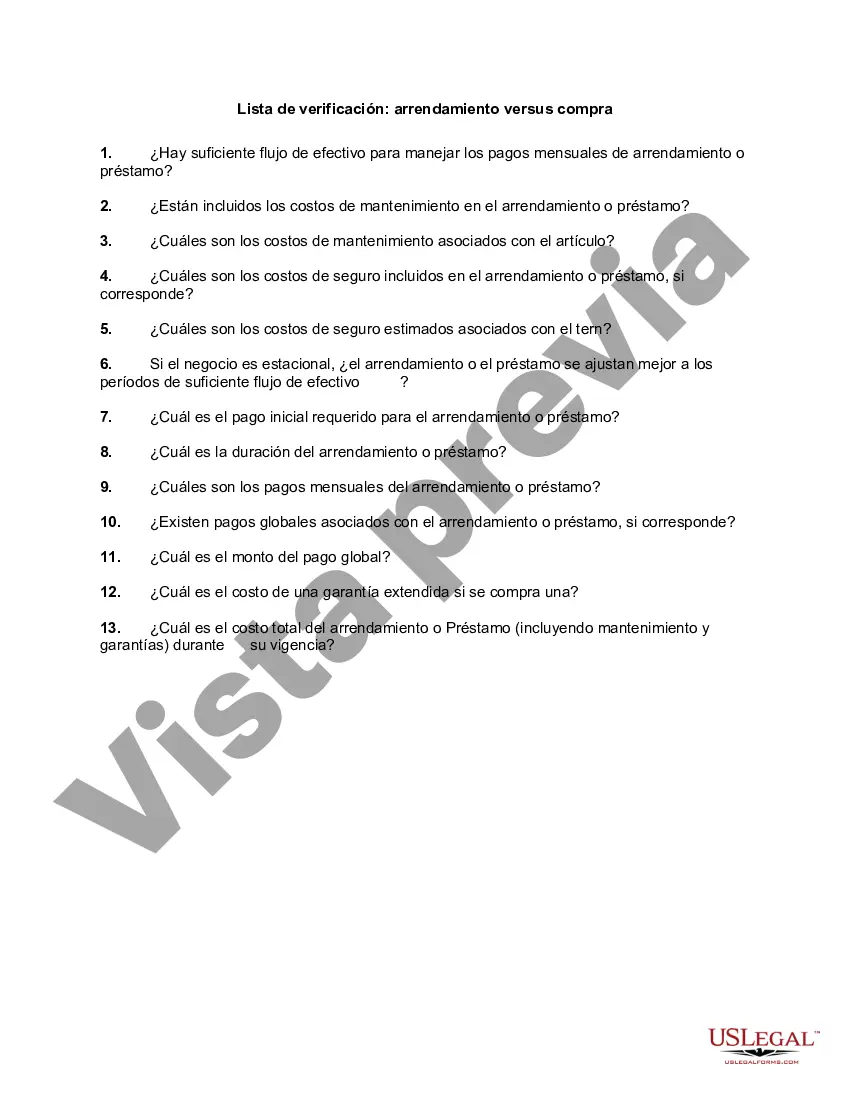

Harris Texas is a county located in the southeastern part of the state. As a prospective resident or business owner, it is important to consider the housing options available in Harris Texas. When it comes to finding a place to live or establish a business, individuals often face the decision of leasing or purchasing property. To assist you in making an informed choice, it is essential to consider the Harris Texas Checklist for Leasing vs. Purchasing. 1. Leasing: Leasing refers to renting a property for a certain period, usually on a monthly basis. This option is often preferred by individuals or businesses who require flexibility in terms of location or duration of stay. The Harris Texas Checklist for leasing includes the following key factors: — Rental Agreement: Understand the terms and conditions of the lease agreement, including the duration, payment terms, and any additional charges or fees. — Landlord's Responsibility: Review the landlord's responsibilities such as property maintenance, repairs, and utilities covered. — Lease Renewal Options: Determine if there are options to renew the lease once it ends and if the terms would remain the same or change. — Security Deposit: Clarify the amount of the security deposit required and the conditions for its return at the end of the lease. 2. Purchasing: Purchasing property in Harris Texas involves buying a property outright, giving individuals or businesses ownership and investment opportunities. Consider the following aspects when going through the Harris Texas Checklist for purchasing property: — Property Financing: Evaluate your financial situation and secure a mortgage loan if needed. Research lenders in Harris Texas to find competitive rates and favorable terms. — Property Value: Assess the current and potential future value of the property to ensure it aligns with your long-term goals and investment plans. — Property Inspections: Arrange for a thorough inspection to uncover any hidden issues or required repairs before committing to the purchase. — Ownership Responsibilities: Understand the responsibilities associated with property ownership, including taxes, maintenance, and insurance. By examining the Harris Texas Checklist for Leasing vs. Purchasing, individuals can weigh the pros and cons of each option based on their specific needs, budget, and long-term goals. This checklist is designed to serve as a valuable guide, helping individuals make an informed decision that suits their unique circumstances. Note: It is important to ensure that the information mentioned here is relevant to Harris Texas and its specific leasing and purchasing guidelines.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Harris Texas Lista De Verificación: Arrendamiento Versus Compra?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Harris Checklist - Leasing vs. Purchasing without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Harris Checklist - Leasing vs. Purchasing by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step guide below to get the Harris Checklist - Leasing vs. Purchasing:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!