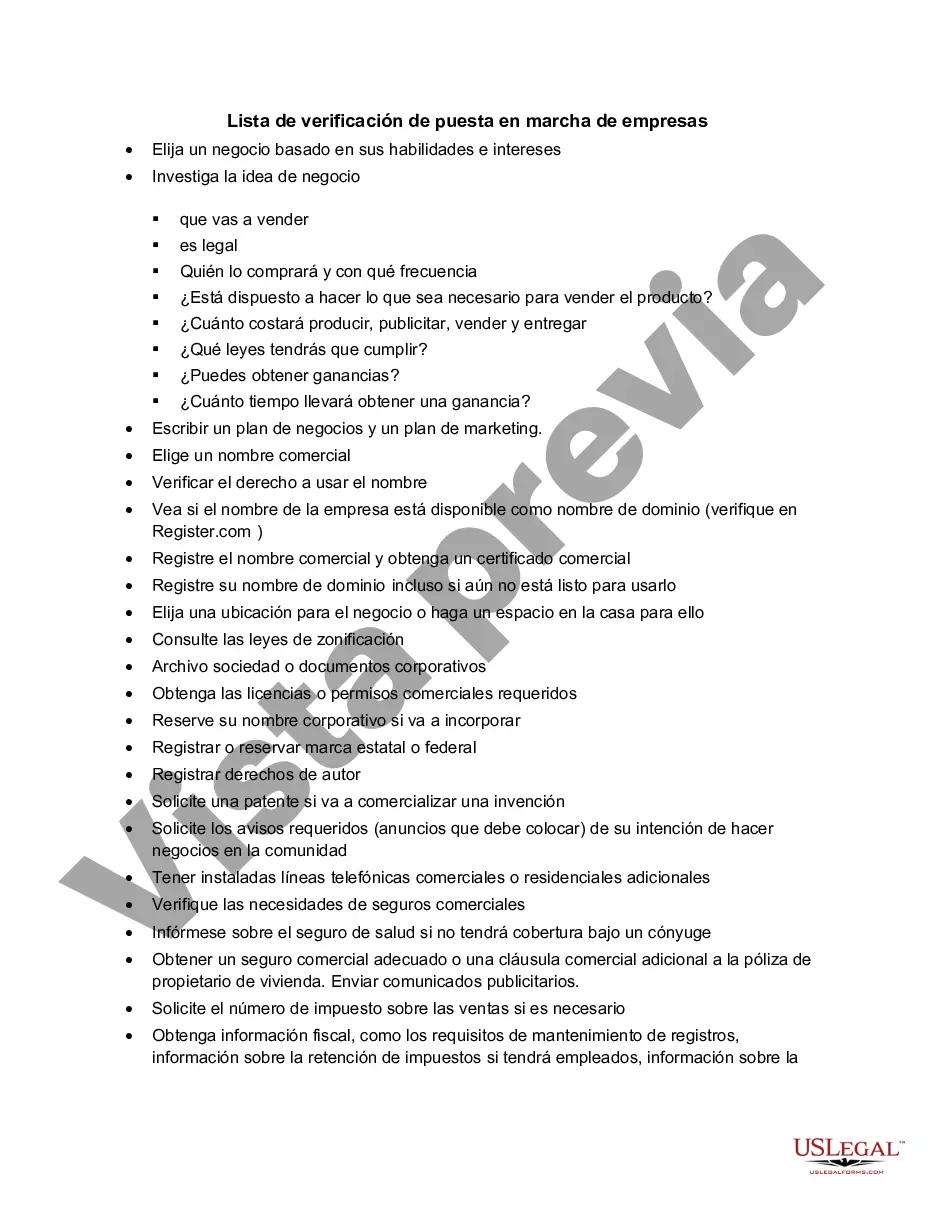

Harris Texas Business Start-up Checklist is a comprehensive guide designed to assist aspiring entrepreneurs in establishing their business in Harris County, Texas. This checklist covers various aspects and crucial steps involved in starting a business in this region, from legal requirements to necessary permits and licenses. By following this checklist, entrepreneurs can ensure that they have fulfilled all the necessary obligations to establish a successful business in Harris County, Texas. Key factors covered in the Harris Texas Business Start-up Checklist include: 1. Business plan: Developing a well-structured business plan tailored to your specific industry is crucial for success. The checklist emphasizes the significance of outlining business goals, target market analysis, financial projections, and marketing strategies. 2. Legal structure and permits: Determining the appropriate legal structure for your business, such as registering as a sole proprietorship, partnership, or corporation, is essential. The checklist provides guidance on obtaining the necessary permits, licenses, and registrations required to operate legally in Harris County, Texas. 3. Naming and registration: Selecting a unique and memorable business name is crucial for branding purposes. The checklist guides entrepreneurs through the process of conducting a name availability search and registering their business name with the appropriate state and county agencies. 4. Taxation requirements: Understanding tax obligations is paramount for every business owner. The checklist outlines the various taxes applicable to businesses in Harris County, Texas, including sales taxes, property taxes, and employment taxes. It also provides resources and links to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). 5. Insurance coverage: Identifying and acquiring appropriate insurance coverage to protect the business and its assets is another critical step. The checklist highlights the importance of different types of insurances, such as general liability, workers' compensation, and professional liability insurance, depending on the nature of the business. 6. Hiring employees: For businesses planning to hire employees, the checklist provides information on obtaining an Employer Identification Number (EIN), adhering to labor laws, creating employment contracts, and understanding payroll tax obligations. 7. Funding and financial planning: Entrepreneurs often require initial investment or financing to start their businesses. The checklist offers resources and guidance on creating financial projections, seeking business loans, applying for grants, and identifying potential investors or funding options available in Harris County, Texas. Different types of Harris Texas Business Start-up Checklists may include industry-specific considerations like healthcare, food service, construction, or retail. These specialized checklists provide additional details tailored to the specific regulations and requirements for those industries in Harris County, Texas. In conclusion, the Harris Texas Business Start-up Checklist serves as an invaluable resource for entrepreneurs seeking to establish their businesses in Harris County, Texas. By diligently following this comprehensive guide, business owners can ensure compliance with legal obligations, obtain necessary permits and licenses, and set a strong foundation for their venture's success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Lista de verificación de puesta en marcha de empresas - Business Start-up Checklist

Description

How to fill out Harris Texas Lista De Verificación De Puesta En Marcha De Empresas?

Draftwing documents, like Harris Business Start-up Checklist, to manage your legal affairs is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for a variety of cases and life situations. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Harris Business Start-up Checklist form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before getting Harris Business Start-up Checklist:

- Ensure that your document is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Harris Business Start-up Checklist isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!