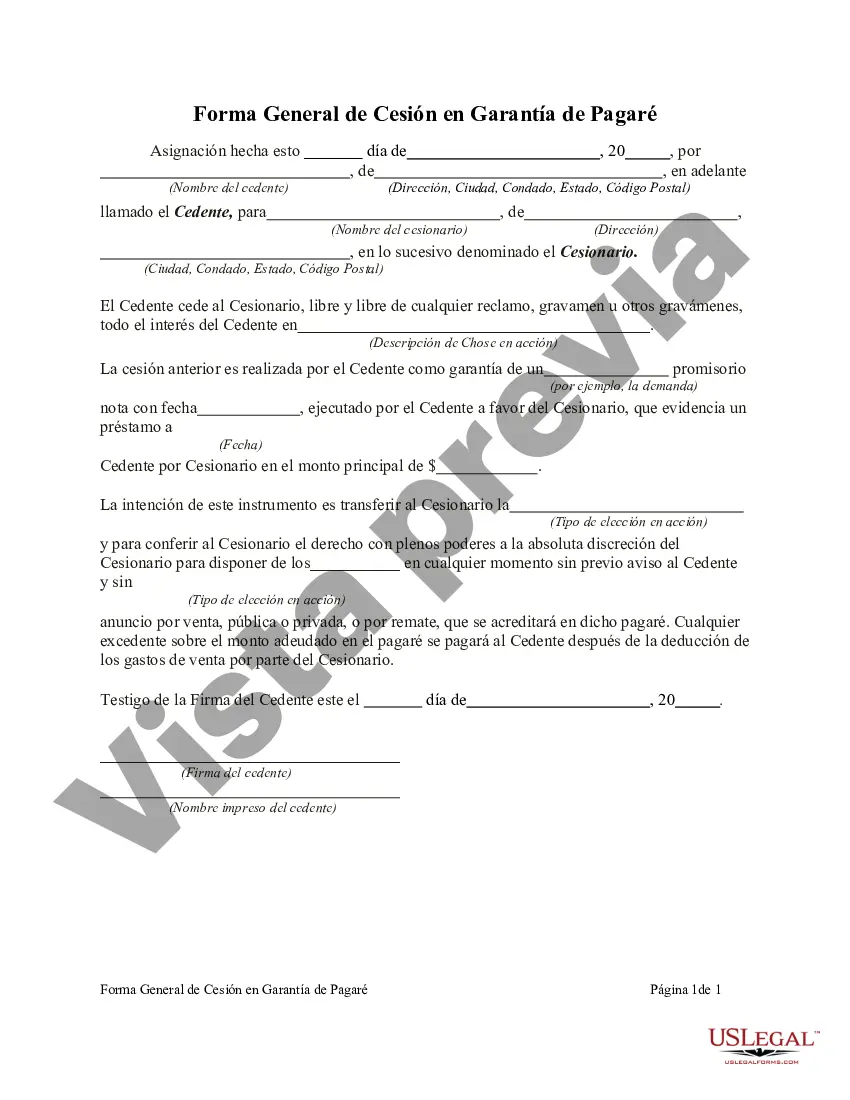

San Antonio, Texas is a vibrant city located in the southern part of the state. It is known for its rich history, diverse culture, and impressive landmarks. One important aspect of the financial industry in San Antonio is the General Form of Assignment as Collateral for Note. This legal document serves as a means to secure a loan by offering a specific asset as collateral. The General Form of Assignment as Collateral for Note is a binding agreement between a lender and a borrower. It outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and consequences for defaulting on the loan. In this case, the borrower pledges collateral in the form of an asset to protect the lender's interest. There are different types of General Form of Assignment as Collateral for Note arrangements in San Antonio, Texas. Some common examples include: 1. Real estate collateral: This type of assignment involves using a property as collateral for the loan. It could be residential, commercial, or industrial real estate. If the borrower defaults on the loan, the lender can seize and sell the property to recover their investment. 2. Vehicle collateral: Another form of assignment involves using a vehicle as collateral. This could include cars, trucks, motorcycles, or even boats. The lender holds the title or lien on the vehicle until the loan is fully repaid. 3. Business assets collateral: In some cases, businesses in San Antonio may pledge their assets, such as equipment, inventory, or accounts receivable, as collateral. This provides additional security for lenders, as they can seize and liquidate these assets if the business fails to repay the loan. 4. Investment collateral: Some borrowers may use their investment portfolios, stocks, bonds, or other financial assets as collateral. This allows them to leverage their investments to secure a loan while still maintaining ownership of the assets. The General Form of Assignment as Collateral for Note is a crucial legal document that protects the interests of both lenders and borrowers in San Antonio, Texas. It ensures that the lender has a security net in case of default, while borrowers can access loans based on the value of their assets. Before entering into such an agreement, it is advisable for both parties to seek legal counsel to fully understand their rights and obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out San Antonio Texas Forma General De Cesión En Garantía De Pagaré?

If you need to get a trustworthy legal document supplier to find the San Antonio General Form of Assignment as Collateral for Note, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed template.

- You can browse from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to locate and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to search or browse San Antonio General Form of Assignment as Collateral for Note, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the San Antonio General Form of Assignment as Collateral for Note template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or complete the San Antonio General Form of Assignment as Collateral for Note - all from the convenience of your home.

Join US Legal Forms now!