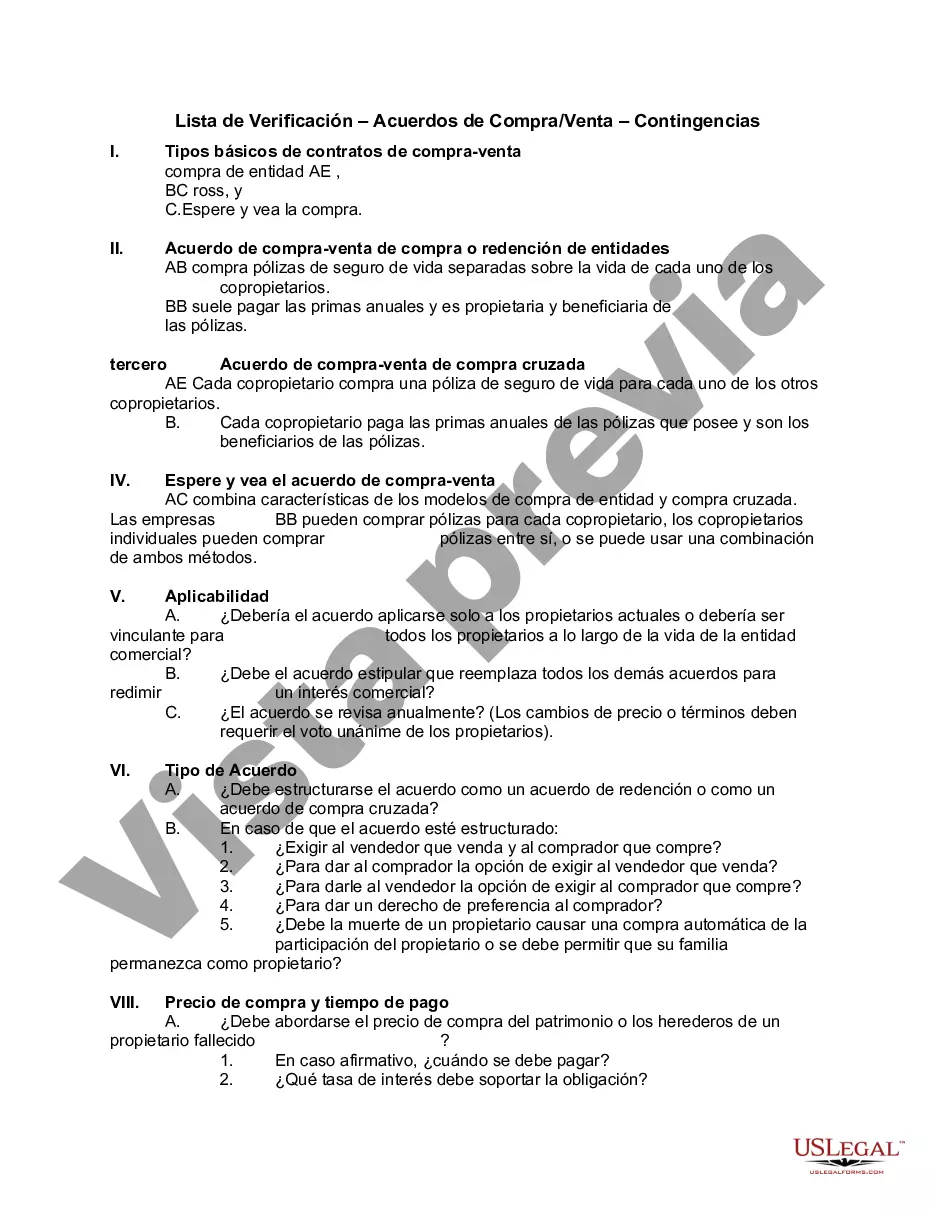

A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

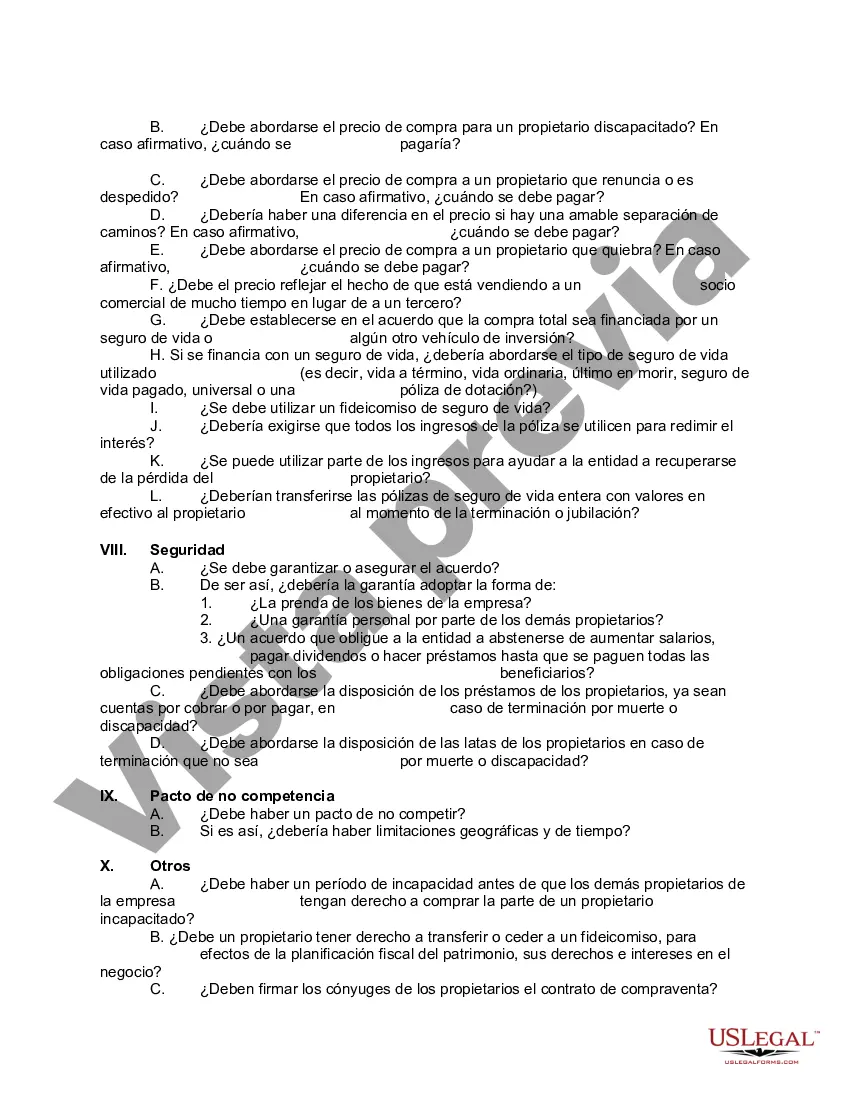

Mecklenburg County, North Carolina, is a vibrant region known for its thriving economic opportunities, natural beauty, and rich history. If you are involved in buying or selling property in Mecklenburg County, it is crucial to have a Checklist that covers essential aspects like Buy/Sell Agreements and Contingencies. This comprehensive guide will help ensure a smooth and successful transaction. Here are some key areas to consider: 1. Buy/Sell Agreements: This refers to a legally binding contract between a buyer and a seller, outlining the terms and conditions of a property transaction. It covers aspects such as purchase price, financing arrangements, closing dates, and contingencies. Having a thorough Buy/Sell Agreement protects both parties and minimizes potential disputes. 2. Property Inspections: Under Contingencies, it is vital to include provisions for property inspections. This may involve hiring licensed professionals to assess the condition of the property, including structural, electrical, plumbing, and pest inspections. Proper evaluation helps identify any issues that may need addressing or negotiation of terms. 3. Financing Contingencies: When buying or selling a property, financing contingencies are crucial to secure necessary funds. This clause allows the buyer time to obtain financing approval or ensures the seller that the buyer will be able to fulfill the payment obligations. It is vital to include specific timelines for loan application submission, approval, and loan commitment. 4. Appraisal Contingencies: To determine the fair market value of a property, an appraisal is often required. Including appraisal contingencies ensures that the property's value aligns with the purchase price. If the appraisal value is below the agreed-upon price, this contingency allows renegotiation or potential termination of the agreement. 5. Title Contingencies: Title contingencies safeguard against any unforeseen issues related to the property's ownership or legal claims. It ensures that the title is clear and transferable, free of any liens or encumbrances. A professional title search is necessary to assess the property's history and identify any potential problems that may arise during the transaction. 6. Homeowner Association (HOA) or Condominium Contingencies: If the property is subject to HOA or condominium regulations, it is essential to include contingencies related to their rules, regulations, and fees. This ensures that buyers have adequate time to review governing documents and the HOA's financial condition before finalizing the purchase. By incorporating these essential contingencies into the Mecklenburg County Checklist for Buy/Sell Agreements, both buyers and sellers can protect their interests and ensure a successful real estate transaction. It is crucial to consult with qualified real estate professionals and legal experts to draft a comprehensive checklist that adheres to North Carolina's local laws and regulations. Note: There are no specific types of Mecklenburg North Carolina Checklist — Buy/Sell Agreement— - Contingencies mentioned in the prompt.Mecklenburg County, North Carolina, is a vibrant region known for its thriving economic opportunities, natural beauty, and rich history. If you are involved in buying or selling property in Mecklenburg County, it is crucial to have a Checklist that covers essential aspects like Buy/Sell Agreements and Contingencies. This comprehensive guide will help ensure a smooth and successful transaction. Here are some key areas to consider: 1. Buy/Sell Agreements: This refers to a legally binding contract between a buyer and a seller, outlining the terms and conditions of a property transaction. It covers aspects such as purchase price, financing arrangements, closing dates, and contingencies. Having a thorough Buy/Sell Agreement protects both parties and minimizes potential disputes. 2. Property Inspections: Under Contingencies, it is vital to include provisions for property inspections. This may involve hiring licensed professionals to assess the condition of the property, including structural, electrical, plumbing, and pest inspections. Proper evaluation helps identify any issues that may need addressing or negotiation of terms. 3. Financing Contingencies: When buying or selling a property, financing contingencies are crucial to secure necessary funds. This clause allows the buyer time to obtain financing approval or ensures the seller that the buyer will be able to fulfill the payment obligations. It is vital to include specific timelines for loan application submission, approval, and loan commitment. 4. Appraisal Contingencies: To determine the fair market value of a property, an appraisal is often required. Including appraisal contingencies ensures that the property's value aligns with the purchase price. If the appraisal value is below the agreed-upon price, this contingency allows renegotiation or potential termination of the agreement. 5. Title Contingencies: Title contingencies safeguard against any unforeseen issues related to the property's ownership or legal claims. It ensures that the title is clear and transferable, free of any liens or encumbrances. A professional title search is necessary to assess the property's history and identify any potential problems that may arise during the transaction. 6. Homeowner Association (HOA) or Condominium Contingencies: If the property is subject to HOA or condominium regulations, it is essential to include contingencies related to their rules, regulations, and fees. This ensures that buyers have adequate time to review governing documents and the HOA's financial condition before finalizing the purchase. By incorporating these essential contingencies into the Mecklenburg County Checklist for Buy/Sell Agreements, both buyers and sellers can protect their interests and ensure a successful real estate transaction. It is crucial to consult with qualified real estate professionals and legal experts to draft a comprehensive checklist that adheres to North Carolina's local laws and regulations. Note: There are no specific types of Mecklenburg North Carolina Checklist — Buy/Sell Agreement— - Contingencies mentioned in the prompt.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.