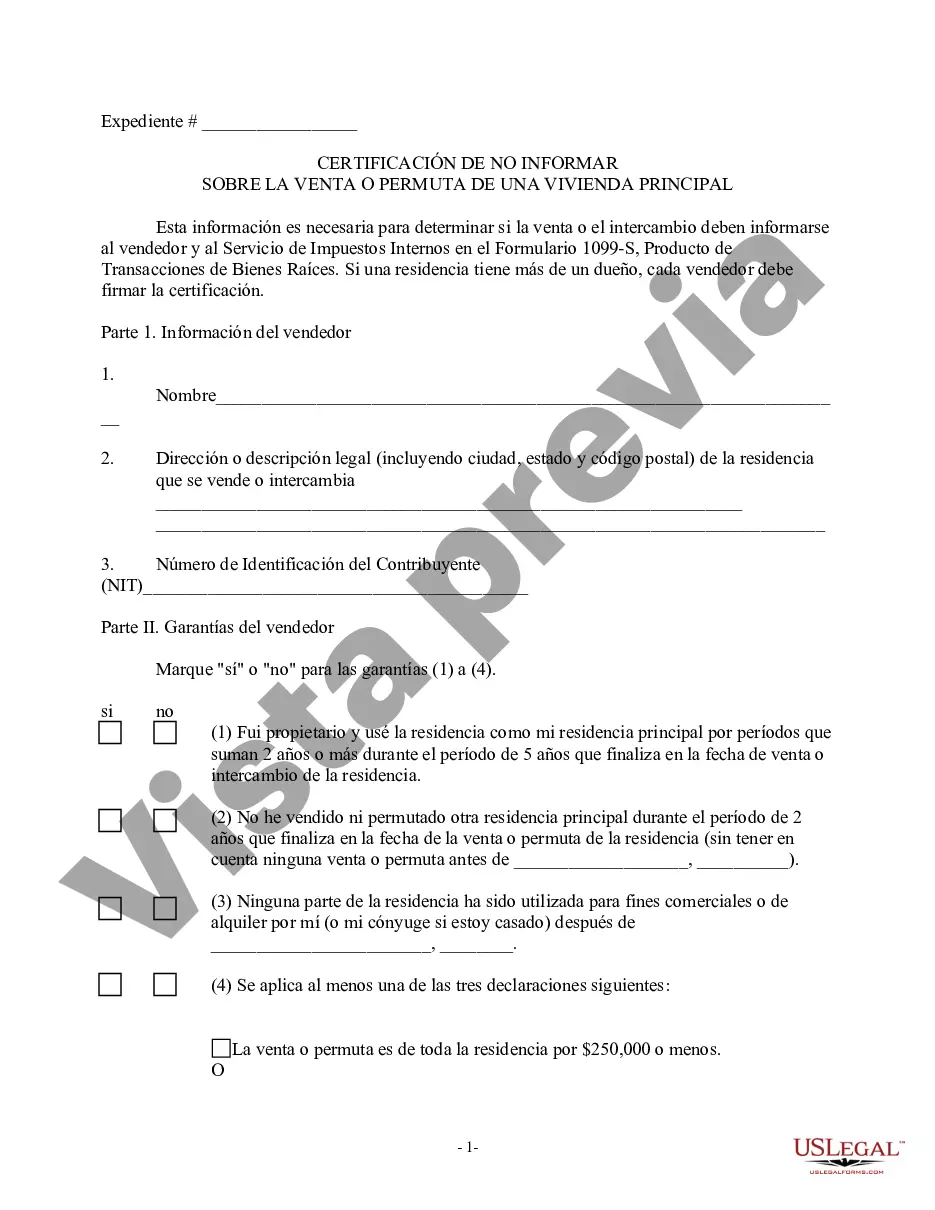

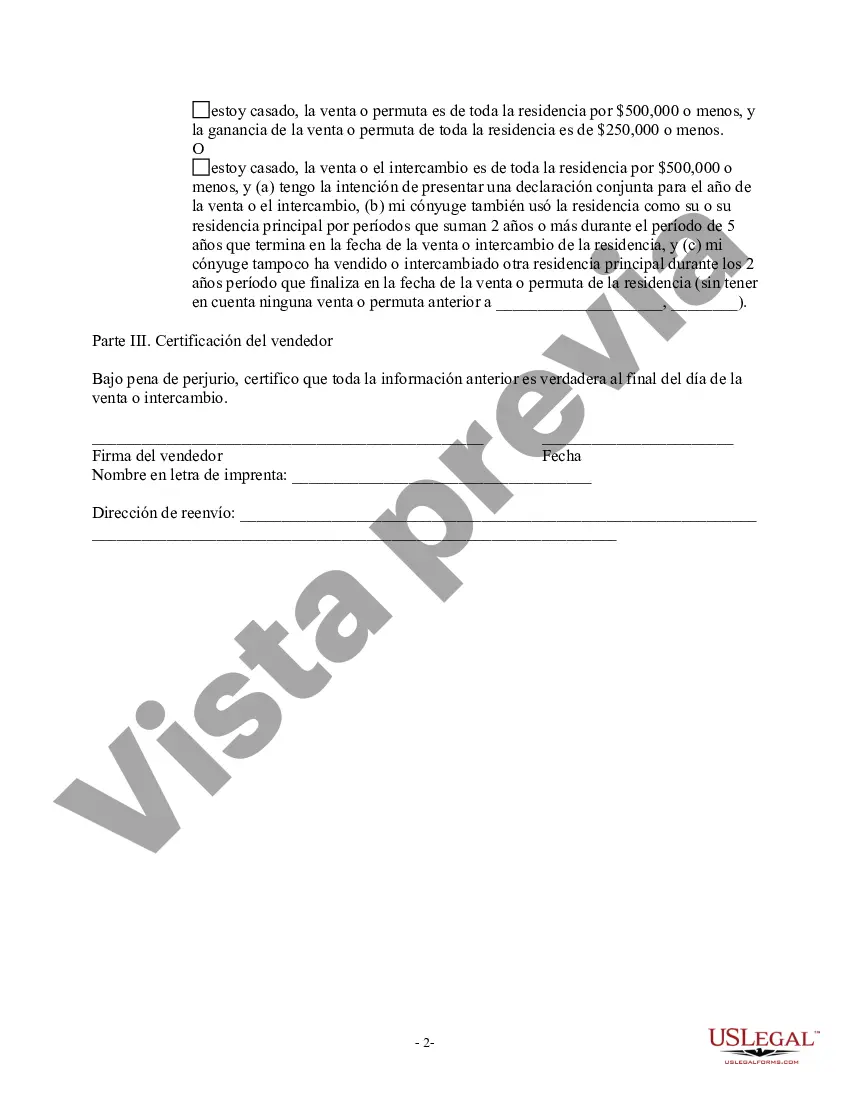

Wayne Michigan Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a vital document that homeowners in Wayne, Michigan may need to obtain when selling or exchanging their principal residence. This certification serves as proof that no reportable transaction occurred during the sale or exchange, thus exempting the seller from certain tax obligations. When individuals decide to sell or exchange their primary residential property, they often face various tax implications. However, certain transactions are exempt from reporting requirements, and obtaining the Wayne Michigan Certification of No Information Reporting on Sale or Exchange of Principal Residence is necessary to establish this exemption. This certification form includes several key details that homeowners must provide. These may include the seller's name, contact information, property address, and identification number. Additionally, the form may require a section to disclose the buyer's information to ensure accurate reporting and exemption verification. It is important to note that there may be different types of exemptions within the Wayne Michigan Certification of No Information Reporting on Sale or Exchange of Principal Residence, tailored to specific circumstances. These exemptions could include: 1. Principal Residence Exemption (PRE): This type of exemption applies to homeowners who sell or exchange their primary residence, which is the property they primarily occupy as their main home. By obtaining this exemption, homeowners may be relieved from reporting requirements on the sale or exchange. 2. Senior Citizen Exemption: This exemption is specific to senior citizens who meet specific age and income criteria established by Wayne, Michigan. It provides additional benefits to qualified older individuals, including tax exemptions, deductions, or credits, when selling or exchanging their principal residence. 3. Disabled Person Exemption: Similarly, this exemption is designed to aid individuals with disabilities when selling or exchanging their primary residence. Applicants must meet specific disability and income criteria to qualify for this exemption and its associated benefits. By obtaining the Wayne Michigan Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, homeowners can ensure compliance with tax regulations while potentially enjoying the benefits of reduced tax obligations or exemptions. It is crucial to consult with local tax authorities or professionals to understand specific eligibility criteria and ensure accurate completion of the certification form.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Wayne Michigan Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

If you need to find a reliable legal document supplier to obtain the Wayne Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it easy to locate and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply select to look for or browse Wayne Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, either by a keyword or by the state/county the form is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Wayne Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or execute the Wayne Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption - all from the comfort of your sofa.

Sign up for US Legal Forms now!