An accountant is one who is skilled in keeping accounts and books of accounts correctly and properly. An accountant plays a variety of roles including the review, audit, organization and certification of financial information. The various types of accountants include; auditors, forensic accountants, public accountants, tax professionals, financial advisers and consultants. Accountants have a minimum of a bachelor’s degree, but often have other advanced degrees, and all accountants must be certified through the appropriate state board.

Most states have statutes that provide for a state board of accountancy or a board of certified public accountants. Statutes may require the registration of accountants and accounting firms with the state board of accountancy. A state has the power to revoke the license which grants the right to practice public accountancy. Regulations relating to accountants in various states are discussed in the links below.

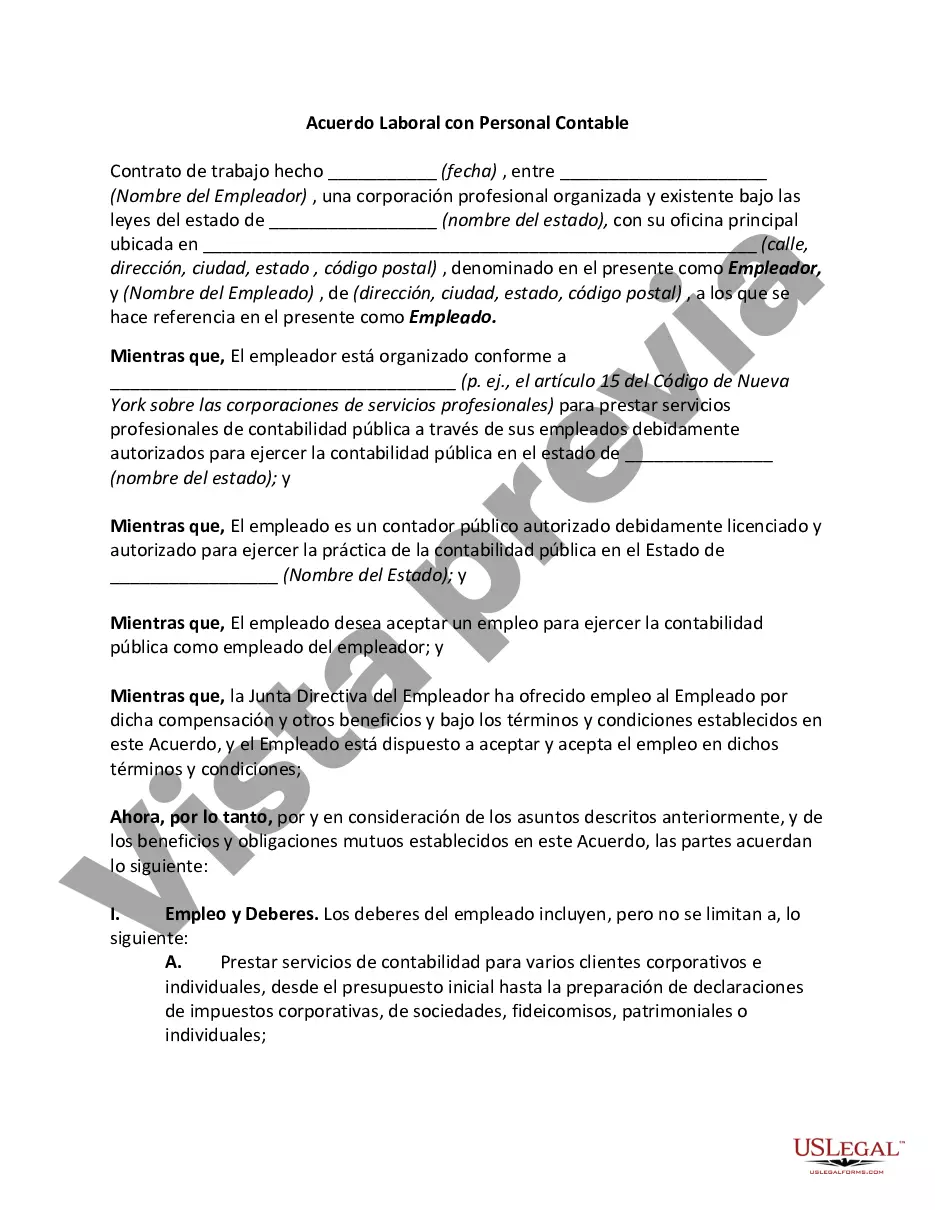

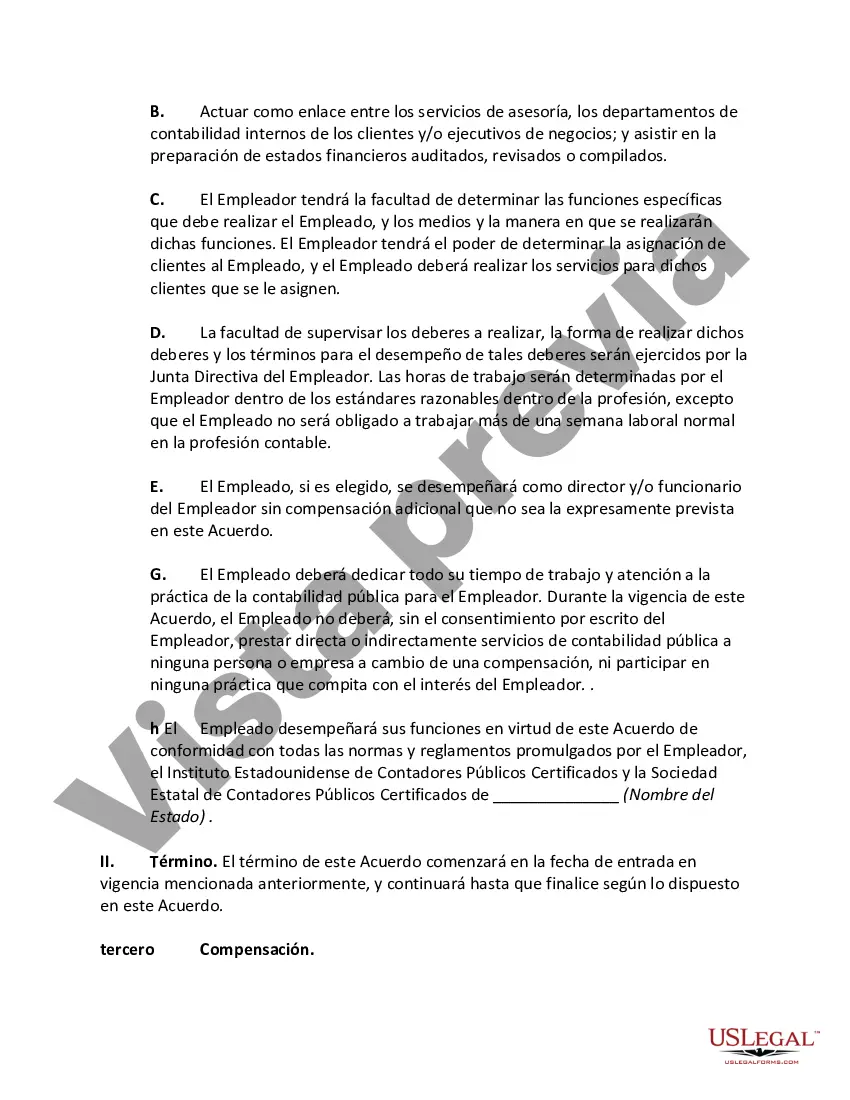

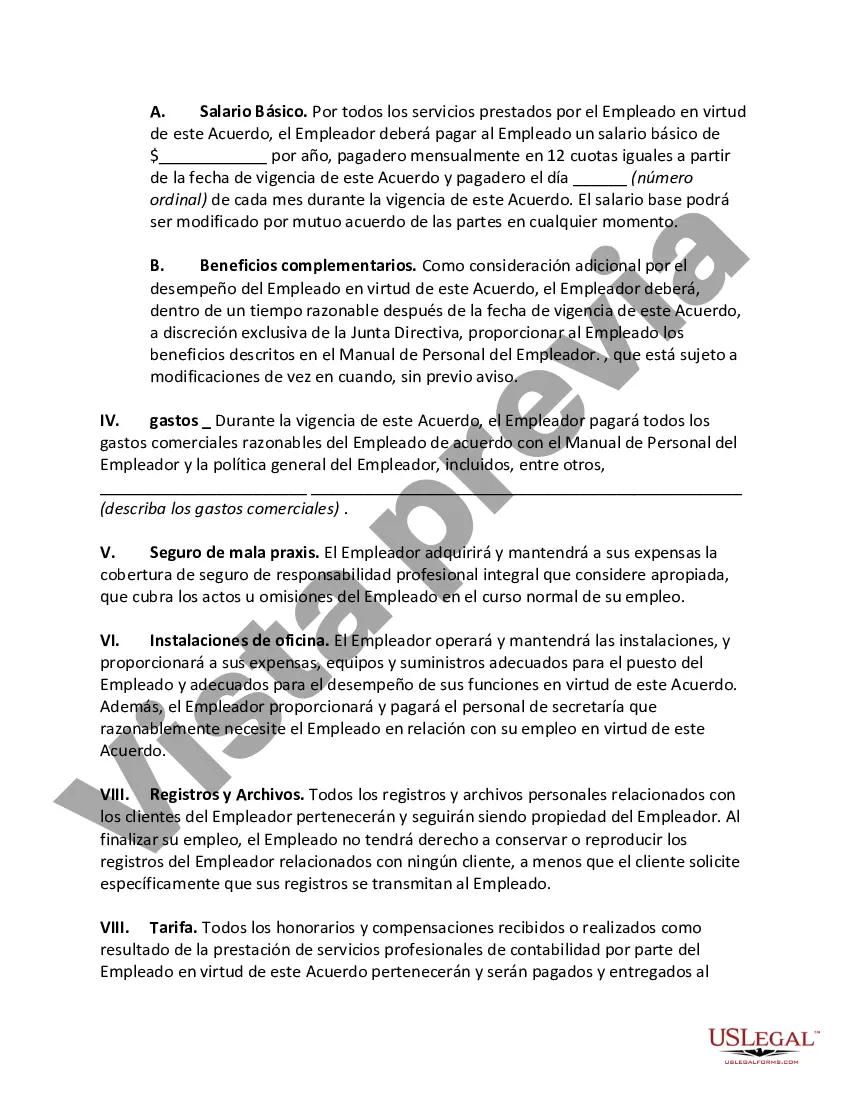

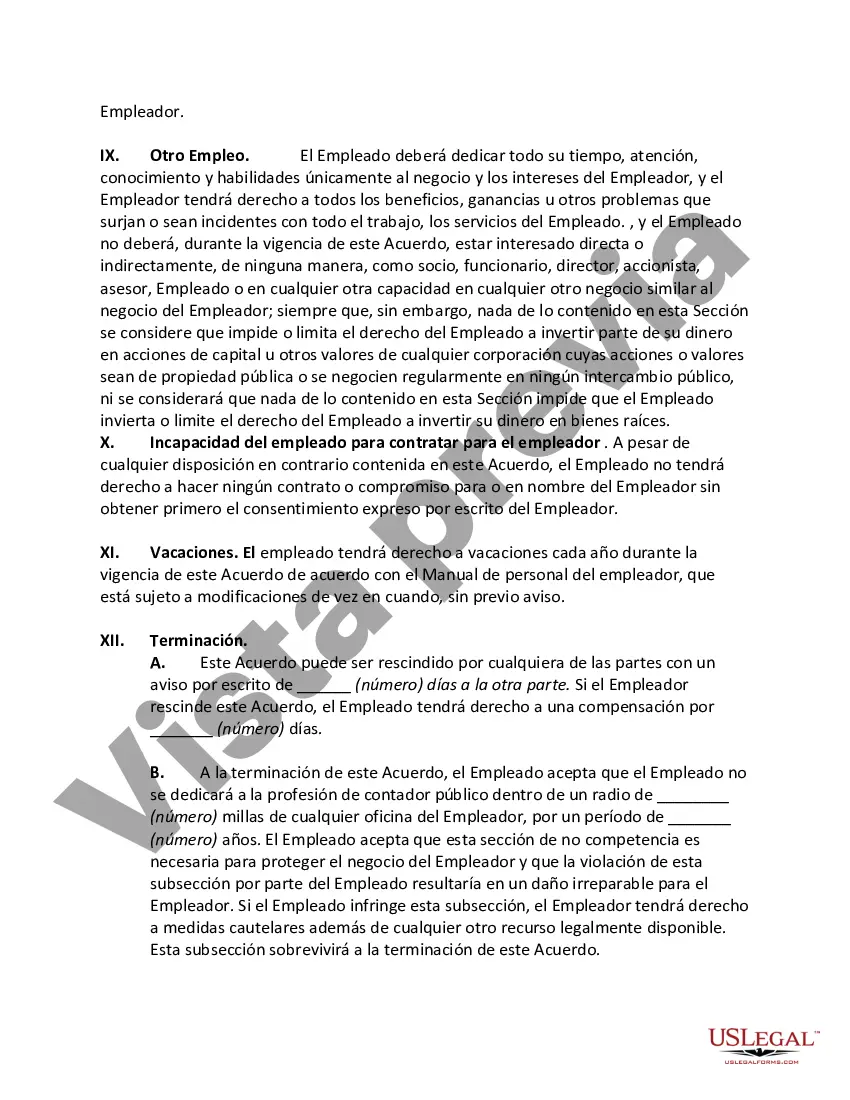

Lima Arizona Employment Agreement with Staff Accountant provides a comprehensive and legally binding document that outlines the terms and conditions of employment for staff accountants in the town of Lima, Arizona. This agreement ensures clarity and protection for both the employer and the staff accountant, many of whom play crucial roles in various organizations, be it small businesses, public accounting firms, or governmental agencies operating in Lima, Arizona. The agreement typically begins with a detailed introduction section, mentioning the names of the employer and staff accountant, the effective date of the agreement, and often includes a clause specifying the at-will employment relationship. It further defines the job title, department, and reporting structure of the staff accountant, elucidating their responsibilities, duties, and specific tasks. The agreement covers various key aspects related to compensation, including the accountant's base salary, bonuses, benefits, and the frequency of payment, usually bi-weekly or monthly. It also specifies the working hours, holiday entitlement, and vacation days for the staff accountant. Additionally, it might outline the provisions for sick leaves, personal leaves, and any other leave benefits applicable as per the Lima, Arizona labor laws. Another essential provision within the agreement pertains to confidentiality and non-disclosure of proprietary or sensitive information about the employer or its clients. This clause ensures the protection of trade secrets, financial data, customer lists, and any other classified information governed by the employer's policies or industry regulations. The agreement often includes a section emphasizing the importance of ethical conduct and compliance with all applicable laws, regulations, and professional standards relevant to the accounting profession. This clause ensures that the staff accountant adheres to rules such as the Generally Accepted Accounting Principles (GAAP) and professional codes of conduct established by organizations like the American Institute of Certified Public Accountants (AICPA) or the Institute of Management Accountants (IMA). In some cases, the agreement may also cover additional provisions such as intellectual property rights, work-for-hire arrangements, non-compete agreements, and dispute resolution mechanisms. These provisions aim to safeguard the employer's interests and ensure a mutually beneficial employment relationship between the staff accountant and the employer. While there may not be different types of Lima Arizona Employment Agreement with Staff Accountant, there can be variations in specific terms and clauses tailored to the unique requirements of different employers. As such, it is crucial for employers and staff accountants to review and modify the agreement accordingly, ensuring compliance with the local labor laws and addressing any specific needs or concerns.Lima Arizona Employment Agreement with Staff Accountant provides a comprehensive and legally binding document that outlines the terms and conditions of employment for staff accountants in the town of Lima, Arizona. This agreement ensures clarity and protection for both the employer and the staff accountant, many of whom play crucial roles in various organizations, be it small businesses, public accounting firms, or governmental agencies operating in Lima, Arizona. The agreement typically begins with a detailed introduction section, mentioning the names of the employer and staff accountant, the effective date of the agreement, and often includes a clause specifying the at-will employment relationship. It further defines the job title, department, and reporting structure of the staff accountant, elucidating their responsibilities, duties, and specific tasks. The agreement covers various key aspects related to compensation, including the accountant's base salary, bonuses, benefits, and the frequency of payment, usually bi-weekly or monthly. It also specifies the working hours, holiday entitlement, and vacation days for the staff accountant. Additionally, it might outline the provisions for sick leaves, personal leaves, and any other leave benefits applicable as per the Lima, Arizona labor laws. Another essential provision within the agreement pertains to confidentiality and non-disclosure of proprietary or sensitive information about the employer or its clients. This clause ensures the protection of trade secrets, financial data, customer lists, and any other classified information governed by the employer's policies or industry regulations. The agreement often includes a section emphasizing the importance of ethical conduct and compliance with all applicable laws, regulations, and professional standards relevant to the accounting profession. This clause ensures that the staff accountant adheres to rules such as the Generally Accepted Accounting Principles (GAAP) and professional codes of conduct established by organizations like the American Institute of Certified Public Accountants (AICPA) or the Institute of Management Accountants (IMA). In some cases, the agreement may also cover additional provisions such as intellectual property rights, work-for-hire arrangements, non-compete agreements, and dispute resolution mechanisms. These provisions aim to safeguard the employer's interests and ensure a mutually beneficial employment relationship between the staff accountant and the employer. While there may not be different types of Lima Arizona Employment Agreement with Staff Accountant, there can be variations in specific terms and clauses tailored to the unique requirements of different employers. As such, it is crucial for employers and staff accountants to review and modify the agreement accordingly, ensuring compliance with the local labor laws and addressing any specific needs or concerns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.