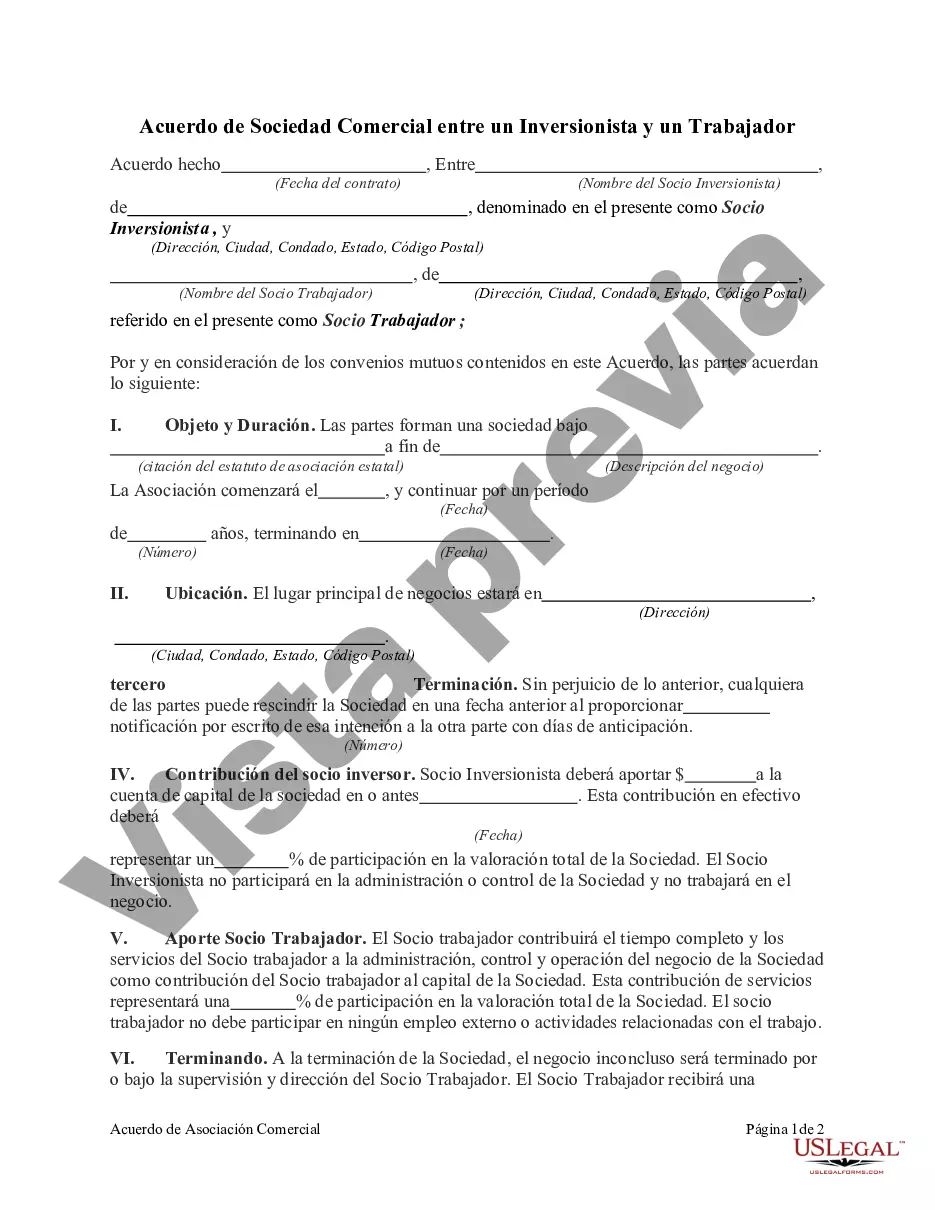

Santa Clara California Commercial Partnership Agreement between an Investor and Worker is a legally binding contract that outlines the business collaboration between an investor and a worker in Santa Clara, California. This agreement aims to establish a formal understanding, rights, and obligations between the two parties involved in a commercial partnership. Keywords: Santa Clara California, Commercial Partnership Agreement, investor, worker, collaboration, formal understanding, rights, obligations. In Santa Clara, California, there are different types of Commercial Partnership Agreements between an Investor and a Worker, namely: 1. General Partnership Agreement: This type of agreement establishes a partnership where both the investor and worker share equal rights, responsibilities, and liabilities. They have an equal say in business decisions and share profits and losses equally. 2. Limited Partnership Agreement: In a limited partnership, there is at least one general partner (investor) who assumes unlimited liability for business debts, while one or more limited partners (workers) contribute capital and have limited liability. Limited partners are passive investors and do not participate in day-to-day operations. 3. Joint Venture Agreement: A joint venture agreement is a temporary partnership where the investor and worker come together to achieve a specific business objective. This agreement outlines the contribution, profit-sharing, decision-making, and termination provisions. 4. Silent Partnership Agreement: In a silent partnership, the investor provides capital, while the worker manages the daily operations. The investor does not actively participate in decision-making or operations and receives a predetermined share of the profits. Key provisions commonly included in Santa Clara California Commercial Partnership Agreements between an Investor and Worker are: 1. Partnership Purpose: Clearly defines the business objectives and activities to be undertaken by the partnership. 2. Capital Contributions: Specifies the capital amounts and assets contributed by each party and how it will be used for the partnership's operations. 3. Profit and Loss Sharing: Determines the distribution of profits and losses among the investor and worker based on their agreed-upon ratios or percentages. 4. Rights and Responsibilities: Outlines the roles, duties, and decision-making authority of each party within the partnership. 5. Duration and Termination: Specifies the duration of the partnership and the conditions under which it may be terminated or extended. 6. Dispute Resolution: Establishes methods for resolving disputes or disagreements that may arise during the partnership. 7. Confidentiality and Non-Compete: Protects the partnership's proprietary information and restricts parties from engaging in similar businesses that may compete with the partnership. 8. Governing Law: Determines the laws of Santa Clara, California, that will govern the interpretation and enforcement of the agreement. By entering into a Santa Clara California Commercial Partnership Agreement between an Investor and Worker, both parties can establish a legally binding framework for their business collaboration, protect their rights and interests, and build a successful partnership in the vibrant commercial landscape of Santa Clara, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Acuerdo de Sociedad Comercial entre un Inversionista y un Trabajador - Commercial Partnership Agreement between an Investor and Worker

Description

How to fill out Santa Clara California Acuerdo De Sociedad Comercial Entre Un Inversionista Y Un Trabajador?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Santa Clara Commercial Partnership Agreement between an Investor and Worker.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Santa Clara Commercial Partnership Agreement between an Investor and Worker will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Santa Clara Commercial Partnership Agreement between an Investor and Worker:

- Ensure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Santa Clara Commercial Partnership Agreement between an Investor and Worker on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!