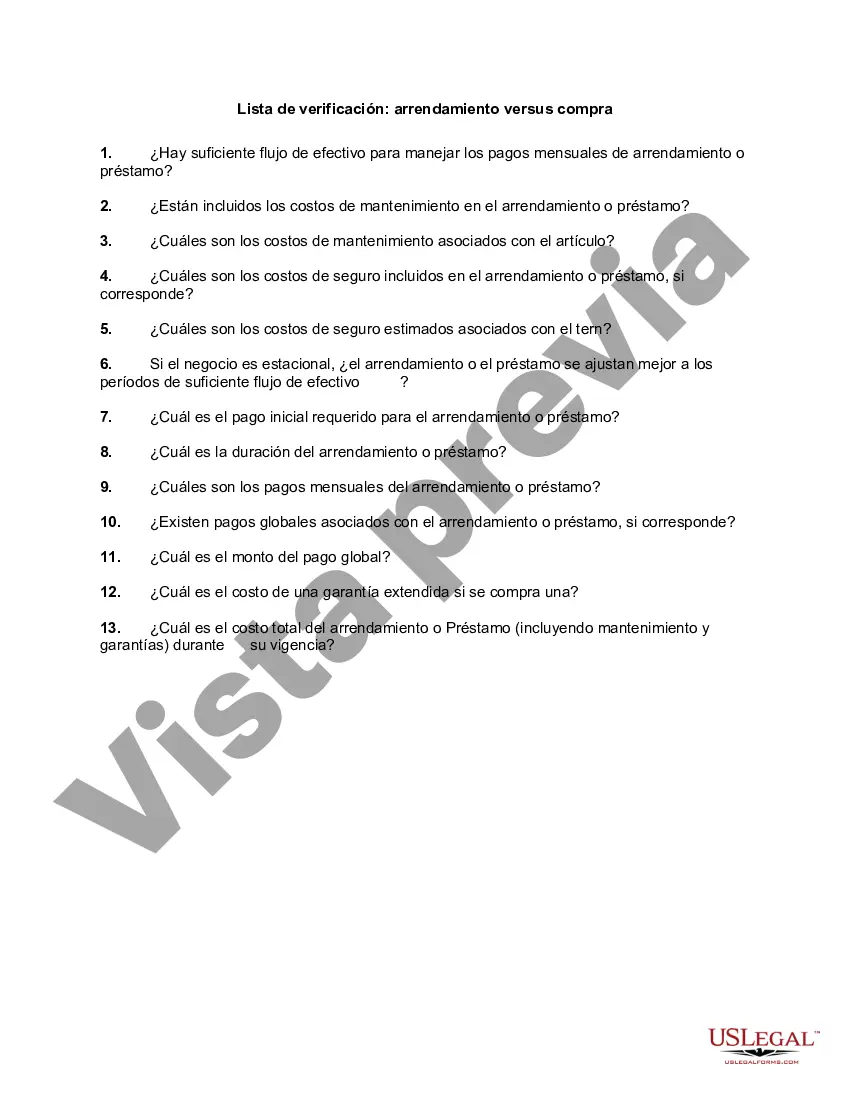

Leasing vs. Purchasing: A Detailed Comparison for Houston, Texas Checklist When it comes to acquiring a new property in Houston, Texas, potential homeowners or business owners face the decision of leasing or purchasing. Both options have their own set of advantages and disadvantages, making it crucial to assess individual needs and long-term goals. This detailed checklist aims to help you evaluate leasing and purchasing options in Houston, Texas, while considering essential factors and making an informed decision. 1. Financial Considerations: — Calculate expected costs: Determine the initial investment, monthly payments, maintenance charges, property taxes, and insurance premiums for both leasing and purchasing. — Assess income stability: Analyze your financial situation to explore your ability to afford mortgage payments, potential rental income, or flexibility in case of unexpected expenses. — Evaluate return on investment: Consider appreciation potential, tax benefits, and the possibility of equity-building opportunities associated with purchasing a property in Houston, Texas. 2. Flexibility and Mobility: — Evaluate short-term plans: If you require flexibility due to relocation opportunities, leasing might be a suitable option, allowing you to move without major commitments. — Assess long-term goals: If you plan on settling down in Houston long-term or wish to customize the property to your preferences, purchasing offers more stability and control. 3. Property Maintenance and Responsibility: — Leasing convenience: Lease arrangements often shift maintenance responsibilities to the landlord, reducing the need for major repairs or renovations. — Ownership obligations: Purchasing entails the responsibility of repairs, maintenance, and any associated costs. Evaluate whether you have the time, resources, or desire to manage these responsibilities. 4. Market Conditions and Property Availability: — Analyze current Houston real estate market trends: Research market conditions, interest rates, and property appreciation potential to gauge whether it's a favorable time to purchase or lease. — Property availability: Consider the availability of suitable properties for both leasing and purchasing options in different neighborhoods and areas within Houston, Texas. 5. Tax Implications: — Consult with a tax professional: Understand the tax implications associated with leasing and purchasing properties in Houston, including deductions, write-offs, and potential tax benefits. — Assess personal tax circumstances: Evaluate how your personal tax situation will be affected by leasing or purchasing, considering factors such as local tax rates and income bracket. Different Types of Houston, Texas Checklist — Leasing vs. Purchasing— - Residential property checklist: Focuses on factors specific to leasing or purchasing residential properties in Houston, Texas, including neighborhood preferences, community amenities, and potential for rental income. — Commercial property checklist: Addresses considerations related to leasing or purchasing commercial properties in Houston, such as proximity to target markets, accessibility, and zoning regulations. In conclusion, this detailed checklist equips individuals with valuable insights while considering the leasing vs. purchasing decision in Houston, Texas. By thoroughly assessing financial aspects, goals, property responsibilities, market conditions, tax implications, and available property types, you can make an informed choice that suits your specific needs and preferences in the vibrant city of Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Houston Texas Lista De Verificación: Arrendamiento Versus Compra?

Whether you intend to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Houston Checklist - Leasing vs. Purchasing is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Houston Checklist - Leasing vs. Purchasing. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Checklist - Leasing vs. Purchasing in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!