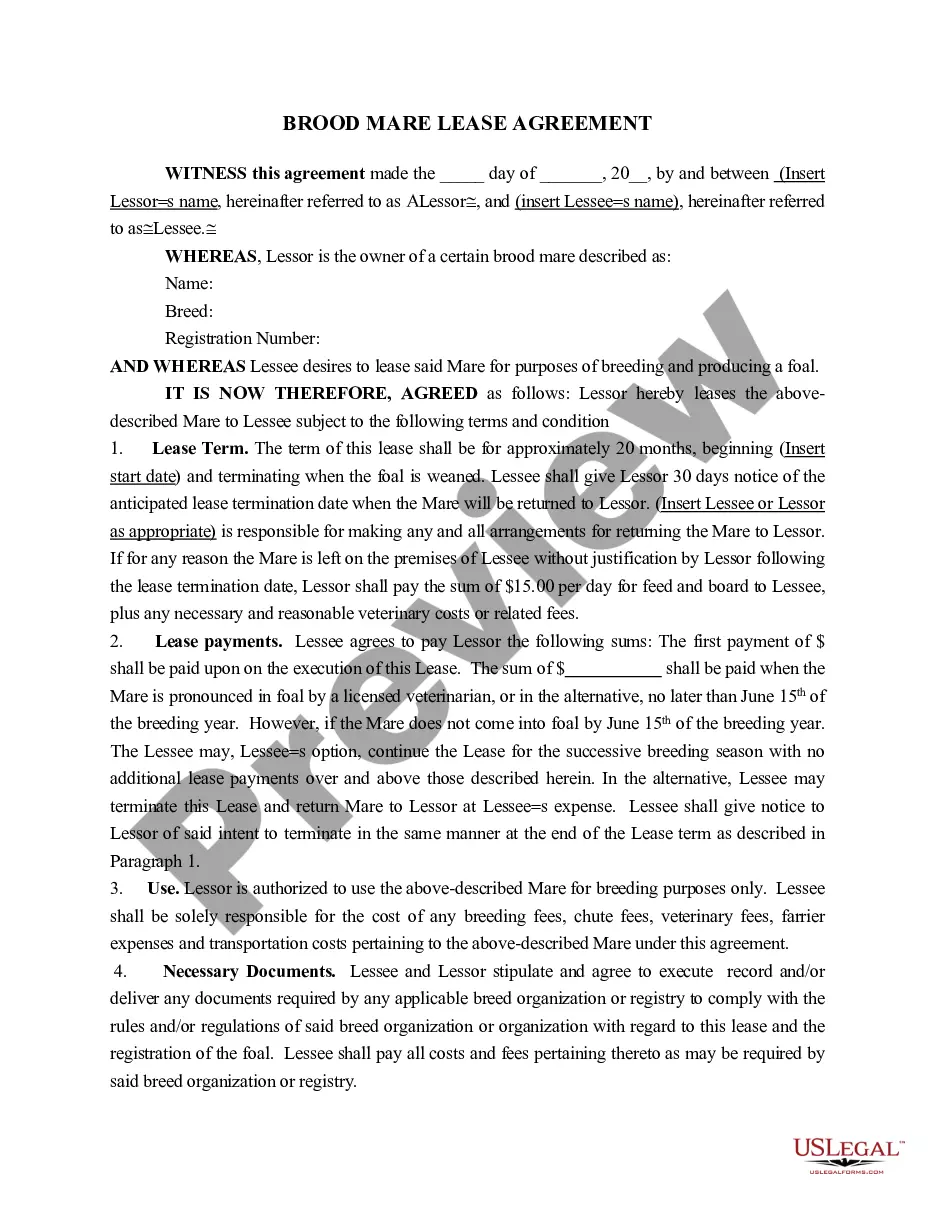

Philadelphia Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an important form required by the City of Philadelphia to document the sale or exchange of a principal residence and claim exemption from information reporting requirements for the transaction. This certification is one of the necessary steps for homeowners in Philadelphia to ensure compliance with local tax regulations and avoid unnecessary reporting obligations. The Philadelphia Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption serves as proof that the transaction meets the criteria for exemption from information reporting. By submitting this form, homeowners declare that the sale or exchange of their principal residence falls within the scope of tax exemption and does not require reporting to the City of Philadelphia. This certification form is particularly relevant for individuals who have sold or exchanged their principal residence within Philadelphia and want to claim exemption from reporting requirements. The form helps homeowners ensure that they are in compliance with local tax laws while relieving them from the burden of unnecessary reporting and documentation related to the transaction. The Philadelphia Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption may have different types based on specific circumstances. While the exact names of these types may vary, some variations could include: 1. Philadelphia Pennsylvania Certification of No Information Reporting on Sale of Principal Residence — Tax Exemption for Primary Residence: This type of certification is applicable when a homeowner sells their primary residence in Philadelphia and claims exemption from information reporting. 2. Philadelphia Pennsylvania Certification of No Information Reporting on Exchange of Principal Residence — Tax Exemption for Relocation: This type of certification is applicable for homeowners who have exchanged their principal residence in Philadelphia due to relocation and want to claim exemption from information reporting. In conclusion, the Philadelphia Pennsylvania Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a necessary form for homeowners in Philadelphia who wish to claim exemption from information reporting when selling or exchanging their principal residence. It ensures compliance with local tax laws while relieving homeowners from unnecessary reporting obligations. Different variations of this certification may exist depending on the specific circumstances of the sale or exchange of the property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Philadelphia Pennsylvania Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

Preparing documents for the business or individual needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to generate Philadelphia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption without professional help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Philadelphia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Philadelphia Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a few clicks!