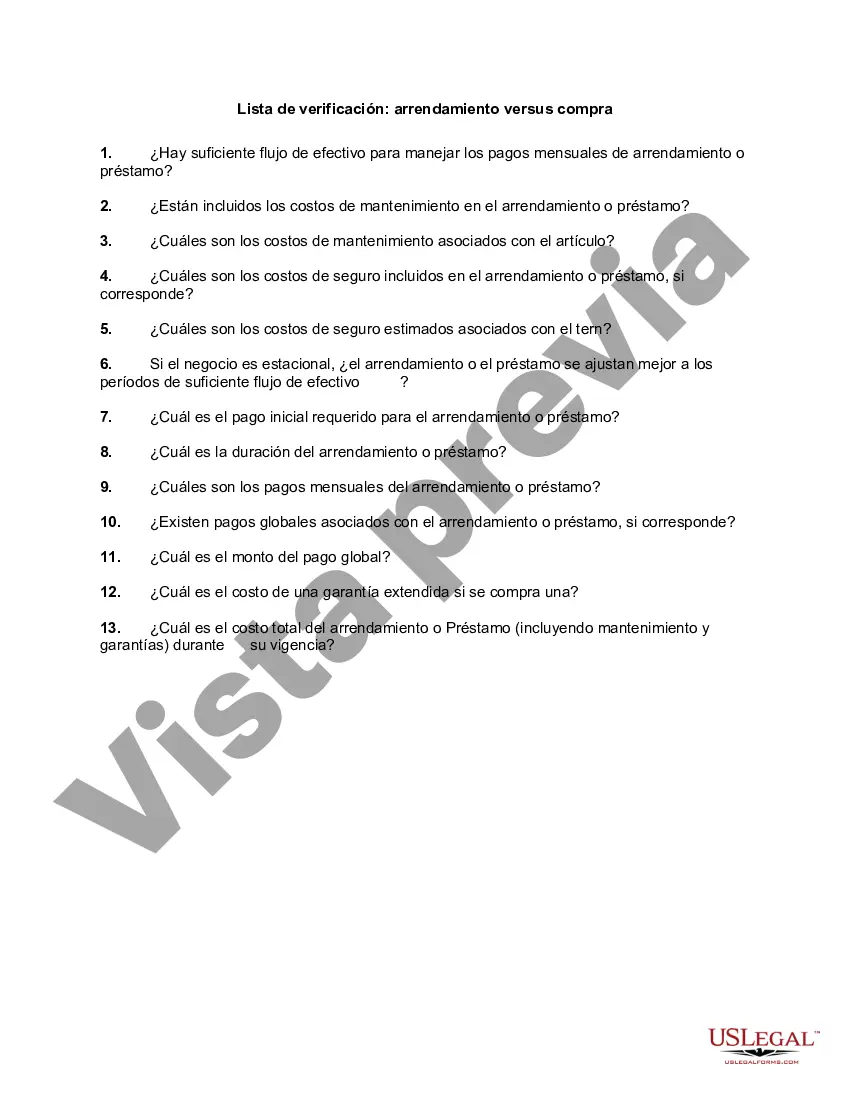

Travis Texas Checklist — Leasing vs. Purchasing: A Comprehensive Guide Introduction: Deciding between leasing and purchasing a property in Travis, Texas can be a significant financial decision. It's important to carefully consider various factors before making a choice that suits your specific needs and circumstances. This detailed checklist will highlight key considerations, benefits, and drawbacks of both leasing and purchasing options in Travis, Texas. 1. Understanding Leasing: — Residential Leasing: An overview of leasing residential properties in Travis, Texas, including apartments, houses, and condos. — Commercial Leasing: Exploring the ins and outs of leasing office spaces, retail stores, warehouses, or other commercial properties in Travis, Texas. — Short-term Leasing: Discussing the benefits and limitations of short-term leasing, such as month-to-month or sublet arrangements in Travis, Texas. 2. Weighing the Benefits of Leasing: — Flexibility and Mobility: Emphasizing the advantages of leasing, such as the ability to move or upgrade more easily compared to purchasing. — Lower Upfront Costs: Explaining how leasing often requires a smaller initial investment, making it more accessible to individuals or businesses with limited funds. — Maintenance and Repairs: Detailing how property maintenance and repairs are typically the landlord's responsibility, relieving tenants of potential financial burdens. 3. Considering the Drawbacks of Leasing: — Lack of Equity: Highlighting that leasing does not build equity, meaning the tenant does not accumulate ownership stake in the property. — Limited Customization: Discussing the restrictions tenants may face when wanting to alter or customize a leased property. — Rent Increase Risk: Mentioning the possibility of rent hikes at the end of lease terms, impacting budget planning. 4. Exploring the Advantages of Purchasing: — Long-term Investment: Emphasizing how purchasing a property builds equity over time, providing potential long-term financial benefits. — Customization Freedom: Discussing the freedom homeowners have to customize and modify the property according to their preferences. — Stability and Predictability: Illustrating how owning a property offers stability in terms of monthly payments and the absence of unexpected lease terminations. 5. Highlighting the Considerations of Purchasing: — Financial Commitment: Noting that purchasing a property requires a larger upfront investment, including a down payment, closing costs, and potential loan financing. — Responsibility for Maintenance: Discussing the homeowner's responsibility for all maintenance and repairs, which can be costly and time-consuming. — Limited Flexibility: Mentioning that selling a property may take time and effort, limiting the ability to easily relocate. Conclusion: In Travis, Texas, choosing between leasing and purchasing a property deserves careful deliberation. This comprehensive checklist provides insights into the various types of leasing, the benefits and drawbacks of both leasing and purchasing, and the considerations involved in each option. Ultimately, it is essential to consider your financial capacity, long-term goals, and lifestyle preferences when making this crucial decision.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Travis Texas Lista De Verificación: Arrendamiento Versus Compra?

Draftwing forms, like Travis Checklist - Leasing vs. Purchasing, to manage your legal affairs is a challenging and time-consumming task. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for various scenarios and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Travis Checklist - Leasing vs. Purchasing template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before getting Travis Checklist - Leasing vs. Purchasing:

- Make sure that your form is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Travis Checklist - Leasing vs. Purchasing isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin utilizing our service and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!