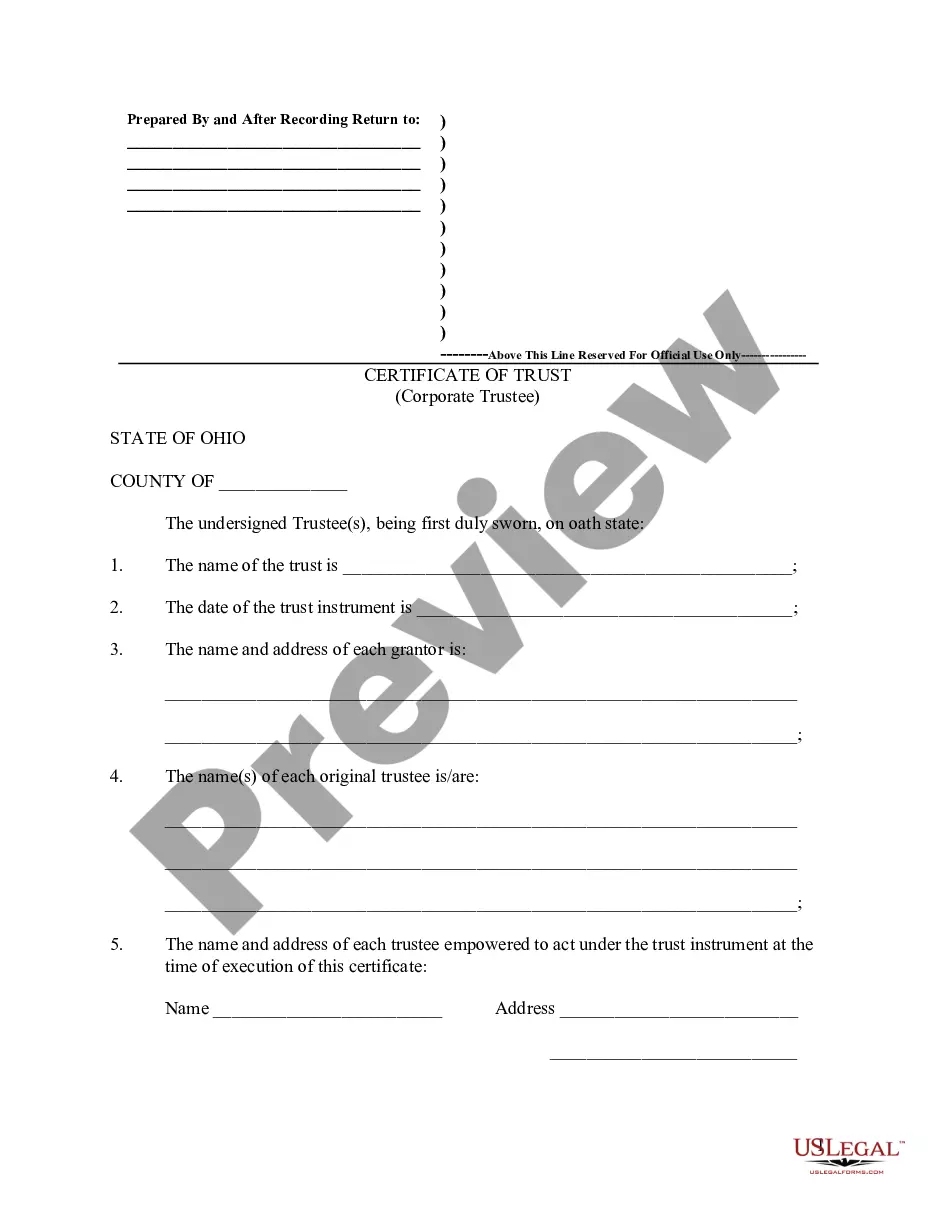

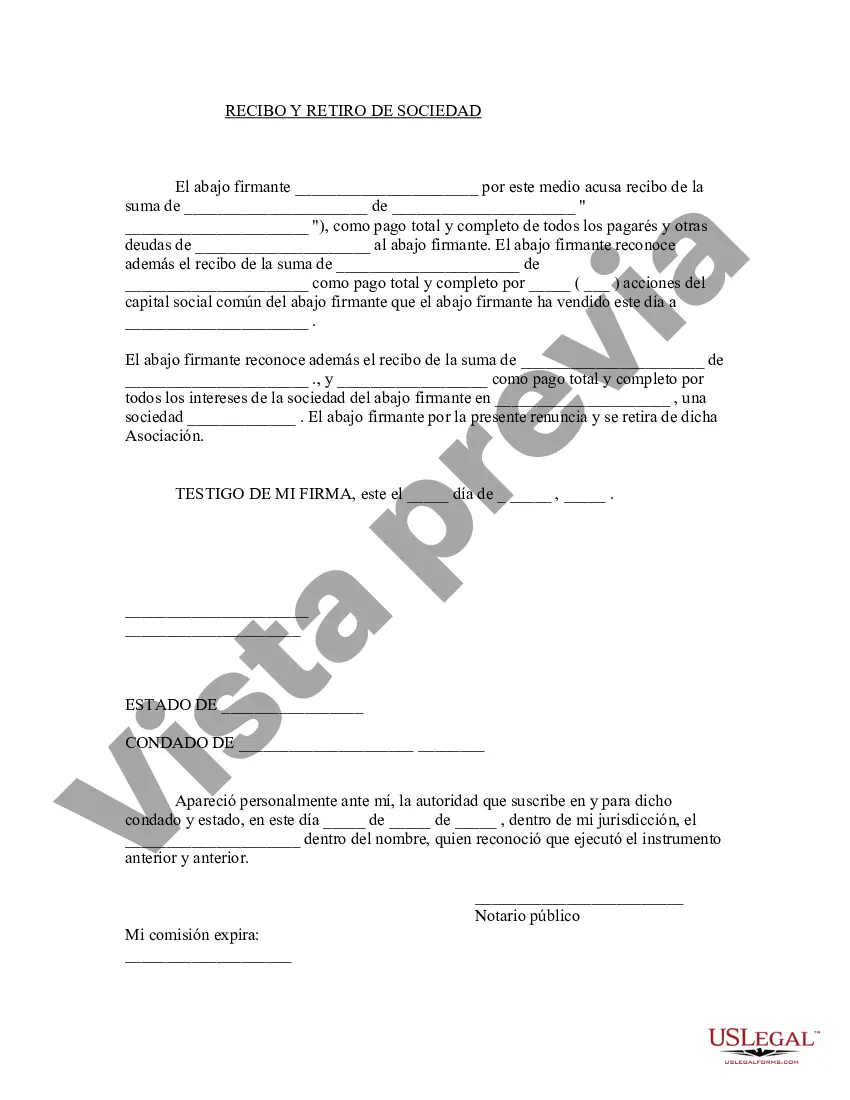

- Use the Preview mode (if available) and review the sample.

- Examine the description (if any) to confirm the form meets your needs.

- Search for an alternative document using the search tab if the sample does not suit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (via credit card or PayPal) to proceed.

- Select file format and save the Wayne Receipt and Withdrawal from Partnership on your device.