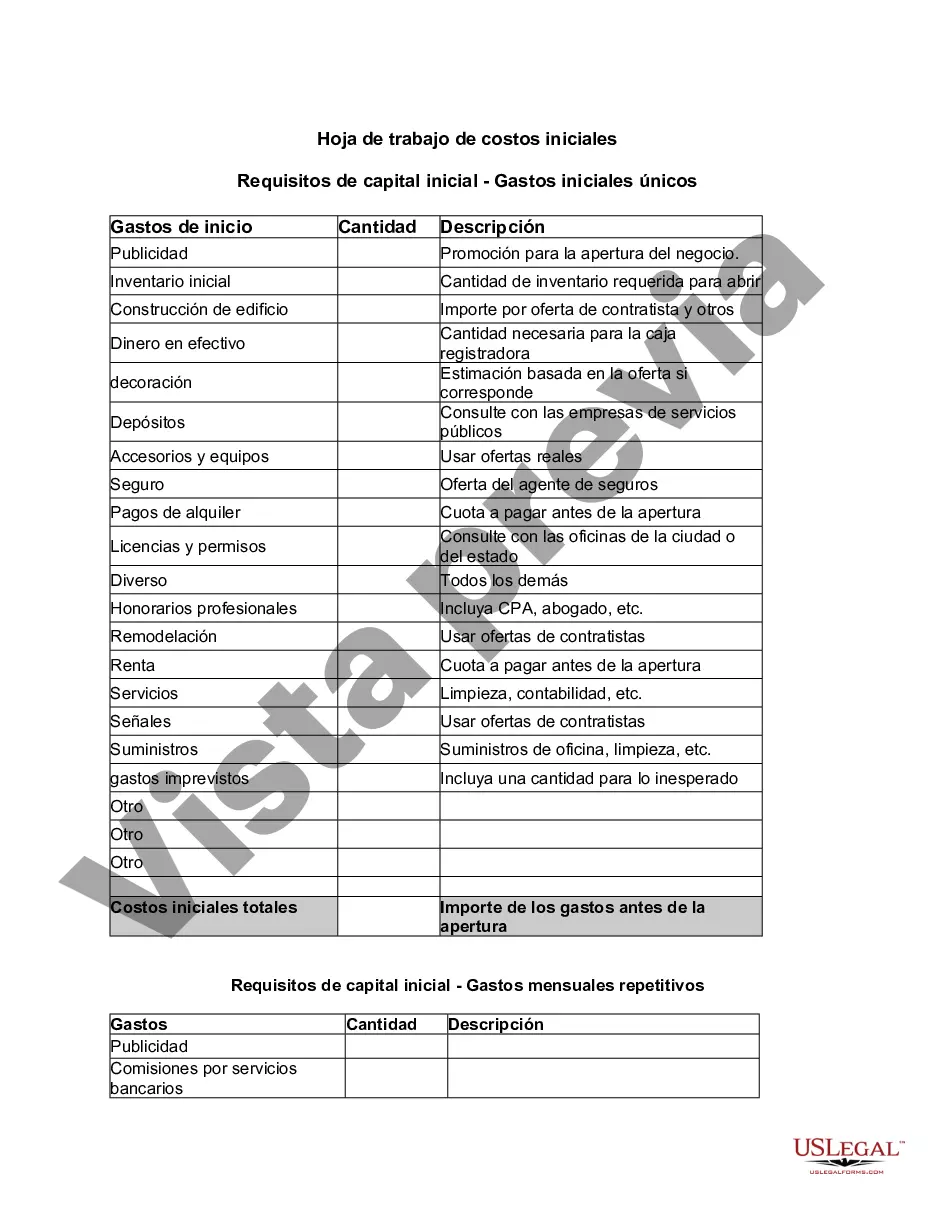

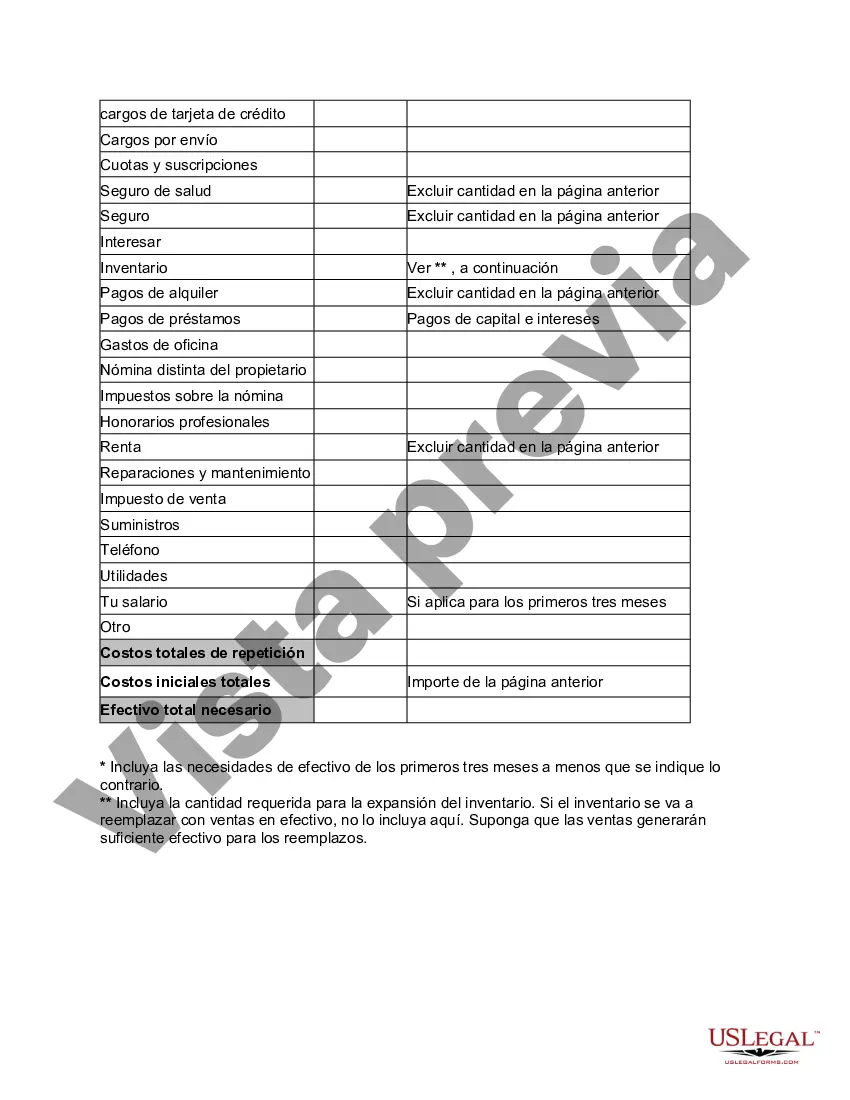

Philadelphia Pennsylvania Startup Costs Worksheet is a comprehensive tool designed to help entrepreneurs in the Philadelphia area accurately estimate and plan their initial expenses when starting a new business venture. This worksheet aims to provide detailed insights into various cost categories involved in launching and operating a startup, enabling entrepreneurs to create a realistic financial plan. The Philadelphia Pennsylvania Startup Costs Worksheet covers a wide range of expenses that entrepreneurs typically encounter during the startup phase. This includes both one-time costs and recurring expenses, giving entrepreneurs a clear understanding of the financial commitments required to establish and sustain their business. The worksheet assists entrepreneurs in organizing and structuring their financial information in a systematic and organized manner. Some key cost categories covered in the Philadelphia Pennsylvania Startup Costs Worksheet include: 1. Initial Investment Costs: This section outlines the expenses incurred before the business starts generating revenue. It includes costs such as market research, product development, legal fees, permits, licenses, branding, office space setup, and equipment purchase. 2. Operational Costs: This category includes ongoing expenses required to keep the business running smoothly. It covers rent, utilities, insurance, employee salaries, technology and software costs, marketing and advertising expenses, and professional services like accounting and legal fees. 3. Inventory and Supply Costs: If your business involves the sale of physical products, this section accounts for the expenses associated with purchasing and maintaining inventory, raw materials, and supplies. It helps to accurately calculate the initial investment needed to stock up on merchandise and replenish inventory as needed. 4. Marketing and Advertising Costs: This category indicates the funds required for marketing campaigns, advertising efforts, and promotional activities. It covers various strategies such as social media advertising, search engine optimization, content creation, print advertisements, and event sponsorships. 5. Administrative Costs: These costs include office supplies, communication expenses, software subscriptions, bookkeeping, and general administrative tasks. By accurately estimating these costs, entrepreneurs can ensure they have the necessary resources to handle day-to-day operations efficiently. 6. Miscellaneous Costs: This section accounts for unforeseen or miscellaneous expenses that may arise during the startup phase. It is advisable to allocate a reasonable portion of the budget for unexpected costs or emergencies. Different types of Philadelphia Pennsylvania Startup Costs Worksheets might exist based on the specific industry or sector of the startup. For example, there could be worksheets specifically tailored for retail businesses, restaurant establishments, technology startups, or service-based ventures. These variations focus on industry-specific costs that entrepreneurs are likely to encounter, providing tailored estimates for particular business types. In conclusion, the Philadelphia Pennsylvania Startup Costs Worksheet is an essential tool for entrepreneurs who aim to launch a successful business venture. By utilizing this worksheet, aspiring business owners can gain a comprehensive understanding of the financial aspects involved, enabling them to make informed decisions and develop a solid financial plan for their startup journey in the vibrant city of Philadelphia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Hoja de trabajo de costos iniciales - Startup Costs Worksheet

Description

How to fill out Hoja De Trabajo De Costos Iniciales?

Are you seeking to swiftly compose a legally-binding Philadelphia Startup Costs Worksheet or possibly any other document to oversee your personal or business affairs.

You have two alternatives: consult a professional to create a valid document for you or draft it completely yourself.

To begin, ensure that the Philadelphia Startup Costs Worksheet is customized to align with your state's or county's regulations.

If the document includes a description, ensure to confirm what it is appropriate for.

- The good news is, there's an alternative choice - US Legal Forms.

- It will assist you in obtaining well-prepared legal documents without having to pay exorbitant fees for legal services.

- US Legal Forms provides an extensive collection of over 85,000 state-specific document templates, including Philadelphia Startup Costs Worksheet and form packages.

- We supply documents for a variety of life situations: from divorce forms to real estate document templates.

- With over 25 years in the industry, we have built a solid reputation among our clients.

- Here's how you can become one of them and acquire the necessary template without additional complications.

Form popularity

FAQ

El costo promedio inicial es de $14,000: la mitad de propietarios reporta iniciar su negocio con menos de $5,000. Ademas de contratar a un abogado para que te ayude a registrar el nombre de tu empresa dentro de tu estado, deberas pagar por las licencias y los costos de publicidad (entre $4,000 y $6,000).

Directos: son los costos que pueden identificarse facilmente con el producto, servicio, proceso o departamento. Son costos directos el Material Directo y la Mano de Obra Directa. Indirectos: su monto global se conoce para toda la empresa o para un conjunto de productos.

Como comenzar una empresa de limpieza paso a paso Averigua si eres un buen candidato para una empresa de limpieza.Decide la estructura de tu empresa.Establece que te hace unico.Decide tus precios.Averigua que licencias necesitaras.Desarrolla un plan para adquirir clientes.Asegurate de tener capital.

El concepto de gastos iniciales en el ambito financiero se refiere al presupuesto que maneja una empresa antes de emprender un proyecto. Para el correcto funcionamiento de una compania sera preciso contar con una serie de bienes y personal que dependeran de las caracteristicas y tamano de la empresa.

Se trata de aquellos que se dan al empezar la actividad de una empresa desde cero. Estos gastos suelen darse solo una vez en toda la vida de la empresa.

Se trata de aquellos que se dan al empezar la actividad de una empresa desde cero. Estos gastos suelen darse solo una vez en toda la vida de la empresa.

Entre los costos de produccion directos, los mas importantes son: Materia prima: Necesitamos conocer su precio unitario y la cantidad que requerimos. Mano de obra directa: Cuando el proceso de produccion esta automatizado, este gasto no debe rebasar el 10 por ciento del costo de produccion.

5 claves para calcular los gastos iniciales de tu negocio Redacta un buen plan de empresa.Gasto solo en lo necesario.Calcula bien tus precios.Informate de todos los tramites legales que debes realizar.Ten en cuenta los gastos de los creditos financieros.

¿Cual es el proceso para abrir una empresa en Estados Unidos? Visa para extranjeros. Dependiendo del tipo de inversion a realizar siendo extranjero, sera necesario o no tener una visa estadounidense para poder emprender.Estructura y ubicacion de la empresa.Agente Autorizado.Registro de la empresa.

Lance su empresa. Elija una estructura comercial. Elija un nombre para su empresa. Registre su empresa. Obtenga su numero de identificacion del contribuyente federal y estatal. Solicite licencias y permisos. Abra una cuenta bancaria comercial. Obtenga un seguro comercial.