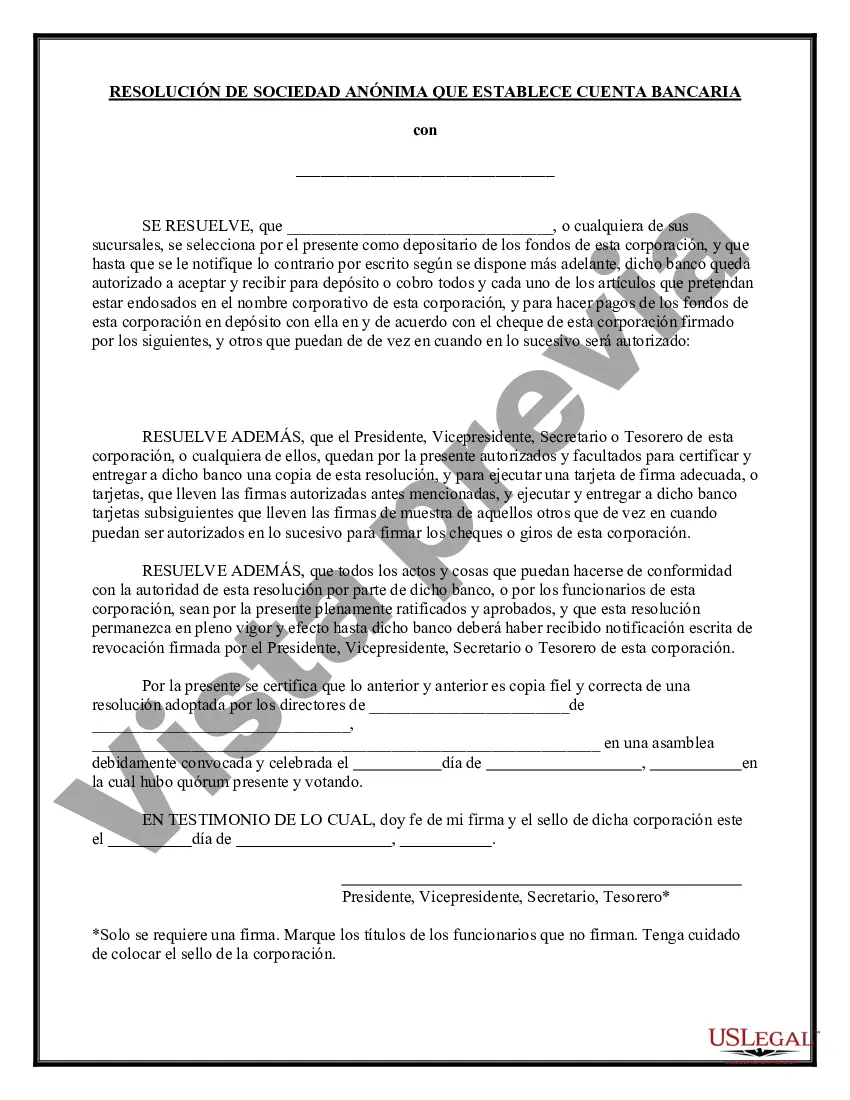

Maricopa Arizona Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

How to fill out Resolución De Selección De Banco Depositario Para Corporaciones Y Signatarios De Cuentas?

Statutes and rules in every domain vary across the nation.

If you're not a lawyer, it's simple to become confused by endless regulations when it comes to drafting legal documents.

To prevent expensive legal fees when preparing the Maricopa Resolution Choosing Depository Bank for Corporation and Account Signatories, you require a confirmed template suitable for your area.

Search for another document if there are discrepancies with any of your requirements. Utilize the Buy Now button to acquire the document once you find the appropriate one. Choose one of the subscription plans and log in or create an account. Decide on your preferred method to pay for your subscription (using a credit card or PayPal). Select the format you wish to save the file in and click Download. Complete and sign the document on paper after printing it or execute it all electronically. This is the simplest and most cost-effective way to obtain current templates for any legal purposes. Find them all with a few clicks and maintain your records in order with the US Legal Forms!

- That's when utilizing the US Legal Forms platform proves to be so beneficial.

- US Legal Forms is a reliable online repository used by millions containing more than 85,000 state-specific legal documents.

- It's an ideal solution for professionals and individuals looking for self-service templates for various life and business circumstances.

- All the forms may be used multiple times: once you select a sample, it stays available in your profile for future utilization.

- Therefore, if you maintain an account with an active subscription, you can simply Log In and re-download the Maricopa Resolution Choosing Depository Bank for Corporation and Account Signatories from the My documents section.

- For new users, it's important to follow a few additional steps to obtain the Maricopa Resolution Choosing Depository Bank for Corporation and Account Signatories.

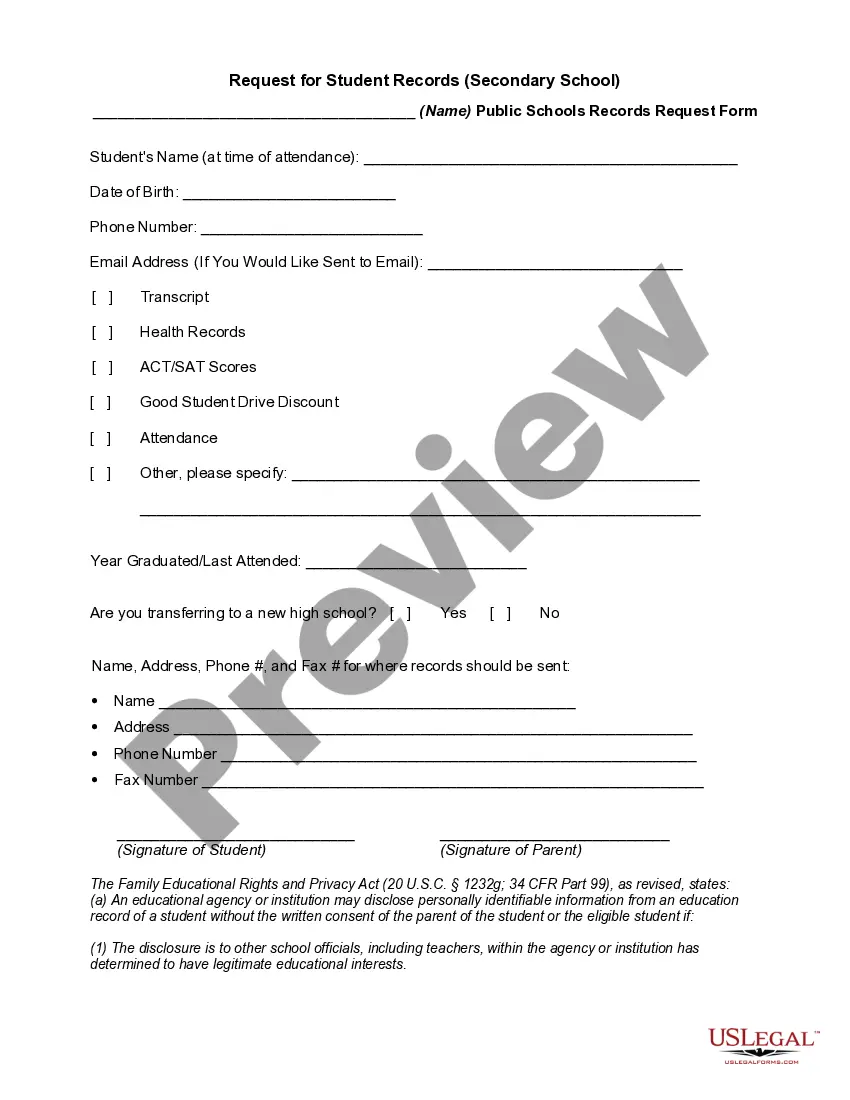

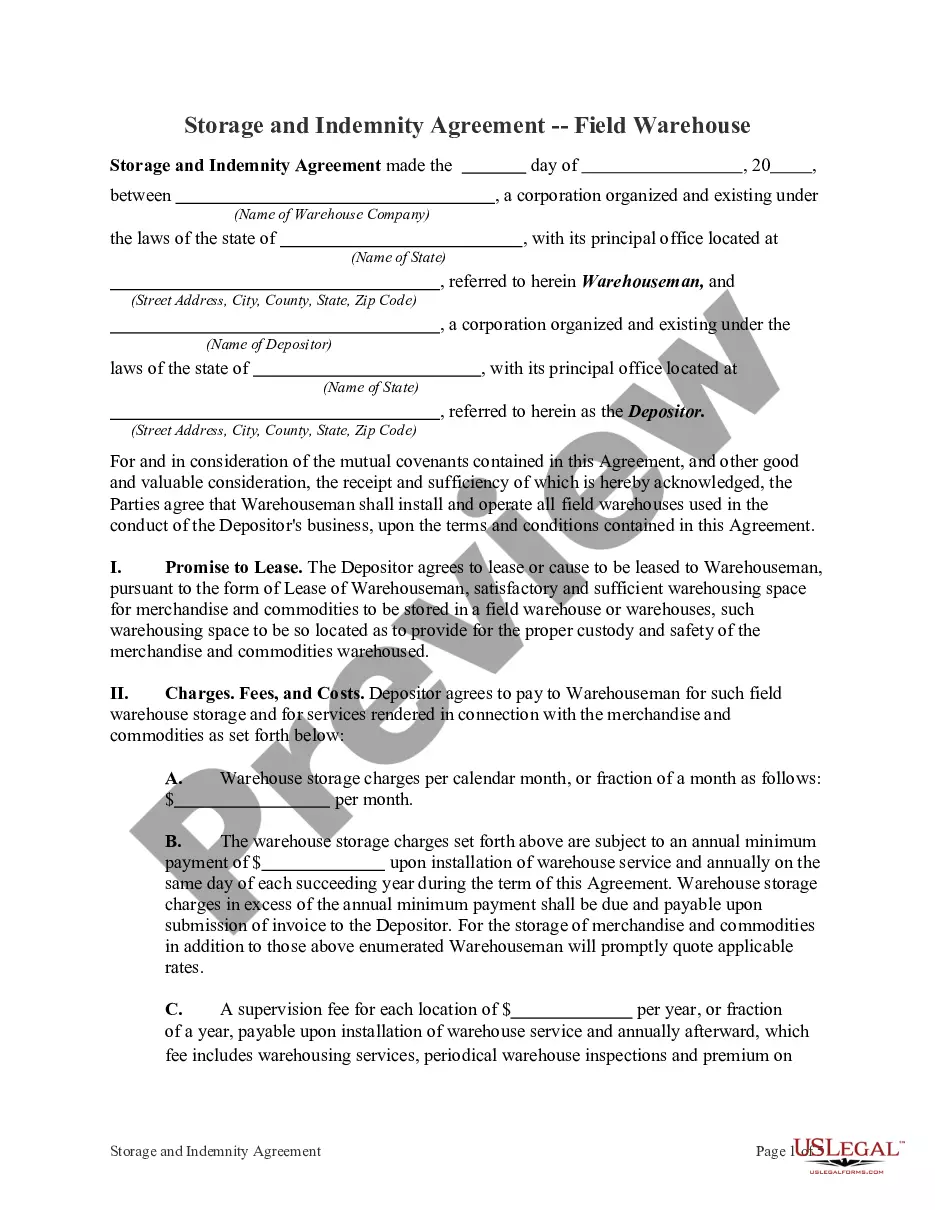

- Review the page content to ensure you've located the correct sample.

- Make use of the Preview feature or read the form description if available.