Palm Beach Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a crucial document for homeowners in Palm Beach, Florida who are selling or exchanging their primary residences. This certification allows eligible homeowners to claim an exemption from the requirement of reporting the sale or exchange of their principal residence for federal income tax purposes. The Palm Beach Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is specifically designed to help homeowners avoid unnecessary reporting burdens when selling their primary residences. By obtaining this certification, homeowners can ensure a smooth and hassle-free process while enjoying the benefits of tax exemption. Keywords: Palm Beach Florida, Certification of No Information Reporting, Sale or Exchange of Principal Residence, Tax Exemption. There are different types of Palm Beach Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, namely: 1. Residential Property Certification: This type of certification is for homeowners who are selling or exchanging their primary residential properties in Palm Beach, Florida. It allows them to claim exemption from reporting the sale or exchange for federal income tax purposes. 2. Condominium Certification: This certification is specifically for individuals who own and sell their condominium units as their primary residences in Palm Beach, Florida. It provides them with the same tax exemption and reporting relief as the Residential Property Certification. 3. Cooperative Certification: Homeowners who own and sell shares of a cooperative housing corporation in Palm Beach, Florida, as their primary residences can apply for this certification. It grants them the necessary tax exemption and reporting relief on the sale or exchange of their cooperative shares. 4. Mobile Home Certification: This type of certification is applicable to individuals who own and sell mobile homes that serve as their primary residences in Palm Beach, Florida. It allows them to claim tax exemption and avoid reporting obligations. By obtaining the appropriate Palm Beach Florida Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can simplify their tax filing process and focus on the sale or exchange of their property without undue hassle. It is crucial for homeowners in Palm Beach, Florida to understand the specific certification that applies to their property type, ensuring compliance and availing the benefits provided by these exemptions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Palm Beach Florida Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

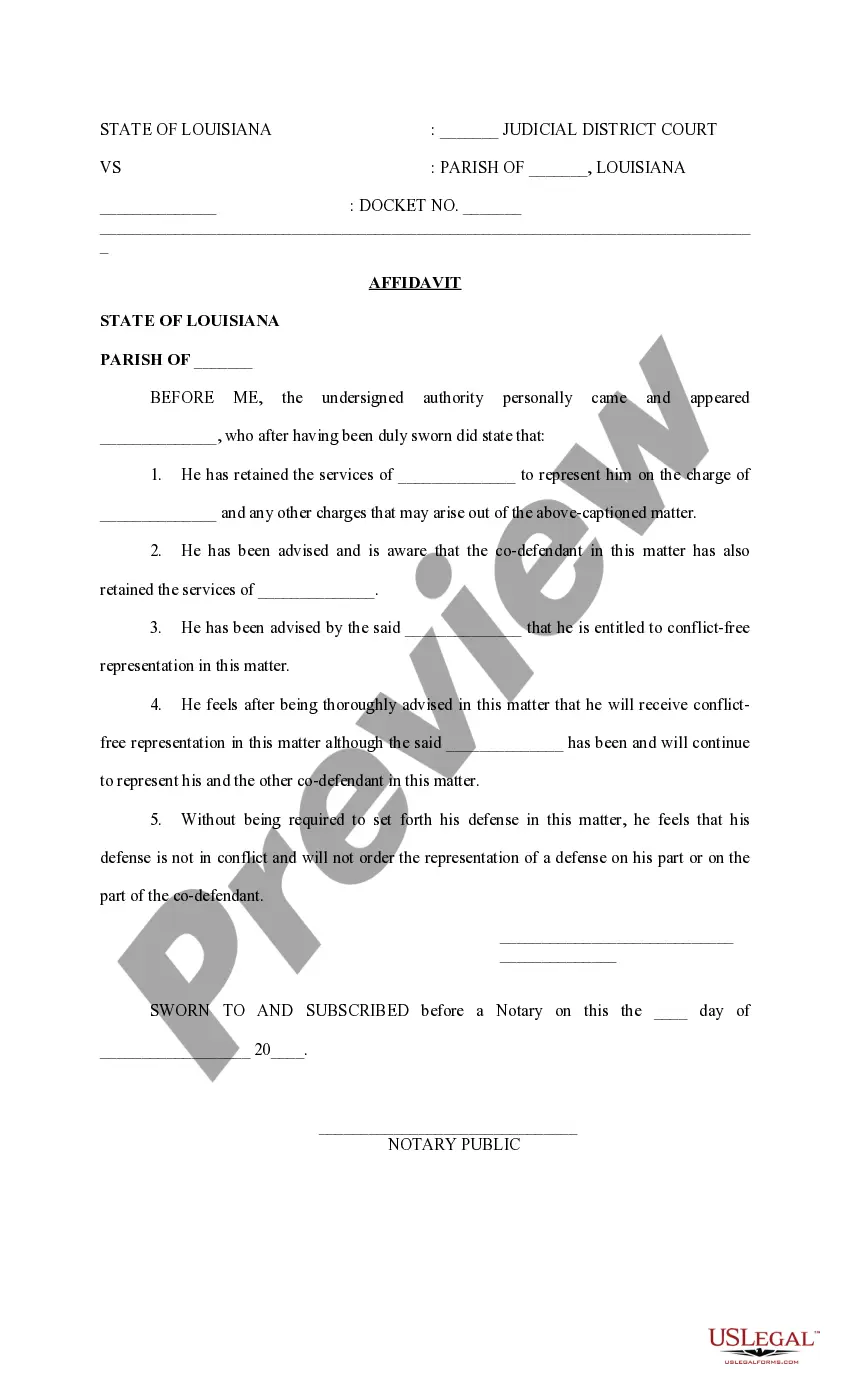

Preparing paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Palm Beach Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Palm Beach Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Palm Beach Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption:

- Examine the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

El impuesto a las ventas y al uso en Puerto Rico es del 11.5%.

¿Cuanto se paga de ISR por la venta de una casa en 2021? Quien vende, debe pagar el % ISR de venta de casa por la utilidad que recibe por la venta, no siempre sera el mismo porcentaje y puede llegar hasta el 35%. Si la casa que vendes supera los 4 millones de pesos, deberas pagar impuestos.

Se llama homestead en ingles. La cantidad protegida se llama homestead exemption (exencion de homestead) y varia en funcion de la edad, estado civil, y el ingreso del dueno de la vivienda.

El impuesto a las ventas y al uso en Puerto Rico es del 11.5%.

2728 Homestead Exemption en. Espanol 2728 propiedad para reducir los impuesto.

Homestead puede referirse a: Homestead (unidad de superficie), una antigua unidad de superficie del sistema anglosajon. Homestead-Miami Speedway, un circuito de carreras en Florida, Estados Unidos. Ayuntamiento de Homestead, un edificio historico ubicado en Homestead, Florida.

Realmente, aplicar al beneficio de Homestead Exemption es muy facil, puede hacerlo online, en persona en las oficinas del Tasador de Propiedades del Condado de Miami-Dade o enviando su aplicacion por correo regular, lo mas importante es que cumpla con los siguientes requisitos: tener el titulo legal de su casa a partir

UU. decreto en 1862, la Homestead Act, que define la titularidad de una propiedad de 65 hectareas a los que la cultivan desde hace cinco anos. Cualquier persona que nunca hubiese tomado las armas contra el gobierno de los EE.

Si bien los compradores pagan la mayoria de los costos de cierre, que pueden sumar entre un 3% y un 4% del precio de venta, los vendedores generalmente pagan un costo de cierre de entre un 1% y un 3%, ademas de las comisiones que pagan a los agentes inmobiliarios.