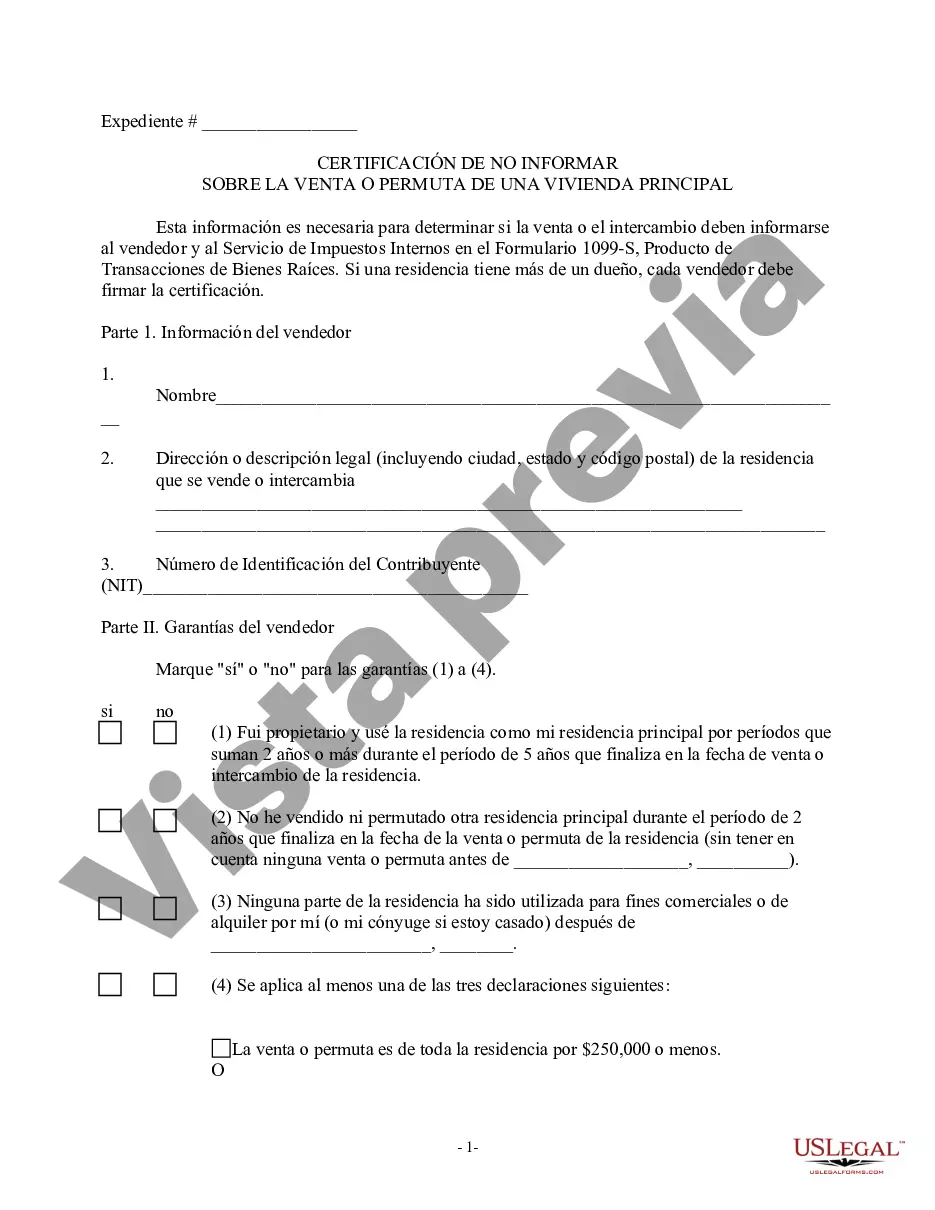

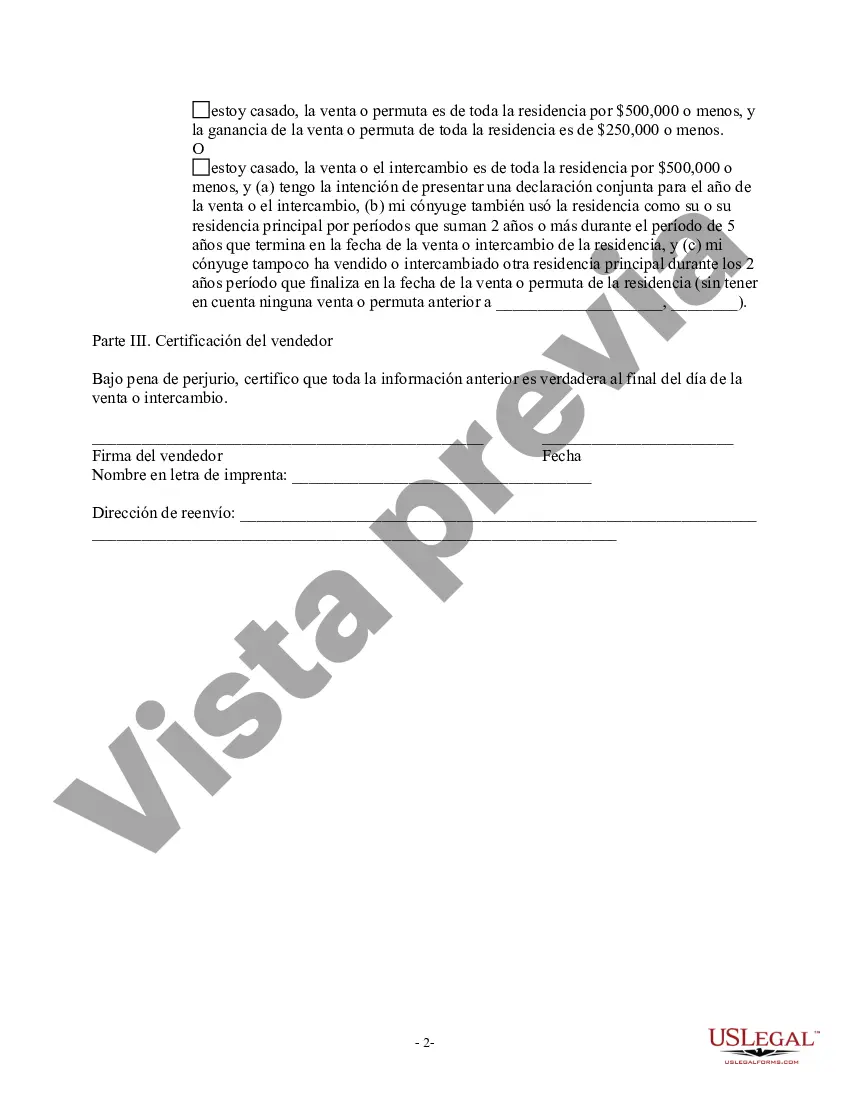

The Wake North Carolina Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a document that homeowners in Wake County can obtain to declare that their sale or exchange of their principal residence is eligible for tax exemption. This certification is essential for individuals who wish to claim exemption from reporting the transaction to the Internal Revenue Service (IRS). To obtain the Wake North Carolina Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners must meet certain criteria set by the county. It is important to note that there are different types of certifications available, depending on the circumstances of the transaction: 1. Standard Certification: Homeowners who have resided in their principal residence for at least two out of the last five years can apply for the standard certification. This option allows them to claim the tax exemption on up to $250,000 of capital gains if filing as an individual, or $500,000 if filing jointly with a spouse. 2. Partial Certification: In some cases, homeowners may not meet the two-year residency requirement but still qualify for a partial certification. This certification allows them to claim a partial exemption based on the duration they resided in the property during the five-year period. 3. Hardship Certification: Homeowners who are facing unforeseen circumstances such as a change in employment, health issues, or divorce may apply for a hardship certification. This certification takes into account the specific hardships faced by the homeowner and provides them with the opportunity to claim the tax exemption. The Wake North Carolina Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an important document that assists homeowners in fulfilling their tax obligations accurately. By obtaining the appropriate certification, homeowners can ensure compliance with IRS regulations and potentially save a significant amount of money by claiming the eligible tax exemption on their principal residence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

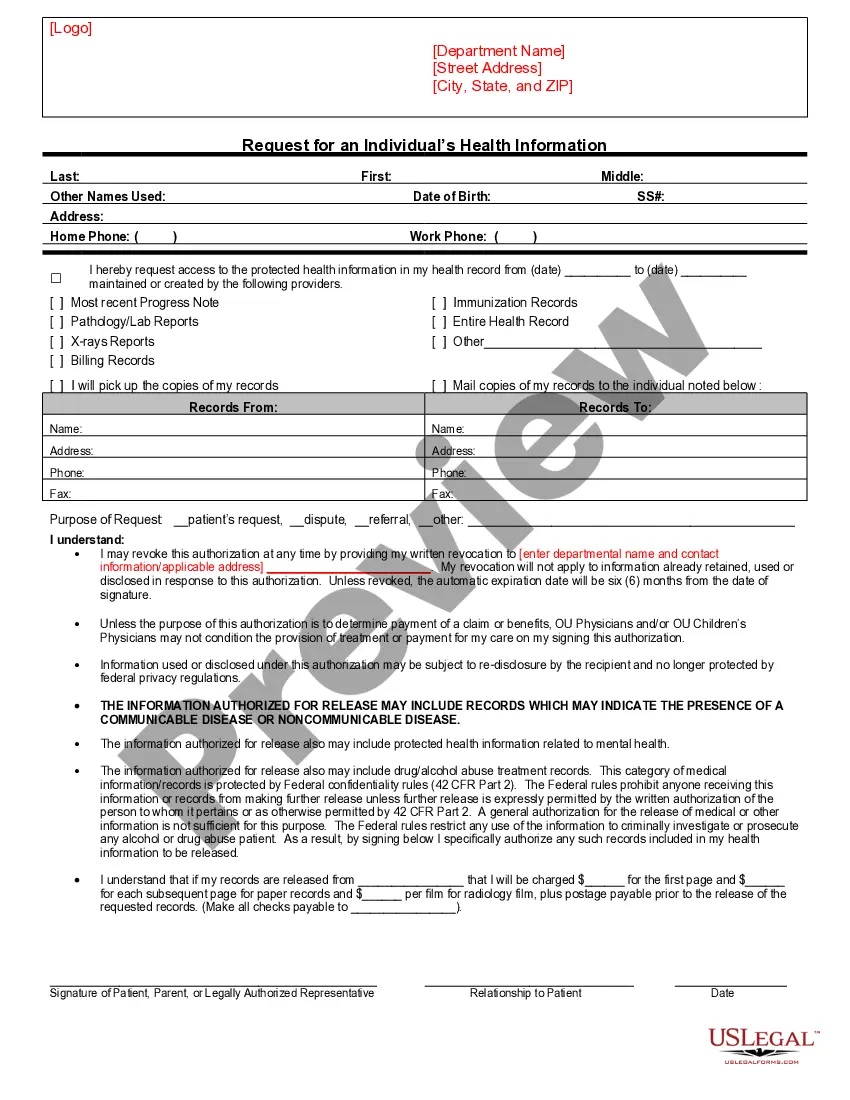

Description

How to fill out Wake North Carolina Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

Whether you plan to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Wake Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to get the Wake Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Follow the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Wake Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!