Cook Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories is a formal document that outlines the process and criteria for selecting a depository bank for a corporation and appointing signatories to the corporation's accounts. This resolution is essential for maintaining proper financial operations and ensuring effective management of the corporation's funds. The Cook Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories involves several key considerations and steps: 1. Purpose: The resolution clarifies that its purpose is to identify and authorize the selection of a depository bank and account signatories for the corporation. This underscores the importance of maintaining financial stability and security within the organization. 2. Background: The resolution provides a detailed background explaining the current financial situation of the corporation, including the need for a depository bank and the significance of choosing suitable signatories for the accounts. 3. Selection Criteria: The resolution establishes specific criteria for the selection of the depository bank. These may include the bank's reputation, financial stability, range of services, interest rates, accessibility, and compatibility with the corporation's financial goals and objectives. 4. Review Process: It outlines the steps involved in the evaluation and selection process of potential depository banks. This may include conducting research, seeking recommendations, reviewing proposals, and conducting interviews with representatives of shortlisted banks. 5. Decision-Making Authority: Specifies the individual(s) or committee responsible for making the final decision regarding the selection of the depository bank. This may involve the board of directors, shareholders, or a specific finance committee designated by the corporation's bylaws. 6. Appointment of Account Signatories: The resolution also addresses the selection of individuals who will act as signatories for the corporation's bank accounts. It outlines the qualifications and responsibilities expected of these individuals, emphasizing the importance of trustworthiness, financial competence, and fiduciary duty. 7. Documentation and Reporting: The resolution stresses the importance of proper documentation and record-keeping throughout the selection process. It may require the preparation of reports and the maintenance of records related to the evaluation and decision-making process. Types of Cook Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories: 1. General Resolution: This resolution applies to corporations seeking a depository bank for their regular banking needs. It covers a wide range of financial operations and may be used by corporations of various sizes and sectors. 2. Specialty Resolution: Some corporations may require a unique resolution tailored to their specific financial requirements. This could include corporations that deal with international transactions, complex banking operations, or corporations with specific regulatory or legal requirements. In conclusion, the Cook Illinois Resolution Selecting Depository Bank for Corporation and Account Signatories is a critical document for corporations aiming to manage their financial affairs efficiently. It outlines the process for selecting a depository bank and appointing signatories and ensures transparency, accountability, and compliance with the corporation's financial objectives.

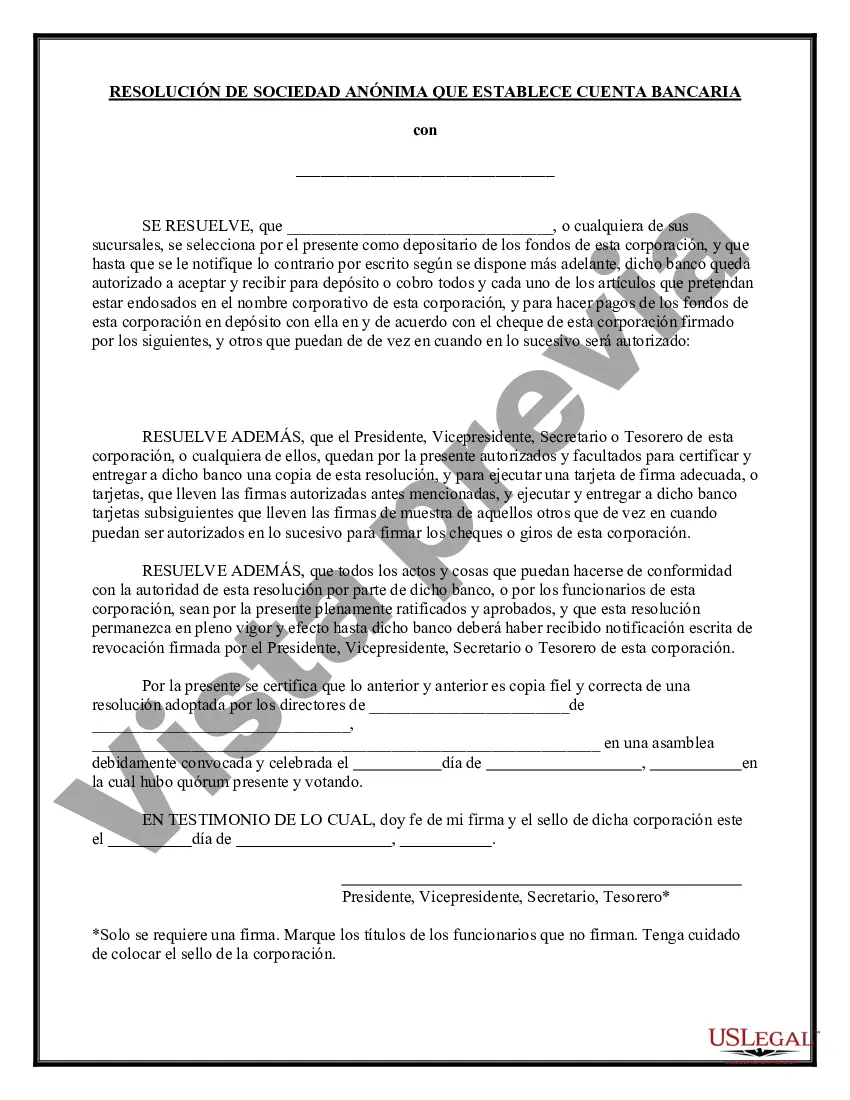

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Cook Illinois Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Cook Resolution Selecting Depository Bank for Corporation and Account Signatories is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few additional steps to get the Cook Resolution Selecting Depository Bank for Corporation and Account Signatories. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Resolution Selecting Depository Bank for Corporation and Account Signatories in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!