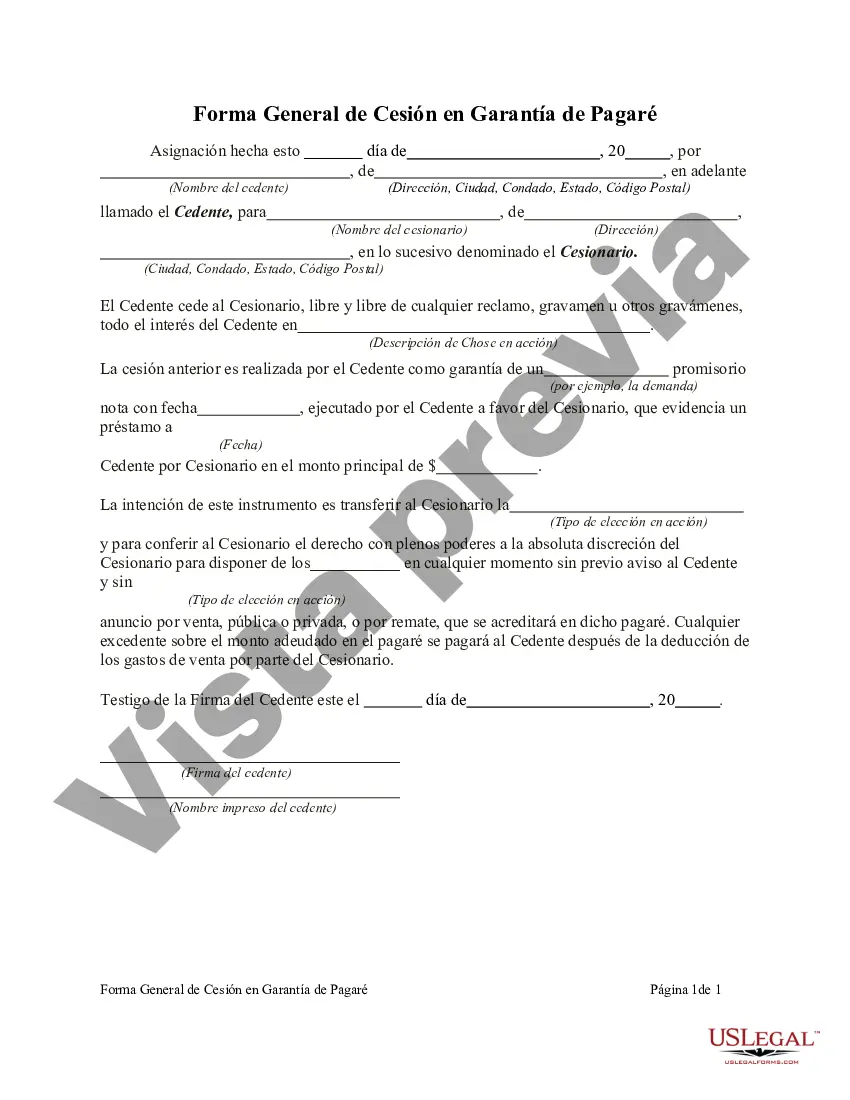

Mecklenburg North Carolina General Form of Assignment as Collateral for Note is a legal document commonly used in financial transactions, particularly in the context of loans and mortgages. It involves the assignment of a property or asset as collateral to secure the repayment of a promissory note. In Mecklenburg County, North Carolina, this type of assignment is governed by specific rules and regulations designed to protect the rights of both parties involved in the transaction. The General Form of Assignment as Collateral for Note outlines the terms and conditions of the assignment, ensuring clarity and allowing for smooth transactions. The key objective of this form is to establish a legally binding agreement between the borrower and the lender, detailing the collateral being offered, describing its value, and specifying its ownership status. The lender often requires collateral to mitigate the risk associated with lending money, as it provides them with a means to recoup their investment if the borrower defaults on the loan. Some essential elements included in Mecklenburg North Carolina General Form of Assignment as Collateral for Note are: 1. Identification of the parties: The names and contact information of the borrower (assignor) and the lender (assignee) are clearly stated at the beginning of the document. It is crucial for both parties to be accurately identified to avoid any confusion or disputes. 2. Description of the collateral: The form provides a comprehensive description of the asset being assigned as collateral. This includes details such as the address (if applicable), make, model, serial number, and any other relevant identification information necessary for accurate identification. 3. Value of the collateral: The assigned value and appraisal of the collateral are clearly mentioned in the form. This allows for transparency and ensures that both parties are aware of the estimated worth of the asset. 4. Assignment purpose: The document must clearly state the purpose of the assignment, which is to secure the repayment of a specified promissory note. This clarity is fundamental in understanding the intentions of both parties and defining the legal obligations associated with the assignment. 5. Representations and warranties: The assignor guarantees that they are the legal owner of the collateral, that it is free from encumbrances, and that there are no conflicting claims or third-party rights attached to it. This section protects the lender from potential disputes regarding the ownership or legal status of the collateral. Different types of Mecklenburg North Carolina General Forms of Assignment as Collateral for Note may include variations depending on the specific requirements of the parties involved or the nature of the transaction. However, the structure and purpose of the form generally remain the same, adhering to the applicable laws and regulations in Mecklenburg County, North Carolina. Note: It is essential to consult with a legal professional or seek expert advice to ensure that the Mecklenburg North Carolina General Form of Assignment as Collateral for Note accurately reflects the specific circumstances and requirements of your situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Mecklenburg North Carolina Forma General De Cesión En Garantía De Pagaré?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the Mecklenburg General Form of Assignment as Collateral for Note.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Mecklenburg General Form of Assignment as Collateral for Note will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Mecklenburg General Form of Assignment as Collateral for Note:

- Ensure you have opened the correct page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Mecklenburg General Form of Assignment as Collateral for Note on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!