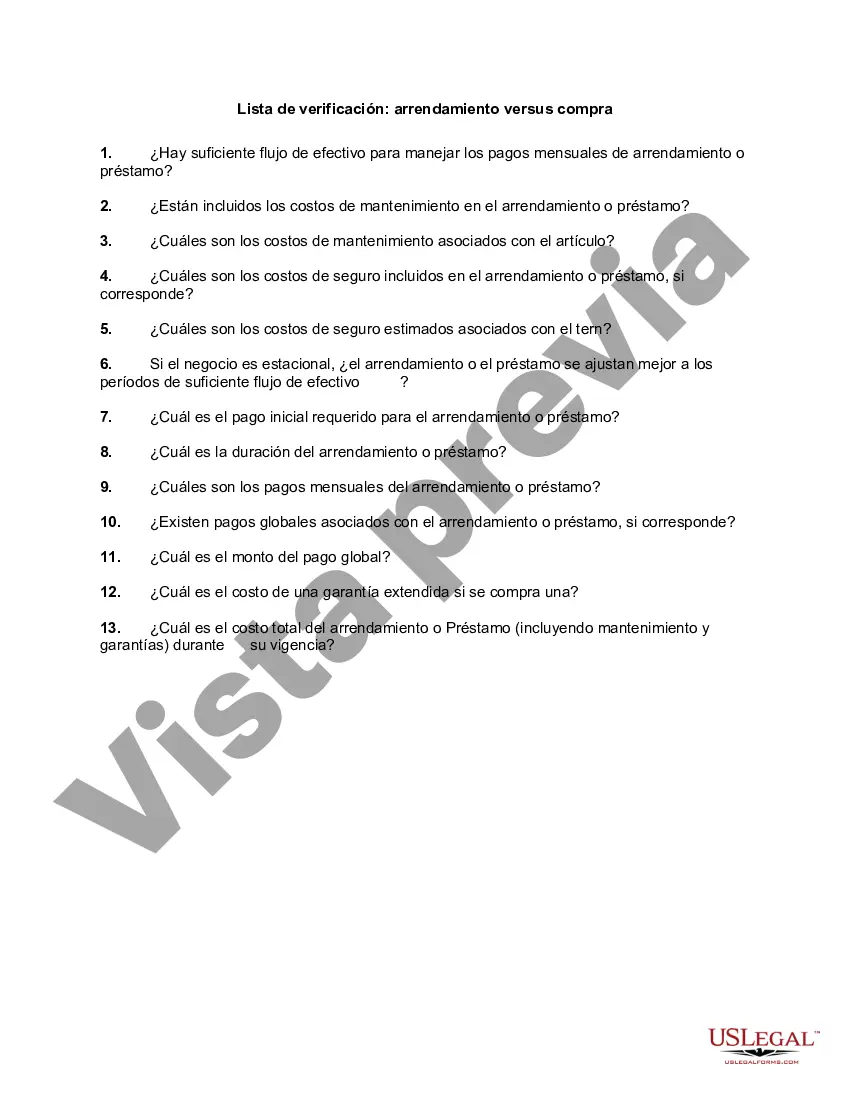

Riverside California Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Lista De Verificación: Arrendamiento Versus Compra?

Creating documents for personal or business needs is always a significant duty.

When formulating a contract, a public service application, or a power of attorney, it is vital to consider all federal and state legislation and regulations specific to the area.

Nonetheless, small counties and cities also have legislative measures that must be taken into account.

Take care to verify that the template meets legal standards and click Buy Now. Choose a subscription plan, then Log In or create an account with US Legal Forms. Use your credit card or PayPal to pay for your subscription. Download the selected file in your preferred format, print it, or fill it out electronically. The advantage of the US Legal Forms library is that all the documents you've ever obtained remain accessible - you can find them in your profile under the My documents section at any time. Join the platform and quickly secure verified legal forms for any scenario with just a few clicks!

- All these factors make it burdensome and lengthy to produce Riverside Checklist - Leasing vs. Purchasing without professional assistance.

- It is feasible to save on attorney fees for document preparation and independently create a legally valid Riverside Checklist - Leasing vs. Purchasing by utilizing the US Legal Forms online library.

- This resource is the most expansive online repository of state-specific legal forms that have been professionally validated, ensuring their legitimacy when selecting a template for your county.

- Previously registered users simply need to Log In to their accounts to obtain the required form.

- If you do not currently have a subscription, follow the step-by-step instructions below to acquire the Riverside Checklist - Leasing vs. Purchasing.

- Review the opened page and confirm if it contains the example you need.

- To do this, utilize the form description and preview if these functions are available.

Form popularity

FAQ

No hay tarifa para este permiso, pero uno es responsable de pagar los impuestos de la ciudad. Este proceso generalmente solo toma un dia, siempre y cuando tenga los documentos correctos: ID, ITIN / SSN. Debe tener un permiso de vendedor del Departamento de Administracion de Impuestos y Tarifas de California.

Debes ir a la oficina comercial de la ciudad o al centro de desarrollo de pequenas empresas y a la oficina del departamento de salud local para solicitar los permisos necesarios. El camion de comida debe ser inspeccionado por seguridad y debes obtener una licencia de comida movil.

Envie una Solicitud de licencia comercial de venta y adjunte los siguientes documentos: Registro corporativo y registro de nombre comercial (si corresponde) Aviso de registro de impuestos comerciales y certificado de manos limpias. Tarjeta de identificacion de gerente de proteccion de alimentos certificada.

Las licencias de cerveza y vino en el mercado abierto pueden oscilar entre $ 3,000 y $ 5,000.

En virtud de la Ley CARES, los inquilinos de ciertas propiedades amparadas no pueden ser desalojados por falta de pago del alquiler a menos que el propietario de un aviso de desalojo de 30 dias.

Solicitar un permiso de vendedor es gratis. Puede solicitar un permiso de vendedor visitando la seccion Servicios en linea de nuestro sitio web, ingresando a . Para completar su solicitud, debera proporcionar informacion sobre su negocio, incluidos detalles de sus cuentas bancarias e ingresos estimados.

Rentar una casa sin firmar un contrato de arrendamiento es un riesgo tanto para los arrendadores, como para los arrendatarios. De acuerdo con el articulo 2046 del Codigo Civil Federal, un contrato de arrendamiento debe entregarse por escrito o de lo contrario el arrendador sera responsabilizado por la falta.

Debe darse el aviso con una antelacion no menor de tres meses a traves del correo del servicio postal autorizado. Del mismo modo el tiempo que tiene un inquilino para desocupar un inmueble es de tres meses desde la fecha de aviso.

Aviso de 15 dias de pago o desalojo por deuda de renta entre el 1.º de septiembre de 2020 y el 30 de septiembre de 2021. El propietario puede darle un Aviso de pago o desalojo de 15 dias para exigir el pago de la deuda de renta de COVID-19.

Puede registrarse en linea para obtener un permiso, una licencia o una cuenta visitando nuestro sitio web y seleccionando Permits & Licenses (Permisos y licencias). El registro en linea tambien esta disponible en nuestras oficinas del CDTFA.