Chicago Illinois Checklist — Leasing vs. Purchasing Chicago, the largest city in the state of Illinois, holds immense economic importance and serves as a business hub. When considering moving to or expanding a business in Chicago, one of the crucial decisions is whether to lease or purchase commercial property. To help potential investors and business owners make an informed choice, here is a detailed description of the Chicago Illinois Checklist for Leasing vs. Purchasing, highlighting essential factors to consider. 1. Location: Determine the preferred neighborhood or district in Chicago that aligns with your business requirements. Consider factors such as proximity to customers, suppliers, transportation hubs, and the local business environment to ensure maximum growth potential. 2. Market Research: Conduct thorough market research to understand the real estate trends, property values, and rental rates in various Chicago neighborhoods. Compare the costs of leasing and purchasing commercial spaces to identify the most cost-effective option for your business. 3. Budget and Financing: Assess your financial capabilities and determine the budget for leasing or purchasing a property in Chicago. Explore financing options, such as loans or mortgages, and evaluate their feasibility in both scenarios. 4. Business Growth Plans: Evaluate your long-term business growth plans and determine the facility requirements accordingly. Leasing provides flexibility for expansion or contraction, while purchasing offers stability but limited flexibility for future adjustments. 5. Lease Terms and Conditions: If considering leasing, carefully review lease agreements, considering factors such as lease duration, rental escalation clauses, maintenance responsibilities, and renewal options. Seek legal advice to ensure all terms align with your business goals. 6. Property Maintenance: Assess the upkeep responsibilities associated with owning a property. Purchasing necessitates maintenance costs, while leasing often includes property management and maintenance covered by the landlord. Consider these factors and their impact on your business expenses. 7. Tax Implications: Understand the tax implications of both leasing and purchasing in Chicago. Consult with a tax professional to determine the tax benefits, deductions, and potential savings associated with each option. 8. Exit Strategy: Plan an exit strategy in case your business operations change or if you decide to relocate. Determine the feasibility of selling or subleasing owned property, or negotiating early lease terminations if you choose to lease. Types of Chicago Illinois Checklist — Leasing vs. Purchasing: 1. Commercial Leasing vs. Commercial Purchasing: This comparison focuses on the considerations specifically relevant to businesses looking for commercial property in Chicago. 2. Residential Leasing vs. Residential Purchasing: For individuals or families considering residential properties in Chicago, this checklist highlights the factors to consider when deciding to lease or purchase a home. 3. Industrial Leasing vs. Industrial Purchasing: Industries that require warehouses or manufacturing facilities can refer to this checklist, emphasizing the unique considerations associated with leasing or purchasing industrial properties in Chicago. By carefully assessing these factors and considering the specific needs of your business, you can make an informed decision between leasing and purchasing a property in Chicago, Illinois. Bear in mind that there are various types of checklists available, depending on the specific nature of the property you are considering.

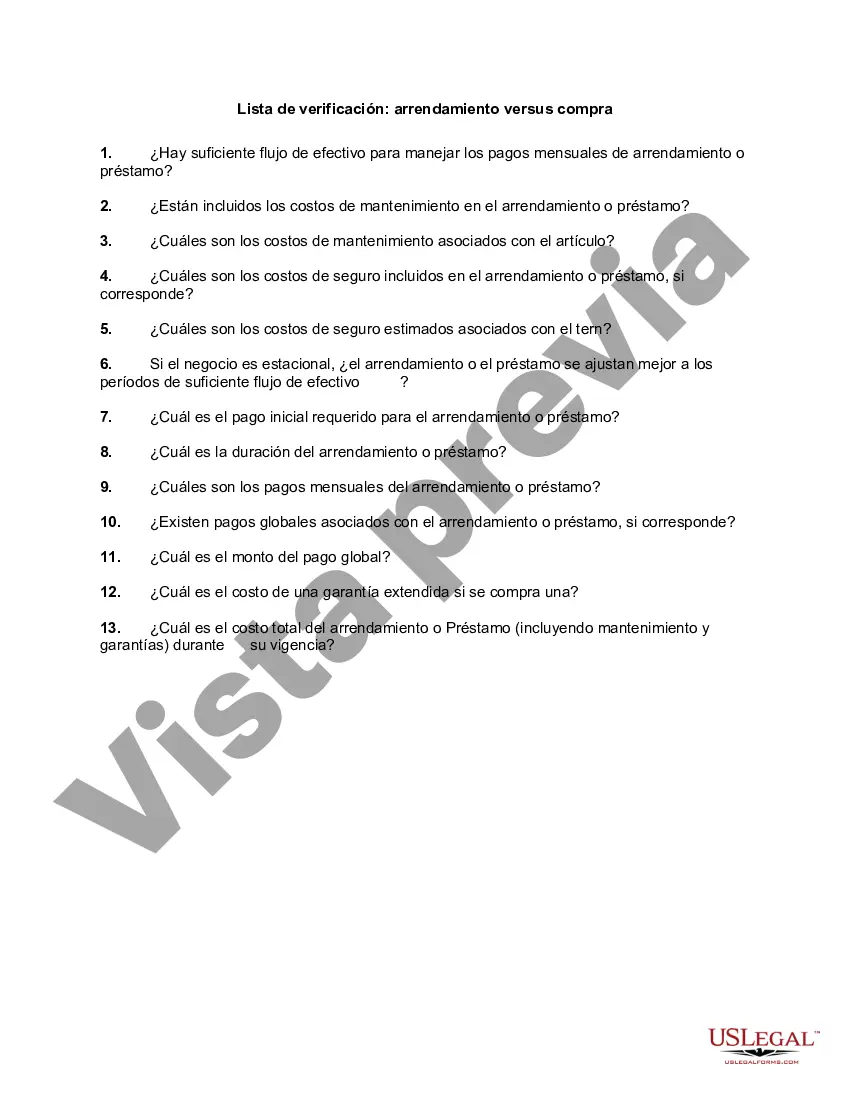

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Chicago Illinois Lista De Verificación: Arrendamiento Versus Compra?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Chicago Checklist - Leasing vs. Purchasing suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. Apart from the Chicago Checklist - Leasing vs. Purchasing, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Chicago Checklist - Leasing vs. Purchasing:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Checklist - Leasing vs. Purchasing.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!