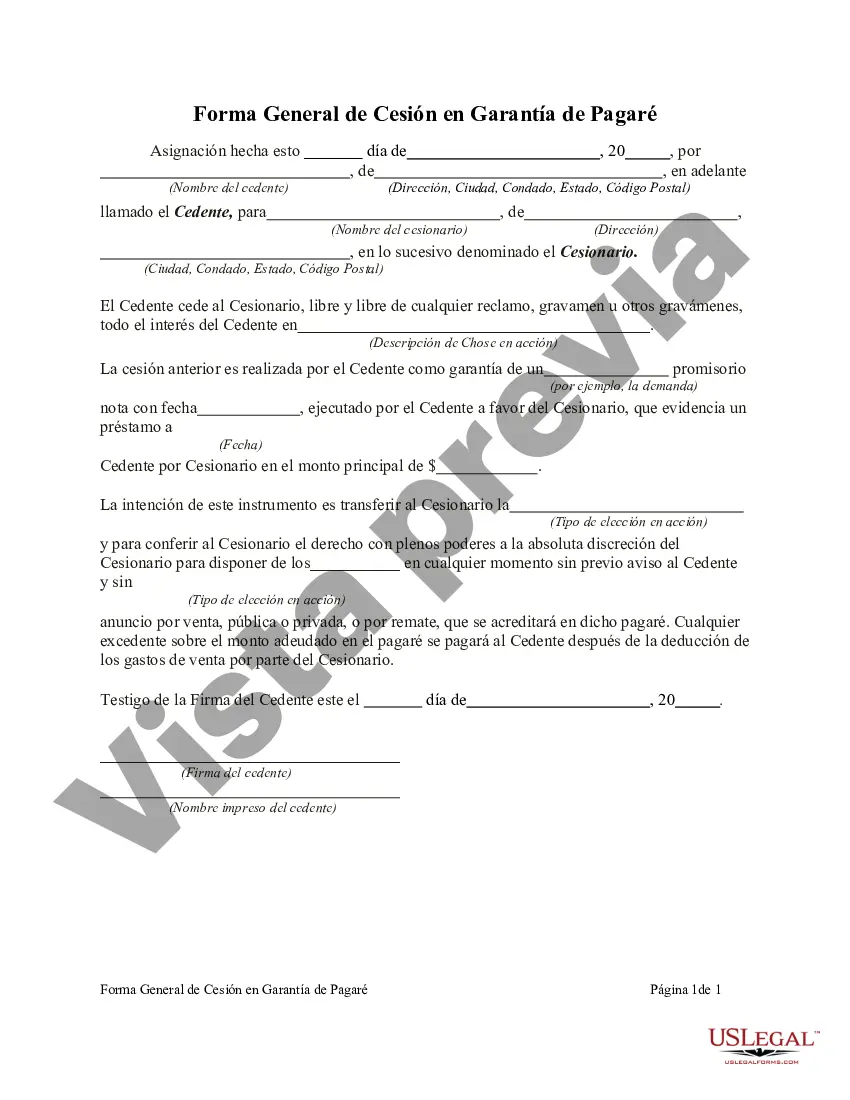

Fulton Georgia General Form of Assignment as Collateral for Note is a legal document used in the state of Georgia to secure debt obligations in various financial transactions. In simpler terms, it is an agreement between two parties that allows the borrower to use certain assets as collateral for a loan or note. This general form of assignment serves as a legal instrument to transfer ownership rights of certain assets to the lender, also known as the assignee, if the borrower fails to repay the loan or meet the terms of the note. The assets pledged as collateral can vary depending on the nature of the agreement and can include real estate properties, vehicles, stocks, bonds, or any other valuable possessions. The purpose of using a Fulton Georgia General Form of Assignment as Collateral for Note is to provide security for the lender by ensuring that in the event of default, they have a legal claim over the assigned assets. This document helps protect the lender's interests and gives them the option to recover their investment by selling or liquidating the collateral. Different types of Fulton Georgia General Form of Assignment as Collateral for Note can arise depending on the nature of the transaction or the specific assets being used as collateral. Some common variations may include: 1. Real Estate Assignment: This occurs when the borrower assigns their ownership rights of a property, such as a house or land, to the lender as collateral for the note. In case of default, the lender can foreclose on the property to recover the outstanding debt. 2. Security Assignment: In this type, the borrower assigns securities like stocks, bonds, or mutual funds to the lender as collateral. These assigned securities can be sold or liquidated by the lender to cover the unpaid debt if the borrower defaults. 3. Chattel Mortgage Assignment: This assignment involves using movable assets like vehicles, equipment, or inventory as collateral. The lender holds a lien on the collateral until the borrower fulfills their debt obligations or the loan is repaid. 4. Accounts Receivable Assignment: Often used in business financing, this assignment involves assigning the rights to receive payments from outstanding invoices or accounts receivable to the lender. In case of non-payment, the lender has the authority to collect directly from the debtor. It is important to note that specific provisions and terms may differ in these different types of Fulton Georgia General Form of Assignment as Collateral for Note. It is recommended to consult legal professionals or review the relevant Georgia statutes to ensure compliance and accuracy when drafting or using such documents.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Fulton Georgia Forma General De Cesión En Garantía De Pagaré?

Laws and regulations in every sphere vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Fulton General Form of Assignment as Collateral for Note, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fulton General Form of Assignment as Collateral for Note from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Fulton General Form of Assignment as Collateral for Note:

- Analyze the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!