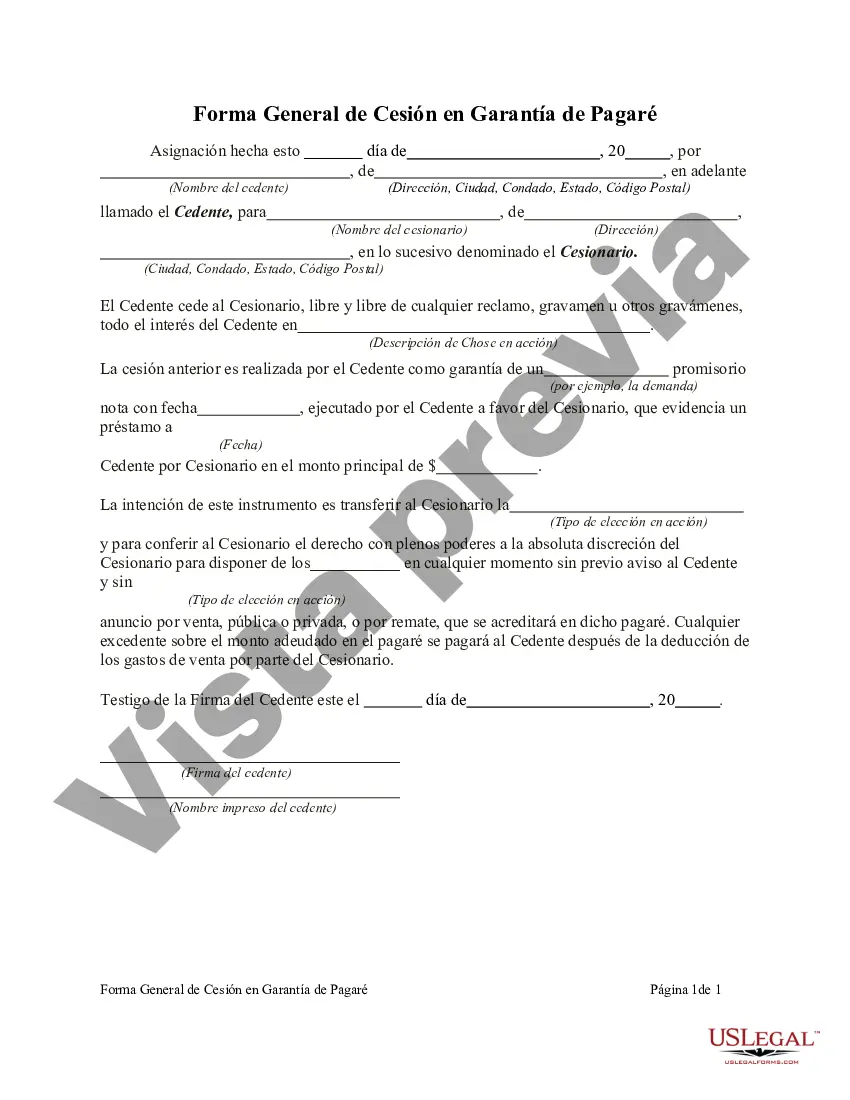

Wayne, Michigan General Form of Assignment as Collateral for Note is an essential legal document that outlines the terms and conditions of assigning collateral to secure a promissory note in Wayne, Michigan. This document serves as a legal contract between the lender and the borrower, providing protection and clarity for both parties involved in the transaction. The Wayne, Michigan General Form of Assignment as Collateral for Note is designed to ensure that the lender has a security interest in the collateral provided by the borrower. This collateral can be any valuable asset of the borrower, such as real estate, vehicles, stocks, bonds, or any other tangible or intangible property that holds value. By signing the General Form of Assignment as Collateral for Note, the borrower acknowledges that they are granting the lender a security interest in the specified collateral. This means that in case of default on the promissory note, the lender has the right to seize and sell the collateral to recover the outstanding balance or satisfy the debt. There are a few different types of Wayne, Michigan General Form of Assignment as Collateral for Note that may vary based on the specific property being assigned as collateral. For example, there may be separate forms for real estate, vehicles, or financial assets. These variations ensure that the assignment accurately describes and secures the particular collateral involved. The Wayne, Michigan General Form of Assignment as Collateral for Note typically includes the following key elements: 1. Identification of the borrower and lender: This section provides the names and contact information of both parties involved in the agreement. 2. Description of the collateral: It specifies the type, quantity, and condition of the collateral being used to secure the promissory note. This section may include detailed descriptions, serial numbers, or any other identifying information related to the collateral. 3. Security interest: The assignment outlines the lender's security interest in the collateral and the borrower's acknowledgement and agreement to grant such interest. 4. Default and remedies: This section explains the actions the lender can take in the event of default, including the right to seize, sell, or otherwise dispose of the collateral to satisfy the debt. 5. Representations and warranties: The borrower may be required to make certain statements and promises regarding the state of the collateral, ensuring its availability and value as security. It is crucial for both the lender and the borrower to consult legal professionals familiar with Wayne, Michigan laws while drafting, reviewing, or executing the General Form of Assignment as Collateral for Note. This helps ensure that the assignment accurately reflects their intentions and protects their interests in compliance with state regulations. By having this document in place, parties involved can navigate their financial arrangements with more clarity and peace of mind.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Wayne Michigan Forma General De Cesión En Garantía De Pagaré?

Are you looking to quickly draft a legally-binding Wayne General Form of Assignment as Collateral for Note or maybe any other document to take control of your personal or business matters? You can select one of the two options: hire a professional to write a valid document for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive professionally written legal documents without paying unreasonable prices for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Wayne General Form of Assignment as Collateral for Note and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Wayne General Form of Assignment as Collateral for Note is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by using the search box in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Wayne General Form of Assignment as Collateral for Note template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Moreover, the templates we provide are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!