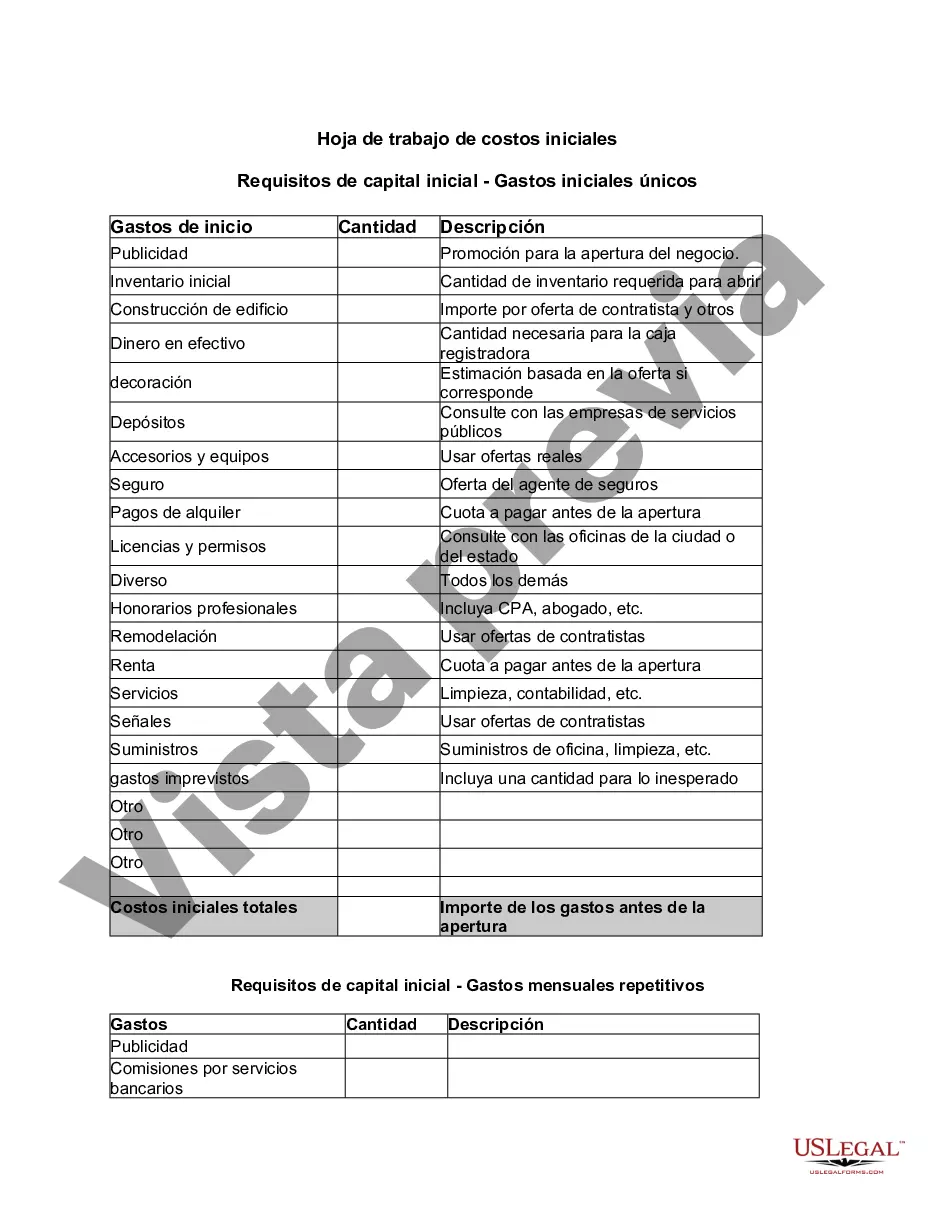

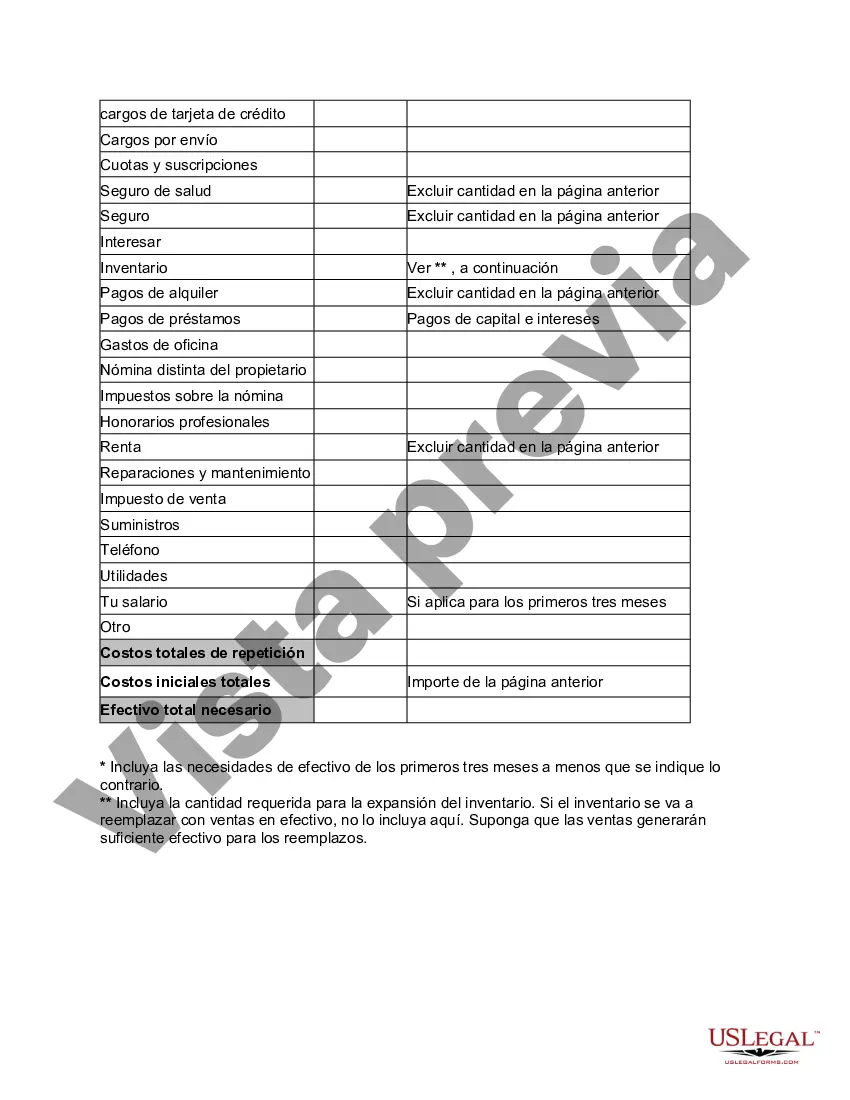

Chicago Illinois Startup Costs Worksheet is a comprehensive financial tool used by entrepreneurs and small business owners to estimate and track the expenses associated with starting a new business in Chicago, Illinois. This worksheet is designed to assist individuals in calculating the initial investment required and projecting ongoing expenses to ensure a successful launch and sustainable growth of their startup ventures. The Chicago Illinois Startup Costs Worksheet typically includes various categories of expenses that are essential for setting up and running a business in the city. This allows entrepreneurs to get a clear understanding of the financial implications and challenges involved in starting a business in Chicago, Illinois. The worksheet aims to provide a structured approach to budgeting and planning, helping entrepreneurs make informed decisions and secure the necessary funding for their startup endeavor. Some common categories covered in the Chicago Illinois Startup Costs Worksheet are as follows: 1. Legal and Licensing Expenses: This category includes the costs associated with obtaining necessary permits, licenses, and registrations to legally operate a business in Chicago. It may also cover legal fees for consulting with business lawyers or filing trademark applications. 2. Office or Retail Space Costs: Entrepreneurs looking to establish a physical presence in Chicago need to consider expenses related to leasing or purchasing a commercial space. This category includes rent, security deposits, utilities, property taxes, and potential renovations to suit the business's needs. 3. Equipment and Technology: Startup businesses require various equipment and technology tools to operate efficiently. This category may encompass costs associated with purchasing or leasing computers, servers, software licenses, specialized machinery, communication systems, and other necessary technological infrastructure. 4. Initial Inventory and Supplies: For startups involved in retail or manufacturing, this category accounts for the costs of acquiring initial stock or raw materials needed to kick-start operations. It includes purchasing or production costs, packaging materials, and any initial inventory required. 5. Marketing and Advertising: Entrepreneurs need to allocate funds for marketing and advertising efforts to promote their business and attract customers. This category may include expenses related to website development, graphic design, printing materials, online advertising, social media campaigns, and other promotional activities. 6. Employee Costs: If a business will have employees, the costs associated with hiring and onboarding need to be considered. This category encompasses salaries, benefits, payroll taxes, workers' compensation insurance, and potential recruiting expenses. 7. Professional Services: Entrepreneurs often require assistance from professionals such as accountants, bookkeepers, and consultants. This category may include fees for professional services related to financial management, tax preparation, business planning, intellectual property, and legal compliance. 8. Miscellaneous Expenses: This category covers any additional costs that might arise during the startup phase. It could include travel expenses, business insurance premiums, office supplies, professional development, maintenance fees, and contingency funds. The Chicago Illinois Startup Costs Worksheet provides an organized format for entrepreneurs to estimate, evaluate, and manage the financial aspects of starting a business in Chicago. It helps in identifying potential funding sources, creating realistic budgets, and presenting a comprehensive financial plan to investors, lenders, or potential business partners.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Hoja de trabajo de costos iniciales - Startup Costs Worksheet

Description

How to fill out Chicago Illinois Hoja De Trabajo De Costos Iniciales?

Whether you intend to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Chicago Startup Costs Worksheet is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Chicago Startup Costs Worksheet. Follow the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Startup Costs Worksheet in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!