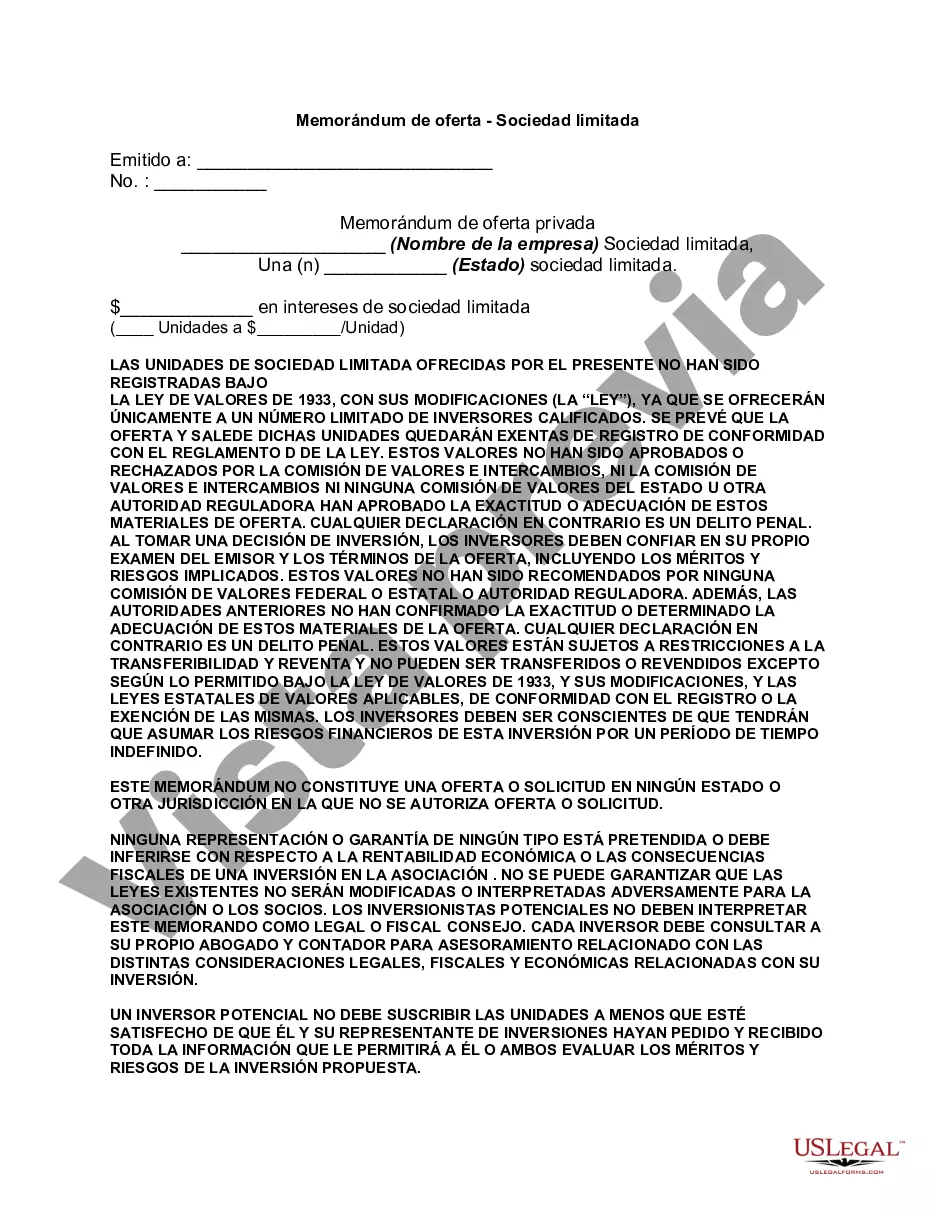

Offering memorandums are legally binding documents that are used to provide important information relevant to the process of a financial transaction. An offering memorandum may be required when offering stocks to investors, or selling real estate. In any situation, the document will include data that is required by law to be supplied to investors, ensuring they have sufficient information to make an informed decision about making the purchase.

Suffolk New York Offering Memorandum — Limited Partnership is a legal document that provides comprehensive details about an investment opportunity in Suffolk County, New York. It is typically used for partnerships where multiple investors pool their resources to fund a specific project or venture in the region. This document serves as an official information package that outlines the terms, conditions, and risks associated with the investment opportunity. The Suffolk New York Offering Memorandum — Limited Partnership contains crucial information that potential investors need to make an informed decision. It includes detailed descriptions of the partnership structure, management team, investment objectives, expected returns, and the overall investment strategy. Additionally, it provides an overview of the specific project or venture being funded and the potential market opportunities it offers. The memorandum also outlines the investment process, including the minimum investment requirement, investment timeline, and any associated fees and expenses. It is essential for investors to carefully review this document and seek professional advice if needed before committing any capital. Types of Suffolk New York Offering Memorandum — Limited Partnership may include: 1. Real Estate Partnership: This type of partnership focuses on investing in real estate properties in Suffolk County, New York. The memorandum will highlight the specific properties, their locations, rental income potential, and expected appreciation. 2. Infrastructure Partnership: This type of partnership aims to invest in and develop infrastructure projects in the region. It could involve the construction of roads, bridges, utilities, or other public or private infrastructure assets. The memorandum will provide details about the specific projects, their funding requirements, and anticipated economic and social impacts. 3. Venture Capital Partnership: This type of partnership focuses on providing funding to early-stage or high-growth potential companies in Suffolk County, New York. The memorandum will outline the investment criteria, the portfolio companies, the expected returns, and the potential risks associated with investing in startups or emerging businesses. 4. Renewable Energy Partnership: This type of partnership centers around investing in the development and operation of renewable energy projects in Suffolk County, New York. Examples may include solar farms, wind farms, or biomass facilities. The memorandum will detail the specific projects, their expected energy generation capacity, long-term contracts, and the potential environmental benefits. Investors should carefully review the Suffolk New York Offering Memorandum — Limited Partnership and evaluate the opportunities and risks involved. It is advisable to consult legal, financial, and investment professionals to ensure their interests are protected and to make informed decisions based on their specific investment goals and risk tolerance.Suffolk New York Offering Memorandum — Limited Partnership is a legal document that provides comprehensive details about an investment opportunity in Suffolk County, New York. It is typically used for partnerships where multiple investors pool their resources to fund a specific project or venture in the region. This document serves as an official information package that outlines the terms, conditions, and risks associated with the investment opportunity. The Suffolk New York Offering Memorandum — Limited Partnership contains crucial information that potential investors need to make an informed decision. It includes detailed descriptions of the partnership structure, management team, investment objectives, expected returns, and the overall investment strategy. Additionally, it provides an overview of the specific project or venture being funded and the potential market opportunities it offers. The memorandum also outlines the investment process, including the minimum investment requirement, investment timeline, and any associated fees and expenses. It is essential for investors to carefully review this document and seek professional advice if needed before committing any capital. Types of Suffolk New York Offering Memorandum — Limited Partnership may include: 1. Real Estate Partnership: This type of partnership focuses on investing in real estate properties in Suffolk County, New York. The memorandum will highlight the specific properties, their locations, rental income potential, and expected appreciation. 2. Infrastructure Partnership: This type of partnership aims to invest in and develop infrastructure projects in the region. It could involve the construction of roads, bridges, utilities, or other public or private infrastructure assets. The memorandum will provide details about the specific projects, their funding requirements, and anticipated economic and social impacts. 3. Venture Capital Partnership: This type of partnership focuses on providing funding to early-stage or high-growth potential companies in Suffolk County, New York. The memorandum will outline the investment criteria, the portfolio companies, the expected returns, and the potential risks associated with investing in startups or emerging businesses. 4. Renewable Energy Partnership: This type of partnership centers around investing in the development and operation of renewable energy projects in Suffolk County, New York. Examples may include solar farms, wind farms, or biomass facilities. The memorandum will detail the specific projects, their expected energy generation capacity, long-term contracts, and the potential environmental benefits. Investors should carefully review the Suffolk New York Offering Memorandum — Limited Partnership and evaluate the opportunities and risks involved. It is advisable to consult legal, financial, and investment professionals to ensure their interests are protected and to make informed decisions based on their specific investment goals and risk tolerance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.