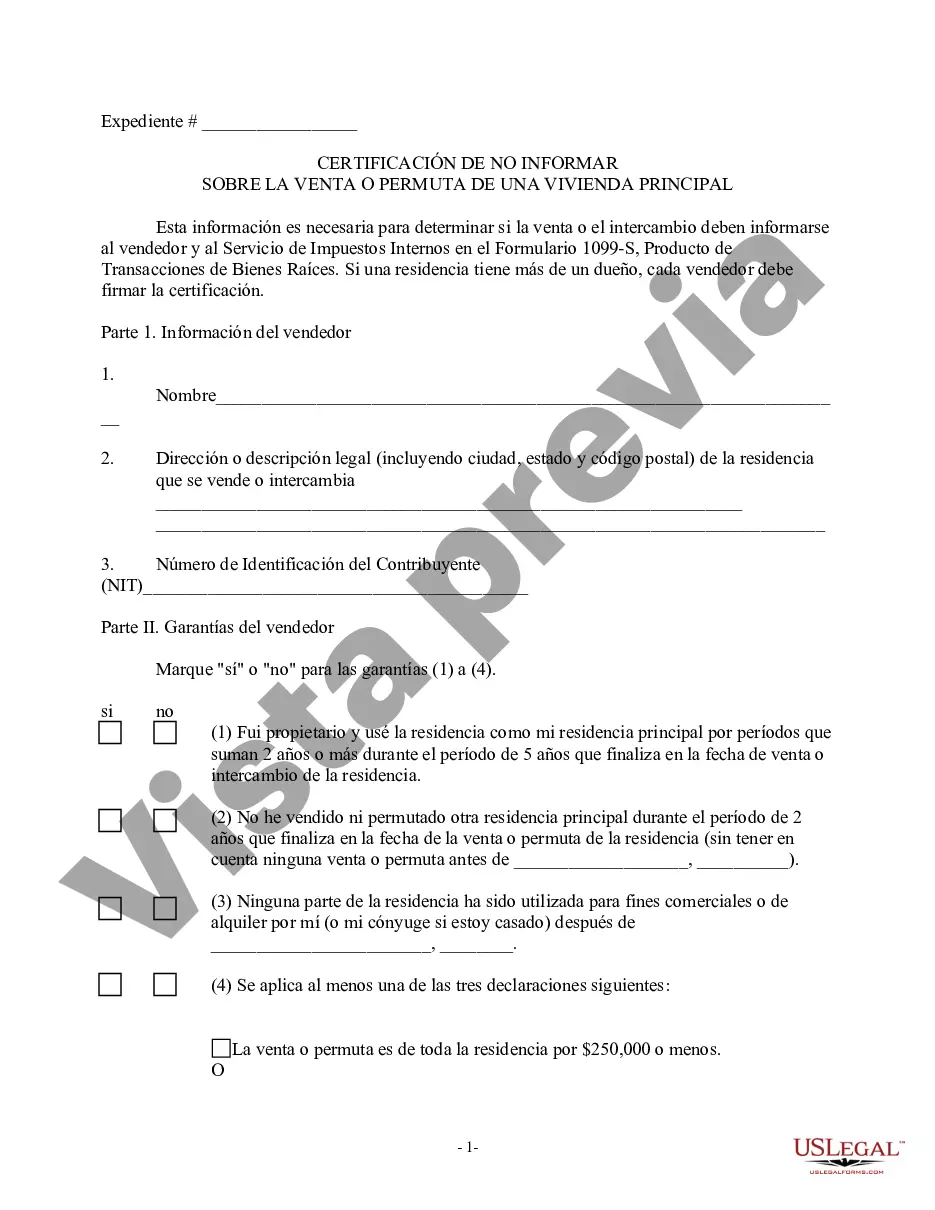

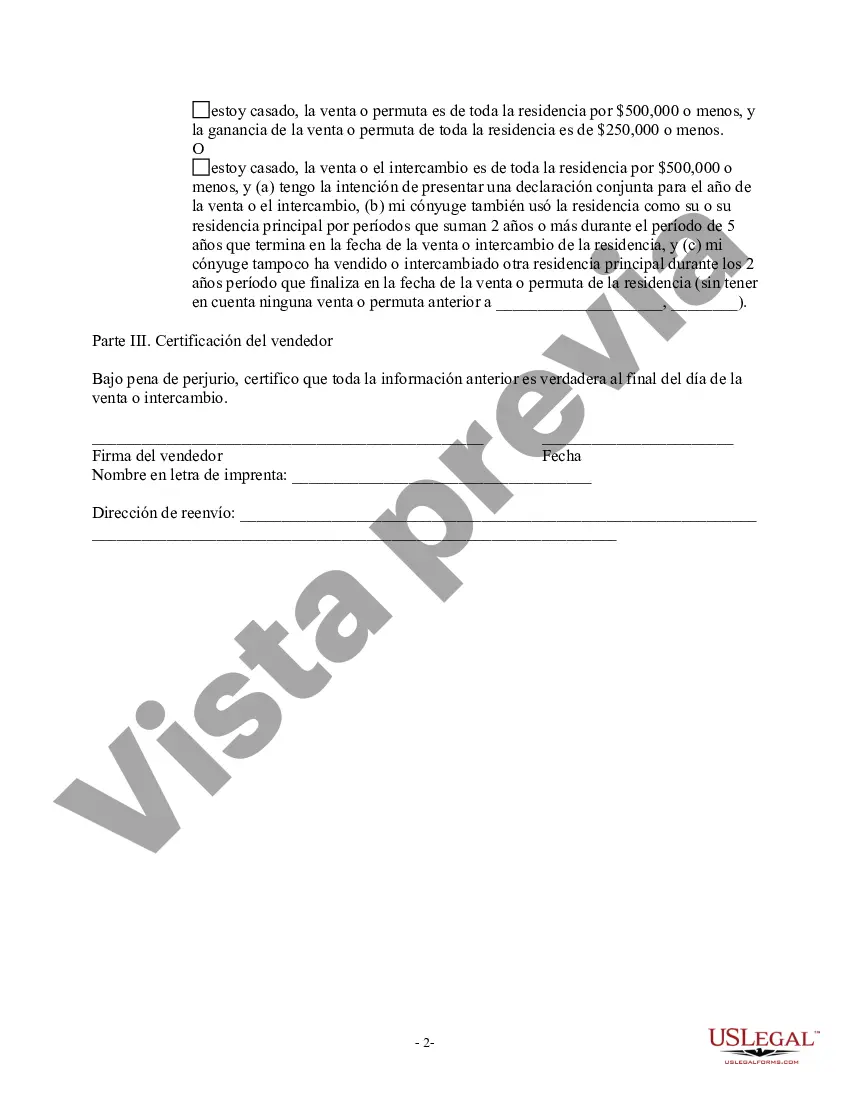

The Hillsborough Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a legal document that homeowners in Hillsborough County, Florida may need to obtain when selling or exchanging their principal residence. This certification exempts the homeowner from reporting the sale or exchange to the Internal Revenue Service (IRS) under certain criteria. Obtaining the Hillsborough Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption ensures that the homeowner meets the requirements set forth by the County for exemption from reporting the transaction to the IRS. By having this certification, the homeowner can avoid potential tax consequences or penalties that may arise from non-compliance. The certification process involves providing specific information about the property and the sale or exchange transaction. This includes details such as the property address, the date of acquisition, the date of sale or exchange, and the sale price or value. The homeowner must also sign and date the certification form, affirming the accuracy of the provided information. It's important to note that there are different types of Hillsborough Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, depending on the circumstances of the transaction: 1. Non-Foreign Certification: This type of certification is applicable when the homeowner is a U.S. citizen or resident alien and the transaction does not involve a foreign person. 2. Foreign Certification: If the homeowner is a foreign person or the transaction involves a foreign person, this certification is required. It ensures compliance with U.S. tax laws and regulations regarding transactions by non-U.S. citizens. Homeowners should consult with their tax advisors or the Hillsborough County tax authorities to determine the specific type of certification they need based on their residency status and the transaction details. In conclusion, the Hillsborough Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a crucial document for homeowners in Hillsborough County looking to sell or exchange their principal residence. It allows them to be exempt from reporting the transaction to the IRS, provided they meet the requirements and criteria set by the County. By obtaining the correct certification, homeowners can ensure compliance with tax regulations and avoid potential penalties or tax consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Hillsborough Florida Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

Draftwing forms, like Hillsborough Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, to manage your legal matters is a tough and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for a variety of cases and life situations. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Hillsborough Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Hillsborough Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption:

- Ensure that your document is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Hillsborough Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!