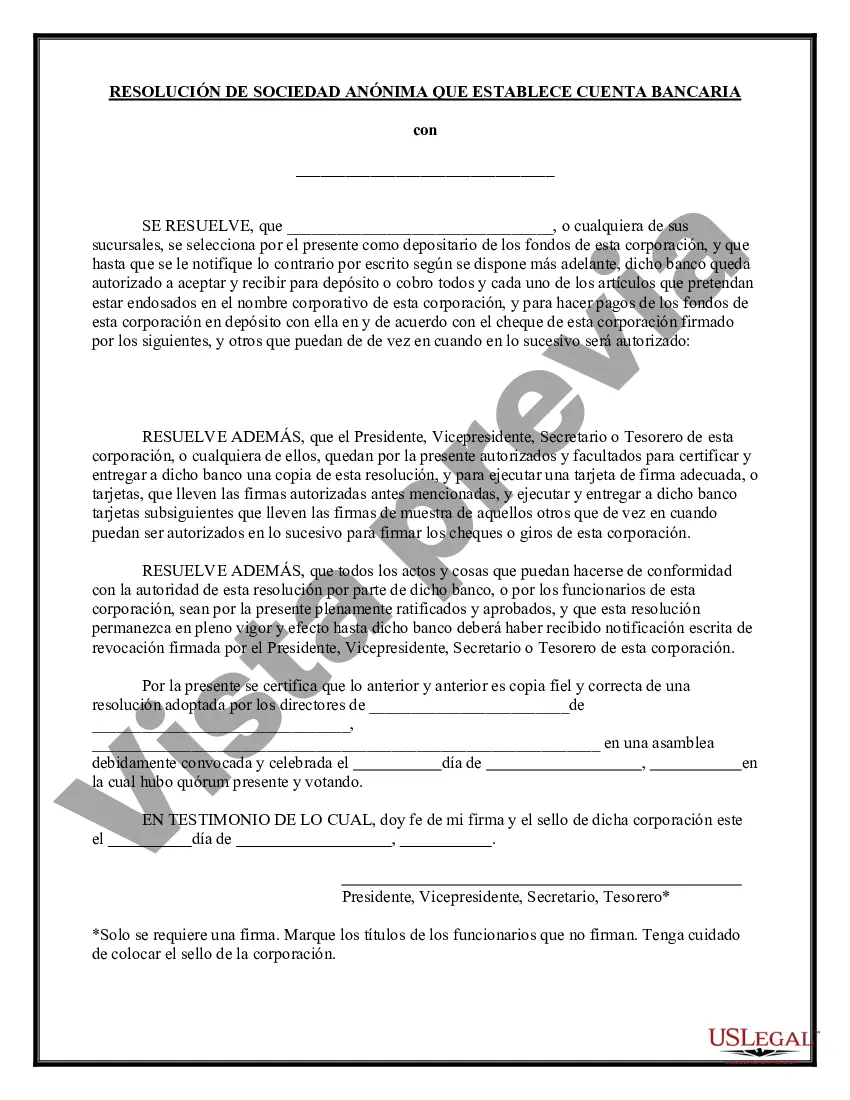

Miami-Dade Florida Resolution Selecting Depository Bank for Corporation and Account Signatories is a formal document that outlines the process and decision-making involved in selecting a depository bank for a corporation and the designated signatories for its accounts. This resolution is a crucial step for corporations operating in Miami-Dade County, Florida, as it ensures efficient management of funds and establishes a trusted financial institution for the company's banking needs. Keywords: Miami-Dade, Florida, Resolution, Selecting Depository Bank, Corporation, Account Signatories. Types of Miami-Dade Florida Resolutions Selecting Depository Bank for Corporation and Account Signatories: 1. General Resolution — This type of resolution is commonly used by corporations to select a depository bank and authorized signatories for their accounts. It typically includes key information such as the corporation's name, purpose, address, and the names of the individuals authorized to execute banking transactions on behalf of the corporation. 2. Special Resolution — A special resolution is specific to unique circumstances or requirements of a corporation. This document may be necessary when there are specific conditions, such as mergers or acquisitions, that warrant a change in the depository bank or the designated account signatories. 3. Annual Resolution — Corporations often draft an annual resolution to review and reaffirm their existing depository bank and account signatories. This resolution ensures that the chosen financial institution continues to meet the corporation's needs and aligns with any changes or updates in the banking industry or the corporation's financial goals. 4. Emergency Resolution — In unforeseen circumstances where an immediate change in the depository bank or account signatories is necessary, an emergency resolution may be adopted. This type of resolution expedites the decision-making process and allows the corporation to quickly select a new bank or modify account signatories to mitigate any financial risks or issues. 5. Amended Resolution — An amended resolution is prepared when modifications need to be made to an existing resolution. This may include changes in the depository bank, authorized signatories, or additional provisions to improve financial governance and compliance within the corporation. The Miami-Dade Florida Resolution Selecting Depository Bank for Corporation and Account Signatories is a crucial tool for corporations operating in the region. It enables effective financial management, ensures compliance with regulatory requirements, and provides a framework for secure transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Resolución de Selección de Banco Depositario para Corporaciones y Signatarios de Cuentas - Resolution Selecting Depository Bank for Corporation and Account Signatories

Description

Form popularity

FAQ

MDC must return unearned funds for students who fail to attend class(es) or withdraw when receiving active duty (TA) benefits. We will assess the amount of funds to be returned. The College will let you when a return is performed, and based on the amount being returned, you may be billed for a debt.

Los estudiantes que ingresan tendrian que cumplir con ciertos requisitos: Ser un residente legal del condado de Miami-Dade. Universidad. Tener puntajes en las pruebas de ingreso de MDC que indiquen que estan listos para la universidad.

El total promedio de los gastos es $23,000 por curso academico. El costo anual estimado de alquiler de vivienda, alimentacion, transporte e incidentales es $11, 500. Los estudiantes que tengan personas dependientes deberan proveer $7000 adicionales por dependiente.

MDC es el college acreditado mas economico y confiable del sur de la Florida. MDC ha suscrito convenios de transferencia con mas de 60 colleges y universidades del pais.

MDC will help with FREE tuition plus books & fees. Ready to get back to living and learning? Miami Dade College is here to help you make it happen. For a limited time only, MDC is offering FREE tuition plus books and fees up to $2,200 for spring term.

According to College Factual's 2022 analysis, MDC is ranked #424 out of 2,576 schools in the nation that were analyzed for overall quality. MDC is also ranked #14 out of 87 schools in Florida.

Provides free tuition for up to two years, plus academic and co-curricular experiences to equip students with the knowledge, resources, and skills for success. Get an early start to your college education by enrolling in the summer term following high school graduation. You can earn up to 6 credits at no cost!

En este campus se encuentra la escuela de educacion, tambien ofrece programas de estudios de traduccion e interpretacion, programas academicos en negocios, contabilidad, programas para aprender ingles, entre otros. El campus ofrece clases diurnas y nocturnas durante la semana y fines de semana.

Miami Dade College is a public institution in Miami, Florida. It has a total enrollment of 54973. The school utilizes a semester-based academic year. The student-faculty ratio is 19-to-1.