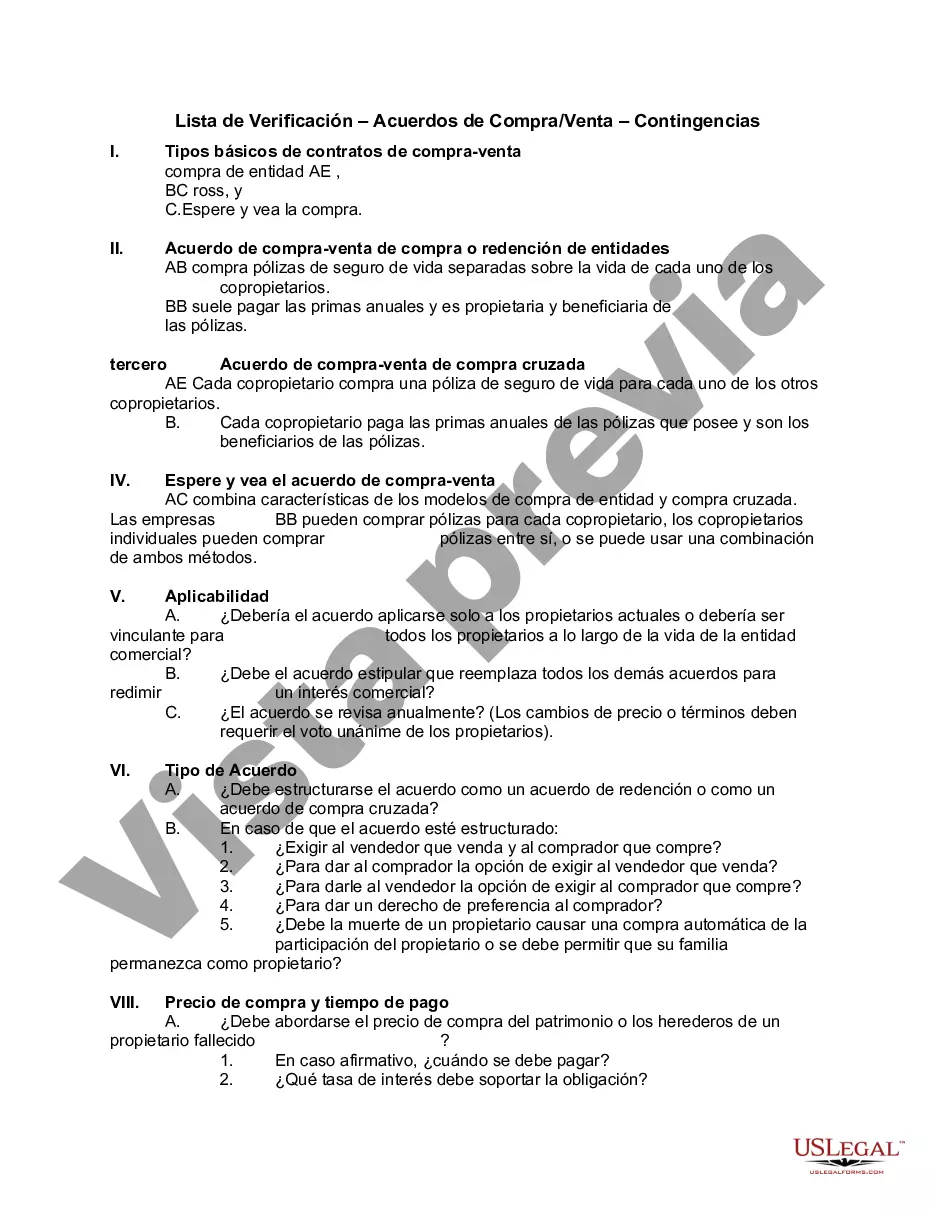

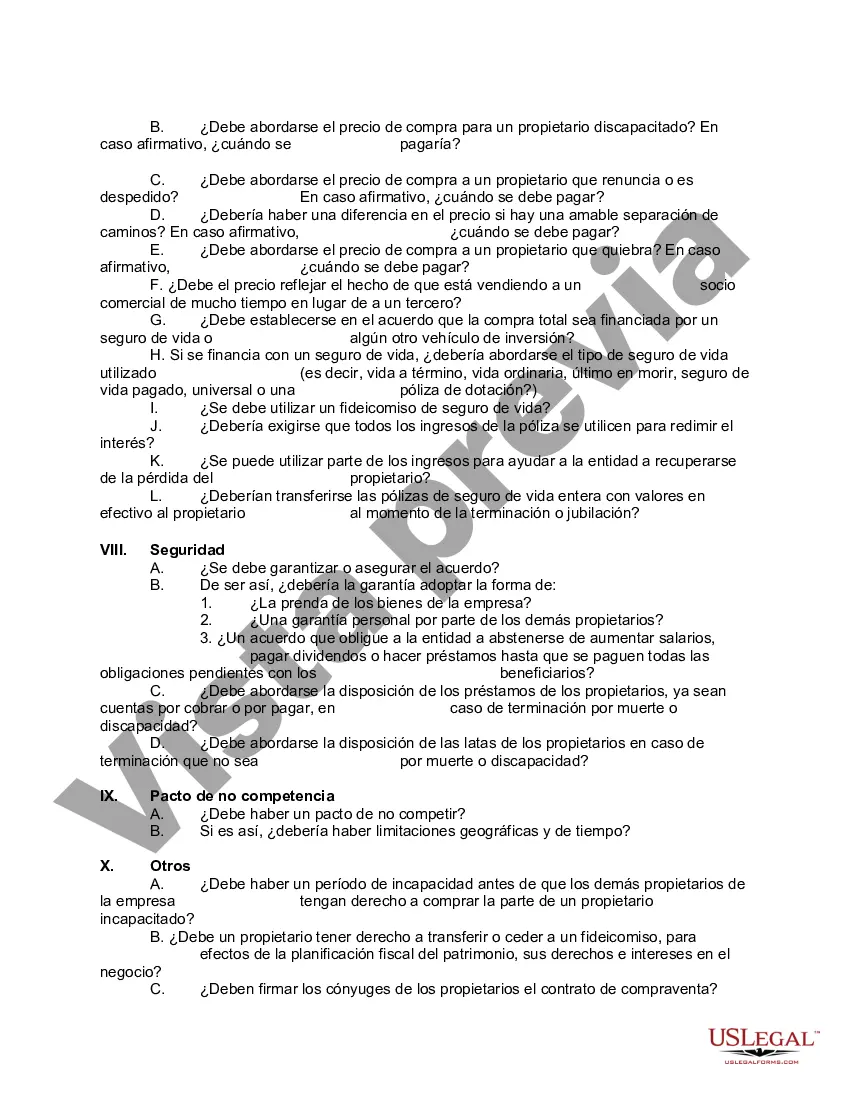

A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

Nassau, New York is a vibrant county located on Long Island, just east of New York City. Known for its beautiful landscapes, rich history, and bustling business environment, Nassau County offers a wide range of opportunities for individuals and businesses alike. When it comes to the real estate market in Nassau County, having a checklist for Buy/Sell Agreements with appropriate contingencies is crucial to ensure a smooth and successful transaction. A Buy/Sell Agreement is a legally binding contract between the buyer and seller of a property, outlining the terms and conditions of the sale. This agreement not only protects the rights and interests of both parties, but it also helps mitigate potential risks and uncertainties that may arise during the buying or selling process. Properly structuring the agreement with well-thought-out contingencies is essential to safeguarding the interests of both the buyer and seller. Key elements to include in a Nassau New York Checklist for Buy/Sell Agreements are: 1. Purchase Price and Payment Terms: Clearly define the agreed-upon purchase price, and specify the payment terms, such as the down payment, financing arrangements, and any applicable interest rates. 2. Contingencies for Financing: Include contingencies that protect the buyer in case they are unable to secure financing within a specified timeframe. This may involve conditions such as obtaining an acceptable mortgage commitment or satisfactory inspection of the property. 3. Inspection Contingency: Ensure that the buyer has the option to conduct a thorough inspection of the property to identify any existing or potential issues. This contingency allows the buyer to request repairs or negotiate on the price based on the inspection results. 4. Contingency for Appraisal: In case the property does not appraise for the agreed-upon purchase price, include a contingency that allows the buyer to renegotiate the price or withdraw from the agreement. 5. Title Contingency: Protect the buyer from any potential defects or liens on the property's title by including a contingency that ensures the seller provides a clear and marketable title. 6. Contingency for Property Sale: If the buyer needs to sell their existing property in order to purchase the new one, inclusion of a contingency that allows the termination of the agreement if the buyer fails to sell within a certain timeframe. 7. Timing and Closing Date: Set a closing date that provides both parties with sufficient time to meet their respective obligations and outline the consequences for any delays. By incorporating these contingencies into the Buy/Sell Agreement, both buyers and sellers can significantly reduce potential risks and conflicts throughout the transaction process. Different types of Nassau New York Checklist — Buy/Sell Agreement— - Contingencies may include specific provisions based on various property types or unique buyer/seller situations. Some examples of specialized checklists include commercial property buy/sell agreements, land acquisition agreements, foreclosure buy/sell agreements, lease-purchase agreements, or agreements tailored for specific industries like healthcare or hospitality. In summary, a well-structured Nassau New York Checklist for Buy/Sell Agreements with appropriate contingencies is crucial for a successful real estate transaction. Covering essential aspects such as purchase price, financing, inspections, appraisals, title, and timing helps protect the interests of both parties involved. Understanding the unique requirements of different property types and buyer/seller situations enables the creation of specialized checklists to address specific needs within the Nassau County real estate market.Nassau, New York is a vibrant county located on Long Island, just east of New York City. Known for its beautiful landscapes, rich history, and bustling business environment, Nassau County offers a wide range of opportunities for individuals and businesses alike. When it comes to the real estate market in Nassau County, having a checklist for Buy/Sell Agreements with appropriate contingencies is crucial to ensure a smooth and successful transaction. A Buy/Sell Agreement is a legally binding contract between the buyer and seller of a property, outlining the terms and conditions of the sale. This agreement not only protects the rights and interests of both parties, but it also helps mitigate potential risks and uncertainties that may arise during the buying or selling process. Properly structuring the agreement with well-thought-out contingencies is essential to safeguarding the interests of both the buyer and seller. Key elements to include in a Nassau New York Checklist for Buy/Sell Agreements are: 1. Purchase Price and Payment Terms: Clearly define the agreed-upon purchase price, and specify the payment terms, such as the down payment, financing arrangements, and any applicable interest rates. 2. Contingencies for Financing: Include contingencies that protect the buyer in case they are unable to secure financing within a specified timeframe. This may involve conditions such as obtaining an acceptable mortgage commitment or satisfactory inspection of the property. 3. Inspection Contingency: Ensure that the buyer has the option to conduct a thorough inspection of the property to identify any existing or potential issues. This contingency allows the buyer to request repairs or negotiate on the price based on the inspection results. 4. Contingency for Appraisal: In case the property does not appraise for the agreed-upon purchase price, include a contingency that allows the buyer to renegotiate the price or withdraw from the agreement. 5. Title Contingency: Protect the buyer from any potential defects or liens on the property's title by including a contingency that ensures the seller provides a clear and marketable title. 6. Contingency for Property Sale: If the buyer needs to sell their existing property in order to purchase the new one, inclusion of a contingency that allows the termination of the agreement if the buyer fails to sell within a certain timeframe. 7. Timing and Closing Date: Set a closing date that provides both parties with sufficient time to meet their respective obligations and outline the consequences for any delays. By incorporating these contingencies into the Buy/Sell Agreement, both buyers and sellers can significantly reduce potential risks and conflicts throughout the transaction process. Different types of Nassau New York Checklist — Buy/Sell Agreement— - Contingencies may include specific provisions based on various property types or unique buyer/seller situations. Some examples of specialized checklists include commercial property buy/sell agreements, land acquisition agreements, foreclosure buy/sell agreements, lease-purchase agreements, or agreements tailored for specific industries like healthcare or hospitality. In summary, a well-structured Nassau New York Checklist for Buy/Sell Agreements with appropriate contingencies is crucial for a successful real estate transaction. Covering essential aspects such as purchase price, financing, inspections, appraisals, title, and timing helps protect the interests of both parties involved. Understanding the unique requirements of different property types and buyer/seller situations enables the creation of specialized checklists to address specific needs within the Nassau County real estate market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.