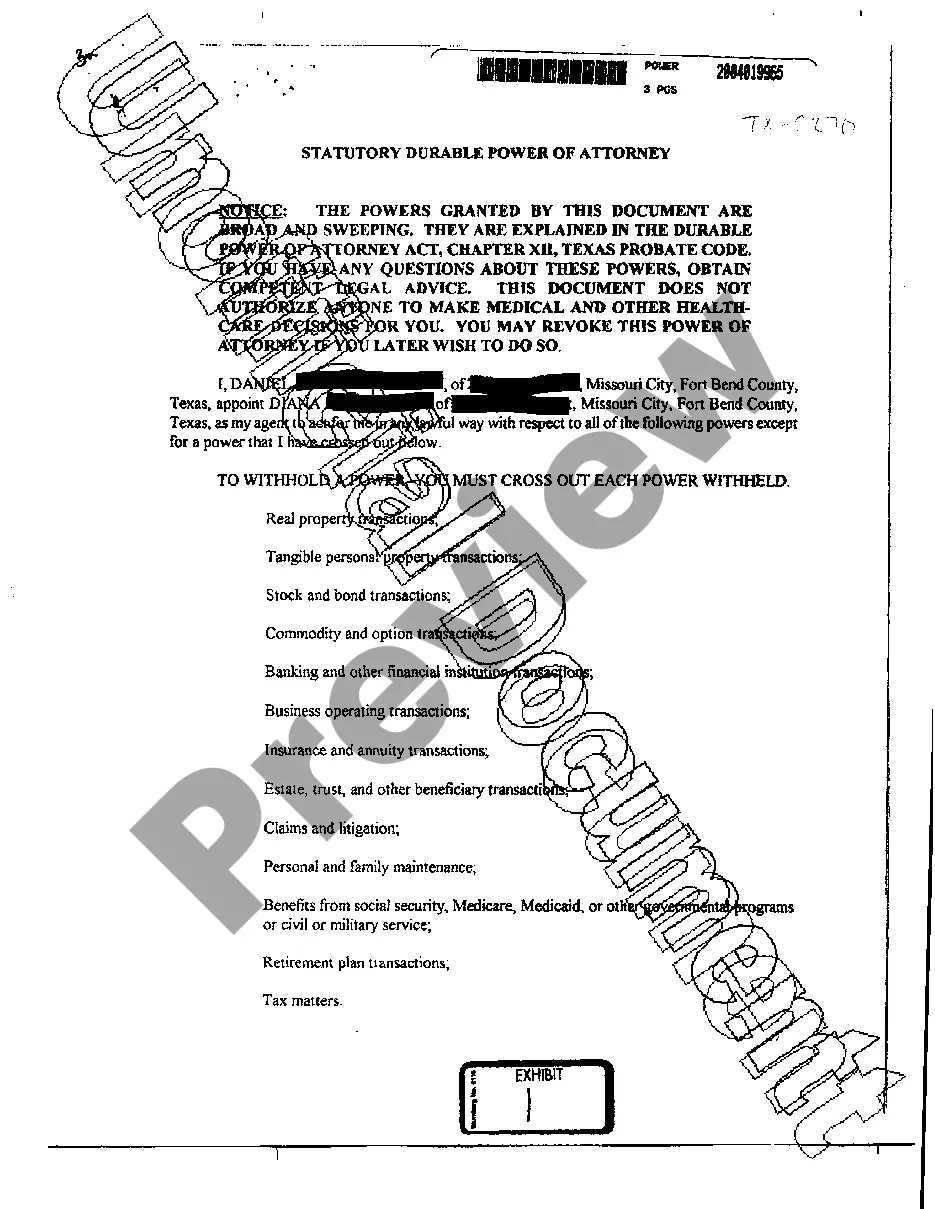

The Houston Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an official document issued by the City of Houston, Texas, to homeowners who meet specific criteria and qualify for exemption from reporting the sale or exchange of their principal residence for tax purposes. This certification is relevant for individuals residing in Houston and looking to benefit from the tax exemption. The Houston Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is designed to provide relief to homeowners and simplify the reporting process by eliminating the requirement of disclosing certain sales or exchanges of residential properties to the tax authorities. To ensure eligibility for this certification, homeowners must fulfill certain conditions, including but not limited to: 1. Owning the property as their primary residence: The certification is intended for individuals who use the property as their primary place of residence. Properties used for rental or commercial purposes may not qualify. 2. Meeting residency requirements: Homeowners must have resided in the property for a specified period, which may vary depending on local regulations. Generally, a minimum residency period of two years is required to qualify for the exemption. 3. Not exceeding the exemption limits: There may be limits on the value of the property for which the certification is applicable. It is essential to review the specific guidelines provided by the City of Houston to determine the applicable limits. By obtaining the Houston Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can avoid disclosing the sale or exchange of their principal residence to the tax authorities during the tax filing process. It streamlines the reporting process and simplifies the requirements for homeowners who meet the necessary criteria. It is important to note that different types of Houston Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption forms or certifications may exist based on factors such as residence location, property value, or tax jurisdiction. The specific types of certifications and their corresponding criteria may vary, and it is advised to consult with the City of Houston or a tax professional to obtain accurate information for your specific situation. In conclusion, the Houston Texas Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption provides eligible homeowners in Houston with the opportunity to simplify the reporting process and potentially save on taxes related to the sale or exchange of their primary residence. By meeting the necessary criteria and obtaining this certification, homeowners can ensure compliance with local tax regulations while enjoying the benefits of an exemption from reporting the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Houston Texas Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Houston Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Houston Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!