The Cook Illinois Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a form used by residents in Cook County, Illinois, to claim an exemption from reporting the sale or exchange of their principal residence for state income tax purposes. This form is specifically designed to provide homeowners with a streamlined process to exclude their residential property transactions from income tax reporting. The purpose of the Cook Illinois Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is to acknowledge that the homeowner is eligible for this tax exemption based on specific criteria. This exemption allows homeowners to exclude up to $250,000 (or $500,000 for married couples filing jointly) of the net gain from the sale or exchange of their principal residence from their taxable income. By completing and submitting this form, homeowners certify that their property qualifies as their principal residence and that they meet all the necessary requirements for this tax exemption. This includes owning and occupying the property as their main residence for at least two out of the five years preceding the sale or exchange. The Cook Illinois Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a crucial document for homeowners looking to save on their state income taxes when selling or exchanging their primary residential property in Cook County. By filing this form, they can ensure that their transaction remains exempt from any reporting obligations to the Illinois Department of Revenue. Different types of Cook Illinois Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption may include variations based on specific circumstances. For example, there might be separate forms or requirements for married individuals filing jointly, qualifying widows or widowers, or individuals with disabilities. Each variant would have tailored criteria and instructions to meet the unique circumstances of the applicant. In conclusion, the Cook Illinois Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an essential form for homeowners in Cook County, Illinois, seeking exemption from reporting the sale or exchange of their principal residence for state income tax purposes. It allows eligible homeowners to exclude a portion of their net gain from their taxable income, potentially saving them significant amounts of money.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Cook Illinois Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

If you need to get a trustworthy legal form provider to find the Cook Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to find and execute various papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Cook Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or save it in the My Forms tab.

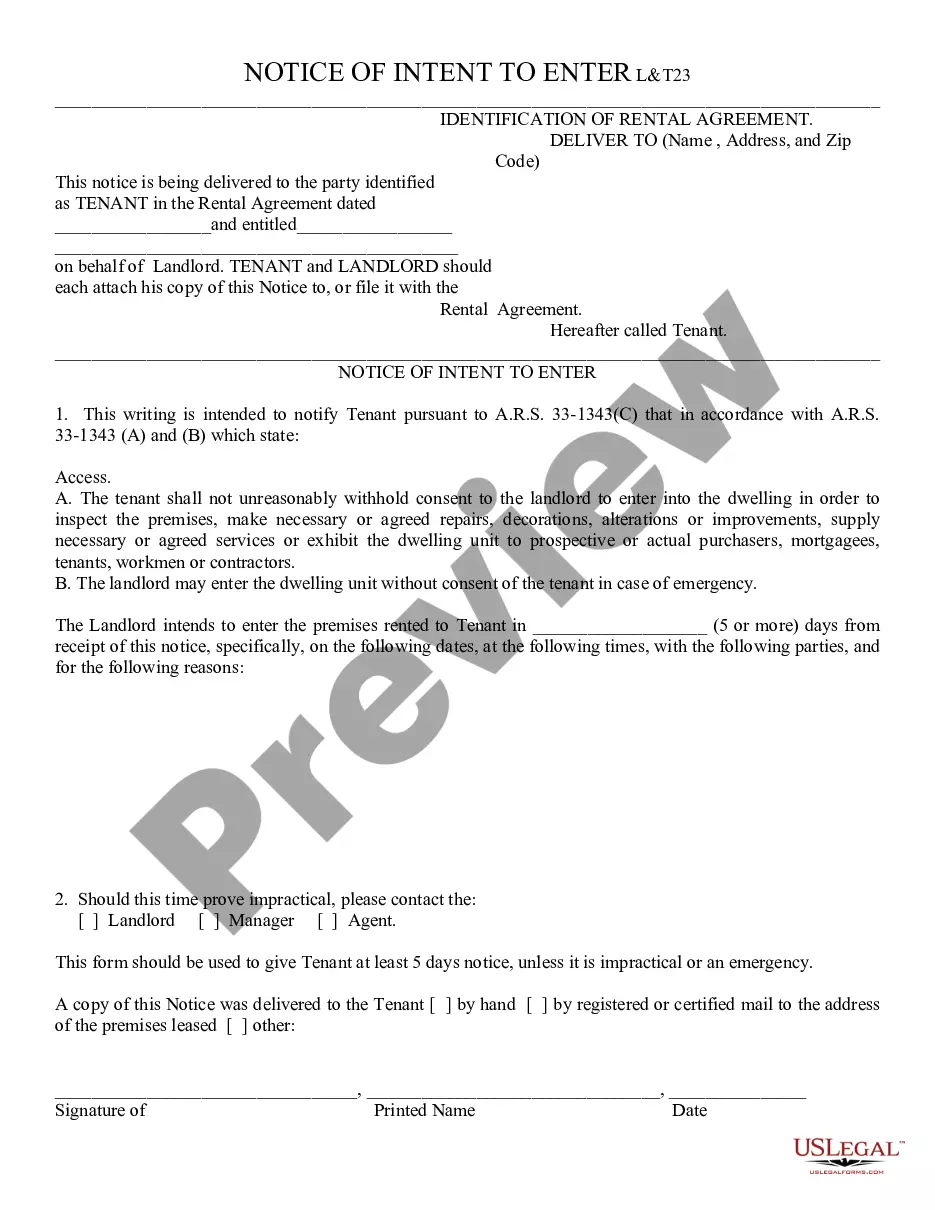

Don't have an account? It's effortless to get started! Simply locate the Cook Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Cook Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption - all from the comfort of your home.

Sign up for US Legal Forms now!