Miami-Dade, Florida Assignment Creditor's Claim Against Estate refers to the legal process wherein a creditor pursues their outstanding claim against the assets of an individual who has passed away. This type of claim specifically relates to cases that occur in Miami-Dade County, Florida. When a person dies, their estate becomes responsible for settling any debts owed by the deceased. Creditors may file a claim against the estate to seek repayment for any outstanding balances owed to them. In Miami-Dade County, this process is governed by specific laws and regulations. The Assignment Creditor's Claim Against Estate process begins with the creditor formally submitting a claim to the probate court. This claim must contain detailed information regarding the debt owed, such as the amount, date incurred, and evidence of the debt's validity. Once the claim is filed, it will be reviewed by the court to determine its legitimacy. Various types of Miami-Dade, Florida Assignment Creditor's Claims Against Estate may arise, including: 1. Unsecured Debts: These are debts that do not have any collateral attached, such as credit card debt, medical bills, or personal loans. Creditors holding unsecured debts must file a claim against the estate to recover their funds. 2. Secured Debts: These are debts that are secured by collateral, such as a mortgage or car loan. In the case of secured debts, the creditor usually has the right to repossess the collateral if the debt is not repaid. However, if the collateral does not fully cover the outstanding debt, the creditor may file a claim against the estate for the remaining balance. 3. Tax Debts: If the deceased individual owed taxes to the state, federal government, or local authorities, these tax agencies may file claims against the estate to recover the outstanding tax liabilities. 4. Priority Debts: Certain debts may hold priority over others, meaning they must be satisfied before lower-priority claims. These priority debts may include child support, spousal support, and administrative expenses associated with the probate process. Once the court reviews the creditor's claim, it will evaluate the available assets within the estate to determine if there are sufficient funds to satisfy the outstanding debts. If there are not enough assets to cover the claims, the estate will be deemed insolvent, and creditors may receive only a fraction of what is owed to them or no payment at all. However, if there are sufficient assets, the court will prioritize the claims according to the established rules and regulations and distribute the funds accordingly. In Miami-Dade County, individuals who find themselves faced with an Assignment Creditor's Claim Against Estate should consult with an experienced probate attorney. Legal professionals familiar with the local laws and court procedures can provide guidance, protect the interests of both creditors and the estate, and ensure a fair and efficient resolution to the assignment creditor's claim.

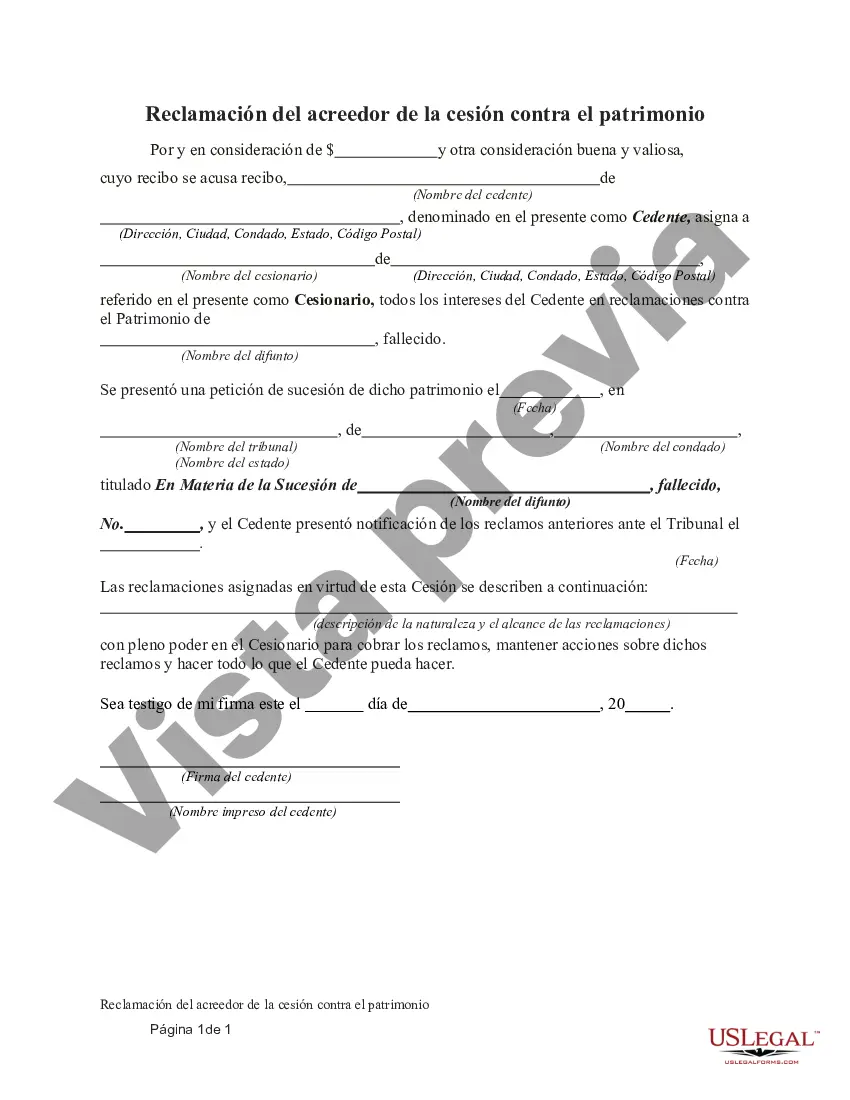

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Reclamación del acreedor de la cesión contra el patrimonio - Assignment Creditor's Claim Against Estate

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-0424BG

Format:

Word

Instant download

Description

This form is an assignment creditor's claim against an estate.

Miami-Dade, Florida Assignment Creditor's Claim Against Estate refers to the legal process wherein a creditor pursues their outstanding claim against the assets of an individual who has passed away. This type of claim specifically relates to cases that occur in Miami-Dade County, Florida. When a person dies, their estate becomes responsible for settling any debts owed by the deceased. Creditors may file a claim against the estate to seek repayment for any outstanding balances owed to them. In Miami-Dade County, this process is governed by specific laws and regulations. The Assignment Creditor's Claim Against Estate process begins with the creditor formally submitting a claim to the probate court. This claim must contain detailed information regarding the debt owed, such as the amount, date incurred, and evidence of the debt's validity. Once the claim is filed, it will be reviewed by the court to determine its legitimacy. Various types of Miami-Dade, Florida Assignment Creditor's Claims Against Estate may arise, including: 1. Unsecured Debts: These are debts that do not have any collateral attached, such as credit card debt, medical bills, or personal loans. Creditors holding unsecured debts must file a claim against the estate to recover their funds. 2. Secured Debts: These are debts that are secured by collateral, such as a mortgage or car loan. In the case of secured debts, the creditor usually has the right to repossess the collateral if the debt is not repaid. However, if the collateral does not fully cover the outstanding debt, the creditor may file a claim against the estate for the remaining balance. 3. Tax Debts: If the deceased individual owed taxes to the state, federal government, or local authorities, these tax agencies may file claims against the estate to recover the outstanding tax liabilities. 4. Priority Debts: Certain debts may hold priority over others, meaning they must be satisfied before lower-priority claims. These priority debts may include child support, spousal support, and administrative expenses associated with the probate process. Once the court reviews the creditor's claim, it will evaluate the available assets within the estate to determine if there are sufficient funds to satisfy the outstanding debts. If there are not enough assets to cover the claims, the estate will be deemed insolvent, and creditors may receive only a fraction of what is owed to them or no payment at all. However, if there are sufficient assets, the court will prioritize the claims according to the established rules and regulations and distribute the funds accordingly. In Miami-Dade County, individuals who find themselves faced with an Assignment Creditor's Claim Against Estate should consult with an experienced probate attorney. Legal professionals familiar with the local laws and court procedures can provide guidance, protect the interests of both creditors and the estate, and ensure a fair and efficient resolution to the assignment creditor's claim.