The Cuyahoga Ohio Collection Report is a comprehensive document that provides detailed information on the financial status and activities of various entities within the Cuyahoga County, Ohio region. This report serves as a crucial tool for individuals and organizations to assess the economic growth, fiscal health, and revenue collection efforts of the county. The primary purpose of the Cuyahoga Ohio Collection Report is to present an accurate overview of the tax collections and financial transactions carried out by government departments, agencies, and other affiliated bodies operating within the county. The report includes data on property taxes, sales taxes, income taxes, and other sources of revenue collected by the local government. By examining the different categories of tax collections and their distribution, individuals can gain insights into how funds are allocated and utilized for various public services such as infrastructure development, education, healthcare, and public safety. Additionally, the report provides an analysis of any changes in tax rates, exemptions, or policies that may impact revenue generation in the county. Moreover, the Cuyahoga Ohio Collection Report may encompass sub-reports based on specific entities or departments within the county. For instance, it might include separate reports for the Cuyahoga County Treasurer's Office, Cuyahoga County Auditor's Office, and various municipal tax collection departments. Each sub-report delves into the finances, transactions, and collections related to a particular entity or department, allowing readers to study their individual contributions to the overall revenue of the county. In conclusion, the Cuyahoga Ohio Collection Report assists individuals in comprehending the financial landscape of Cuyahoga County by providing an in-depth analysis of tax collections, revenue distribution, and financial activities. Its sub-reports offer a detailed breakdown of the financial status of specific entities or departments within the county. This comprehensive report aids decision-makers, researchers, and residents in making informed assessments and evaluating the economic progress and fiscal stability of the Cuyahoga County, Ohio region.

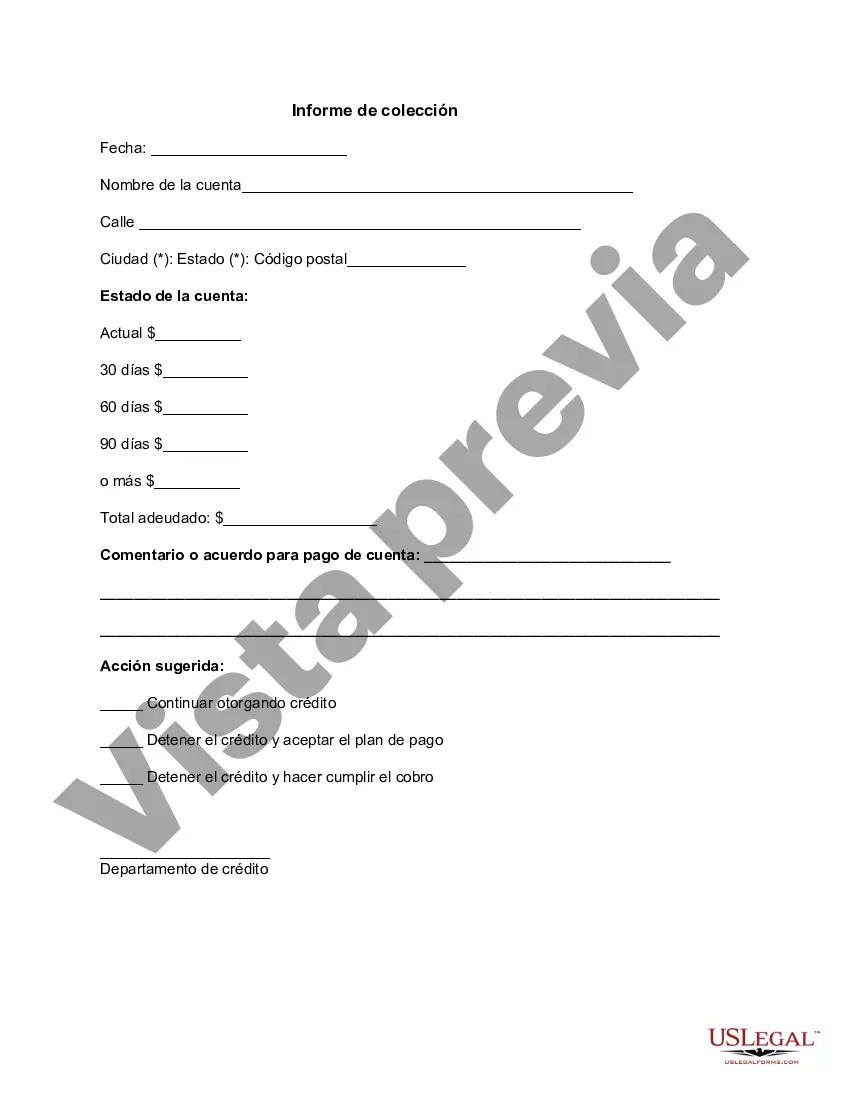

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Informe de colección - Collection Report

Description

How to fill out Cuyahoga Ohio Informe De Colección?

Drafting papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Cuyahoga Collection Report without professional assistance.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Cuyahoga Collection Report on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Cuyahoga Collection Report:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!