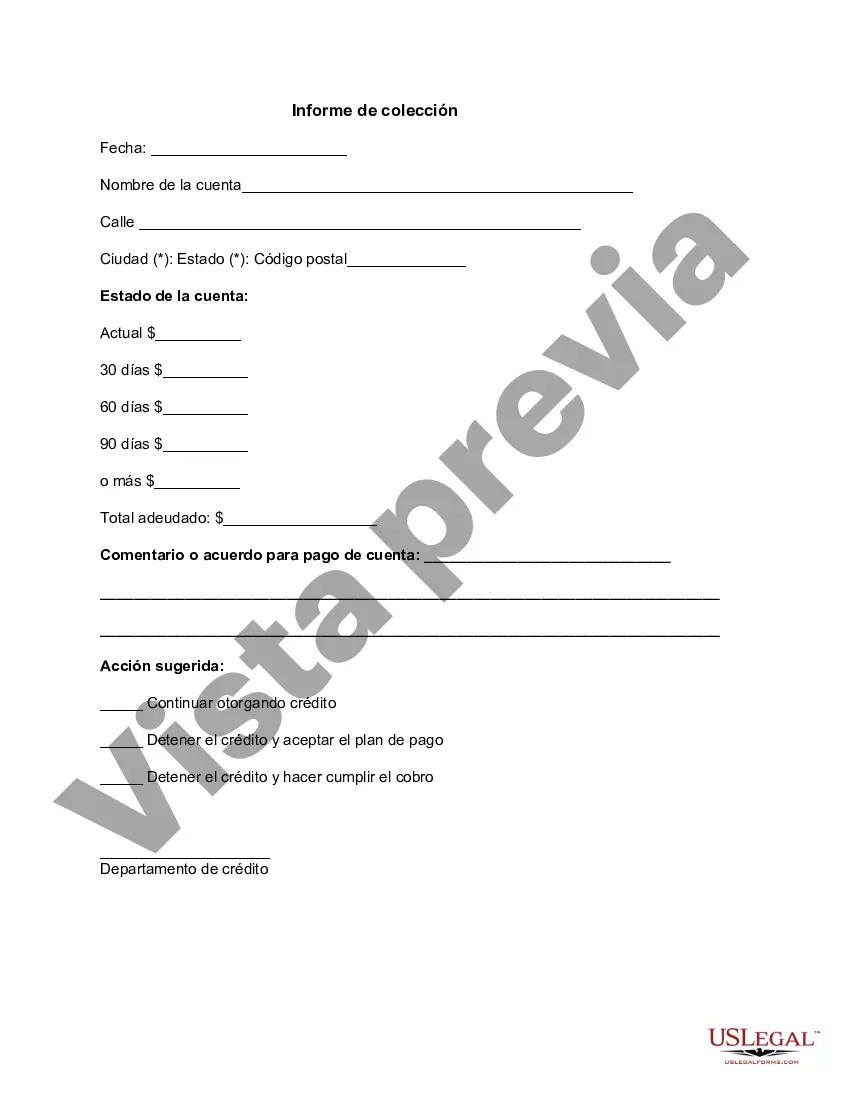

The Nassau New York Collection Report is a comprehensive document that provides detailed information and analysis regarding the various collections in Nassau County, New York. It serves as a valuable resource for individuals and organizations involved in financial management, budgeting, and planning. The report includes data on the different types of collections in Nassau County, such as property taxes, sales taxes, and other revenue streams. It outlines the collection process, highlighting the methods used, collection periods, and the overall efficiency of the collection system. The Nassau New York Collection Report also provides an in-depth analysis of the collection trends over time, identifying any fluctuations or patterns in revenue generation. This information helps policymakers and stakeholders understand the financial health of the county and make informed decisions about budgetary allocations and revenue projections. Key sections of the report may include: 1. Property Tax Collection: This section examines the collection process for property taxes, the primary source of revenue for many municipalities within Nassau County. It analyzes the percentage of property taxes collected and identifies any issues or challenges faced during the collection period. 2. Sales Tax Collection: This section focuses on the collection of sales taxes, which are crucial for economic development within the county. It provides insights into the sales tax collection rate, any changes in tax rates, and the impact of local economic factors on collection performance. 3. Other Revenue Collections: Nassau County also generates revenue from various sources like permits, fines, and fees. This section examines the efficiency and effectiveness of collecting these revenue streams, including any updates to relevant collection policies or regulations. 4. Collection Strategies: The report may discuss the strategies employed by Nassau County to ensure timely and efficient collection. This can include measures like incentivizing early payment, adopting technological solutions for online payments, or enhancing communication channels with taxpayers. 5. Comparative Analysis: In some instances, the report may provide a comparative analysis between different municipalities within Nassau County, allowing for benchmarking and identifying areas of improvement in collection performance. Different types of Nassau New York Collection Reports may include annual, quarterly, or monthly reports depending on the frequency of data updates and the requirements of relevant stakeholders. The frequency and depth of the reports can vary, as they can be tailored to specific needs, such as financial audits, budget planning, or monitoring revenue trends. In conclusion, the Nassau New York Collection Report is a critical tool for assessing the financial health of Nassau County's various revenue streams. Through detailed analysis and reporting, it aids in facilitating informed decision-making and efficient financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Informe de colección - Collection Report

Description

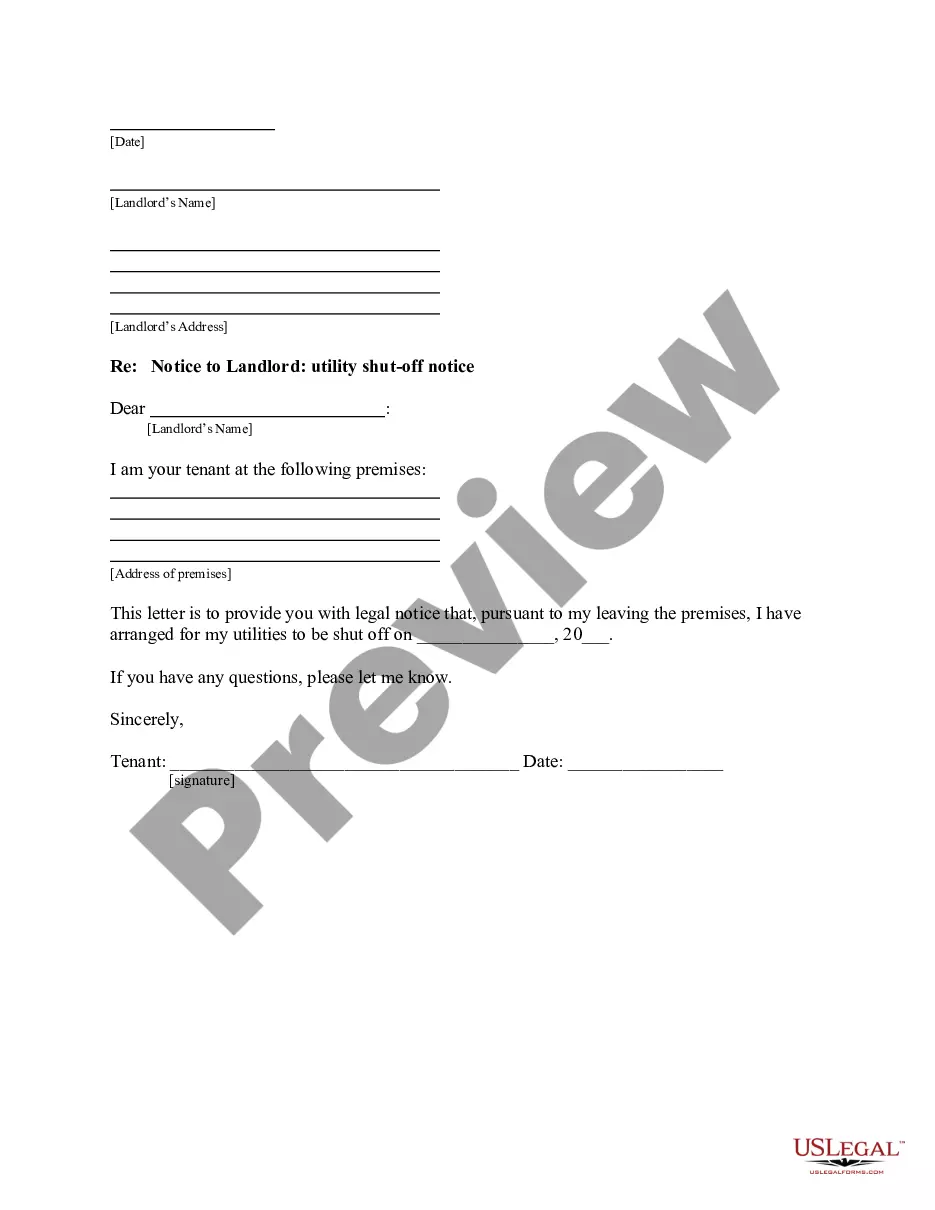

How to fill out Nassau New York Informe De Colección?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Nassau Collection Report.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Nassau Collection Report will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Nassau Collection Report:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Nassau Collection Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!