Suffolk New York is a county located in New York State, USA. It is known for its beautiful landscapes, historical landmarks, and vibrant communities. In order to establish a corporation in Suffolk County, organizers must conduct a preliminary meeting where several important matters need to be considered and documented in the meeting minutes. 1. Purpose of the Corporation: The preliminary meeting should begin by discussing and defining the purpose or mission of the corporation. This includes outlining the primary objectives, goals, and activities that the corporation will engage in. 2. Name and Registered Office: Organizers must evaluate and finalize the name of the corporation while ensuring its availability and compliance with state laws. Additionally, the registered office address, which will be the official address of the corporation, should be designated. 3. Incorporates and Directors: The individuals involved in organizing the corporation, known as incorporates, should be identified and appointed. Discussion regarding the potential members of the board of directors, who will oversee the corporation's operations, should also take place. 4. Articles of Incorporation: Organizers must decide on the specific provisions and details to include in the corporation's articles of incorporation. This includes specifying the purpose, registered agent, share structure, and any other necessary information for legal compliance. 5. Bylaws: Drafting and approving the corporation's bylaws is a crucial task during the preliminary meeting. Bylaws outline the internal governance and operational procedures of the corporation, including the roles and responsibilities of directors, officers, and shareholders. 6. Initial Directors and Officers: The meeting should address the appointment and election of the initial directors and officers of the corporation. This includes key positions such as president, treasurer, secretary, etc., highlighting their respective responsibilities and terms. 7. Stock Issuance and Ownership: Discussion regarding the initial issuance of shares, their classes, and potential restrictions on their transfer should be covered. Organizers should also determine the ownership structure, including the initial shareholders and their respective ownership percentages. 8. Initial Capitalization and Funding: Evaluating the initial capital requirements of the corporation and determining the capitalization structure is vital. Matters such as funding sources, contributions from organizers, and potential fundraising strategies should be considered. 9. Bank Account and Tax Obligations: The meeting should address the opening of a corporate bank account and establish the corporation's tax obligations, including obtaining a federal Employer Identification Number (EIN) and registering for state taxes. 10. Next Steps and Future Meetings: Once all crucial matters have been discussed, organizers should outline the next steps, assign action items, and set a timeline for future meetings to ensure the smooth progression of the corporation's formation process. Types of Suffolk New York Checklist of Matters: — Preliminary Meeting Checklist for Nonprofit Corporations: This checklist would include additional considerations related to obtaining tax-exempt status, compliance with non-profit regulations, and board structure specific to non-profit organizations. — Preliminary Meeting Checklist for LLC Formation: While not a corporation, limited liability companies have their own specific requirements and considerations during the preliminary meeting, such as member agreements, operating agreements, and tax classifications. Remember, it is imperative to consult legal professionals or experts familiar with New York State laws while conducting the preliminary meeting and drafting official minutes to ensure compliance and accuracy.

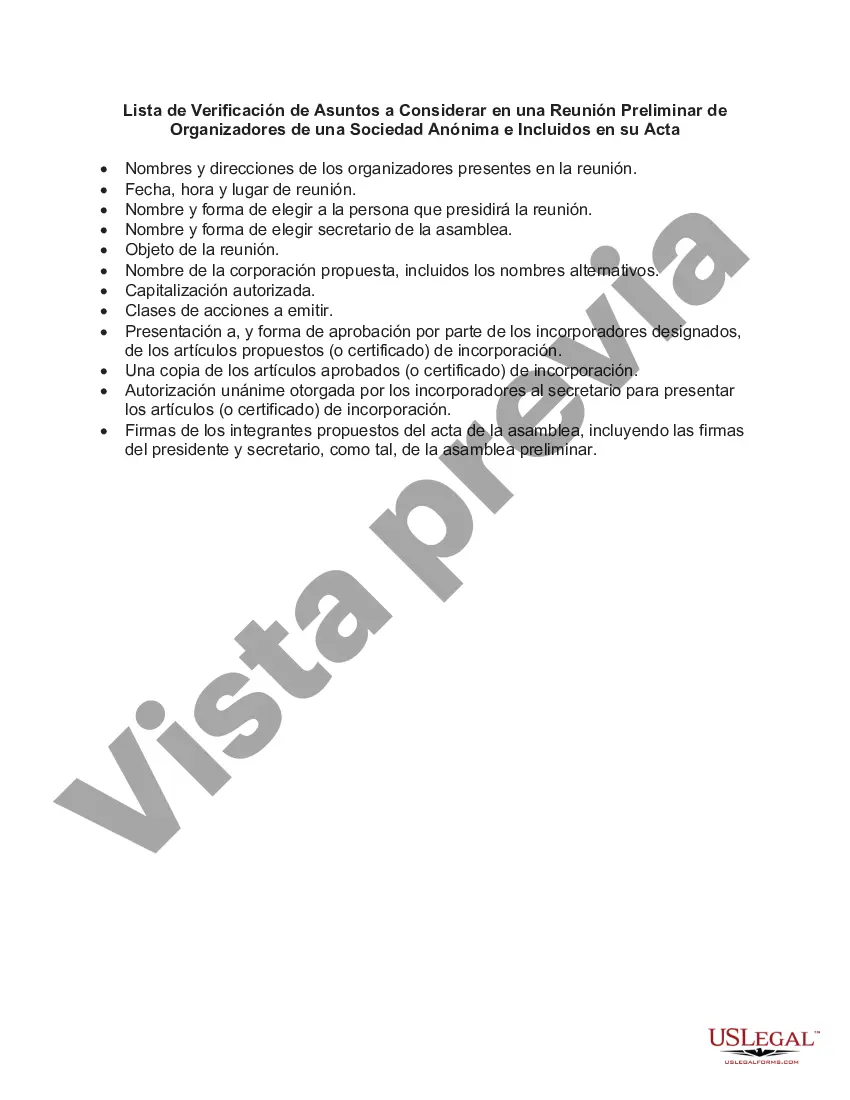

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Lista de Verificación de Asuntos a Considerar en una Reunión Preliminar de Organizadores de una Sociedad Anónima e Incluidos en su Acta - Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes

Description

How to fill out Suffolk New York Lista De Verificación De Asuntos A Considerar En Una Reunión Preliminar De Organizadores De Una Sociedad Anónima E Incluidos En Su Acta?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Suffolk Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Suffolk Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Suffolk Checklist of Matters to be Considered at a Preliminary Meeting of Organizers of a Corporation and Included in its Minutes:

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!