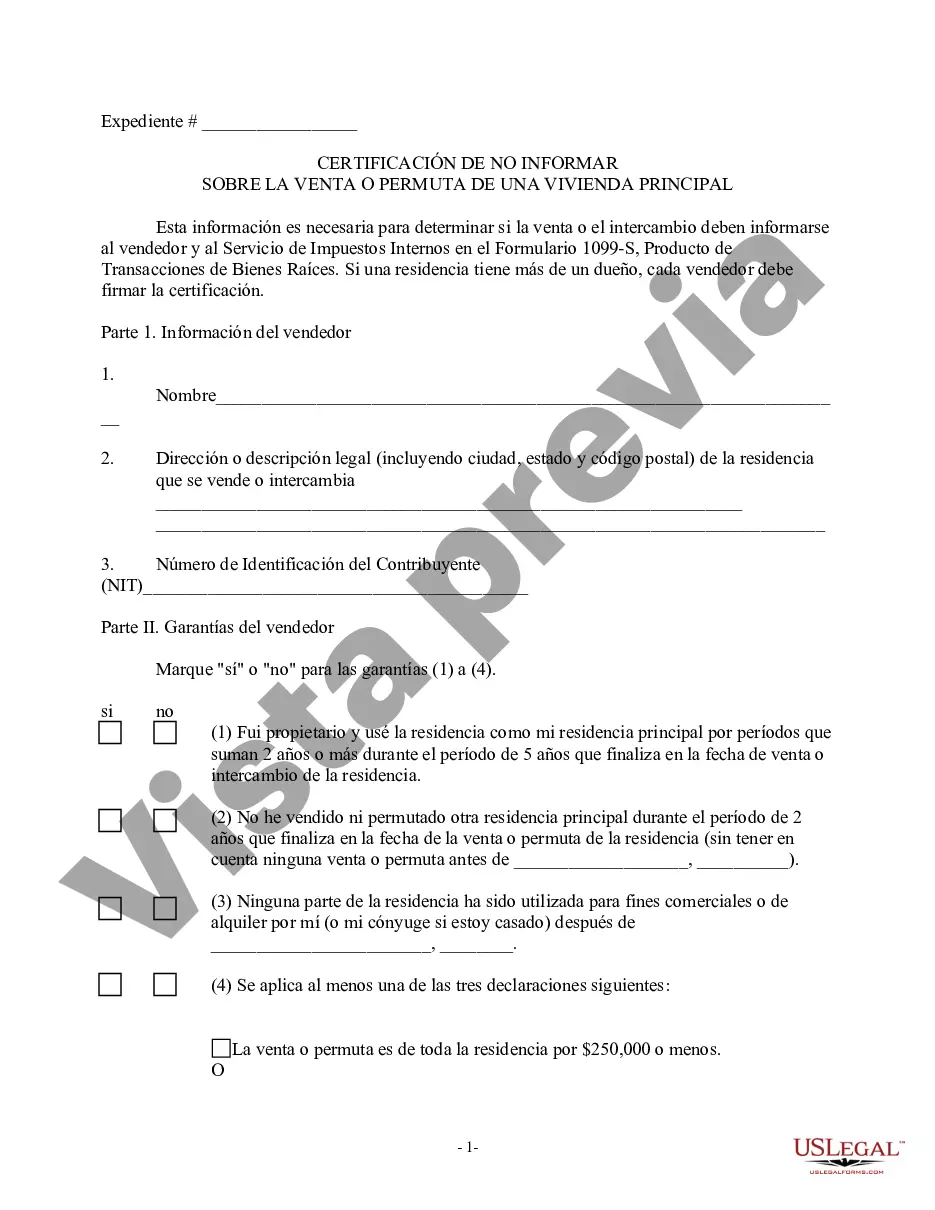

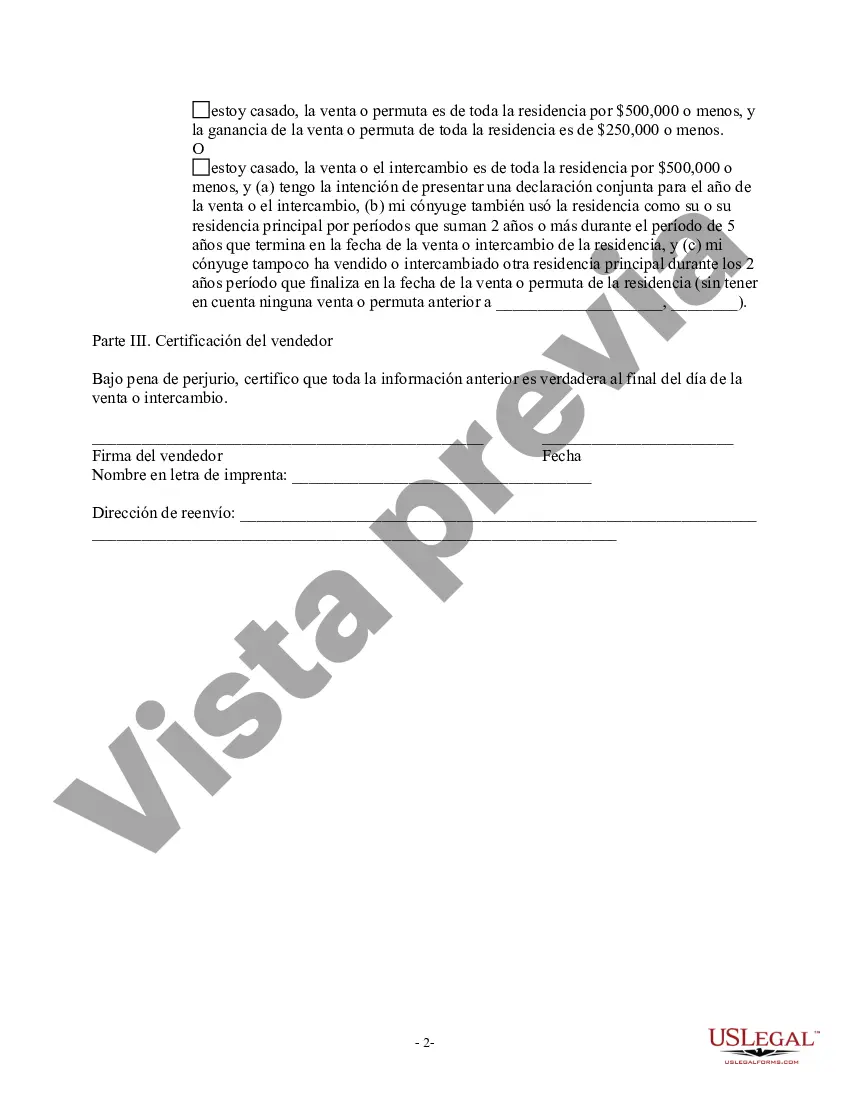

The Harris Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an important document for residents of Harris County, Texas who are selling or exchanging their principal residence. This certification allows individuals to claim an exemption from information reporting requirements under certain circumstances. The primary purpose of the Harris Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is to provide a tax benefit to individuals selling their principal residence. By certifying that the sale or exchange meets specific criteria, homeowners can avoid certain reporting requirements that are typically associated with real estate transactions. This exemption can save homeowners time and effort in fulfilling reporting obligations to the Internal Revenue Service (IRS). It is crucial to note that there are different types of Harris Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, each catering to specific situations. Here are a few common types: 1. Standard Exemption: This type of certification applies to homeowners who are selling or exchanging their principal residence and meet the requirements for exemption from information reporting. It is applicable to individuals who have lived in their home for a certain period and meet specific ownership and use criteria outlined by the IRS. 2. Partial Exemption: This variation of the certification is relevant when homeowners wish to sell or exchange a portion of their principal residence while still maintaining their primary residence on the property. The partial exemption allows individuals to exclude a portion of the gain on the sale or exchange from taxable income, provided they meet the eligibility criteria. 3. Reverse Mortgage Exemption: This type of certification is specific to individuals who have obtained a reverse mortgage on their principal residence. It allows homeowners to exclude certain proceeds resulting from a reverse mortgage from information reporting and potential taxation. Regardless of the type, completing the Harris Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption requires homeowners to provide detailed information about the property, ownership history, and terms of the sale or exchange. It is important to carefully review the requirements and consult with a qualified tax professional or legal advisor to ensure compliance and maximize the benefits of this certification. By utilizing the Harris Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners in Harris County can simplify their tax reporting obligations and potentially reduce their tax liability when selling or exchanging their principal residence. This certification serves as an essential tool for individuals seeking tax relief and ensuring compliance with the relevant tax laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Harris Texas Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

Are you looking to quickly draft a legally-binding Harris Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption or maybe any other document to handle your personal or corporate matters? You can go with two options: hire a legal advisor to write a legal document for you or draft it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive neatly written legal papers without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Harris Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Harris Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption is tailored to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Harris Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Moreover, the documents we offer are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!