Houston Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal arrangement in which a person designates their assets to be held and managed by a trustee for the benefit of their immediate family members. This type of trust provides financial security and asset protection for future generations, ensuring that the intended beneficiaries receive their inheritances in a structured and tax-efficient manner. There are different variations of Houston Texas Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren that cater to specific needs and preferences. These include: 1. Houston Texas Irrevocable Life Insurance Trusts: This type of trust allows individuals to use life insurance policies as a funding source for the trust, ensuring that beneficiaries receive a tax-free death benefit while safeguarding the policy proceeds from estate taxes and creditors. 2. Houston Texas Dynasty Trusts: These trusts are designed to benefit multiple generations, such as grandchildren and great-grandchildren, by preserving wealth and minimizing estate taxes over an extended period. This trust allows assets to grow and be distributed to beneficiaries according to a predetermined plan, often skipping a generation or two to leverage tax advantages. 3. Houston Texas Special Needs Trusts: This type of trust is specifically tailored to provide financial support and care for a disabled or special needs child or grandchild. By pooling resources and appointing a trustee, families can ensure that the beneficiary's eligibility for government assistance is not jeopardized while also securing their future well-being. 4. Houston Texas Qualified Personnel Residence Trusts: These trusts enable individuals to transfer their primary residence or vacation home to the trust, retaining the right to live in the property for a specified period. By removing the property's value from their estate, individuals can reduce estate taxes while ensuring their family can continue to enjoy the property after their passing. Overall, a Houston Texas Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren allows individuals to protect and manage their assets for the long-term benefit of their loved ones. By structuring these trusts according to specific needs and goals, individuals can ensure a smooth transfer of wealth, protect assets from creditors, minimize estate taxes, and provide financial security for future generations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Contrato de Fideicomiso Irrevocable en Beneficio de Cónyuge, Hijos y Nietos - Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

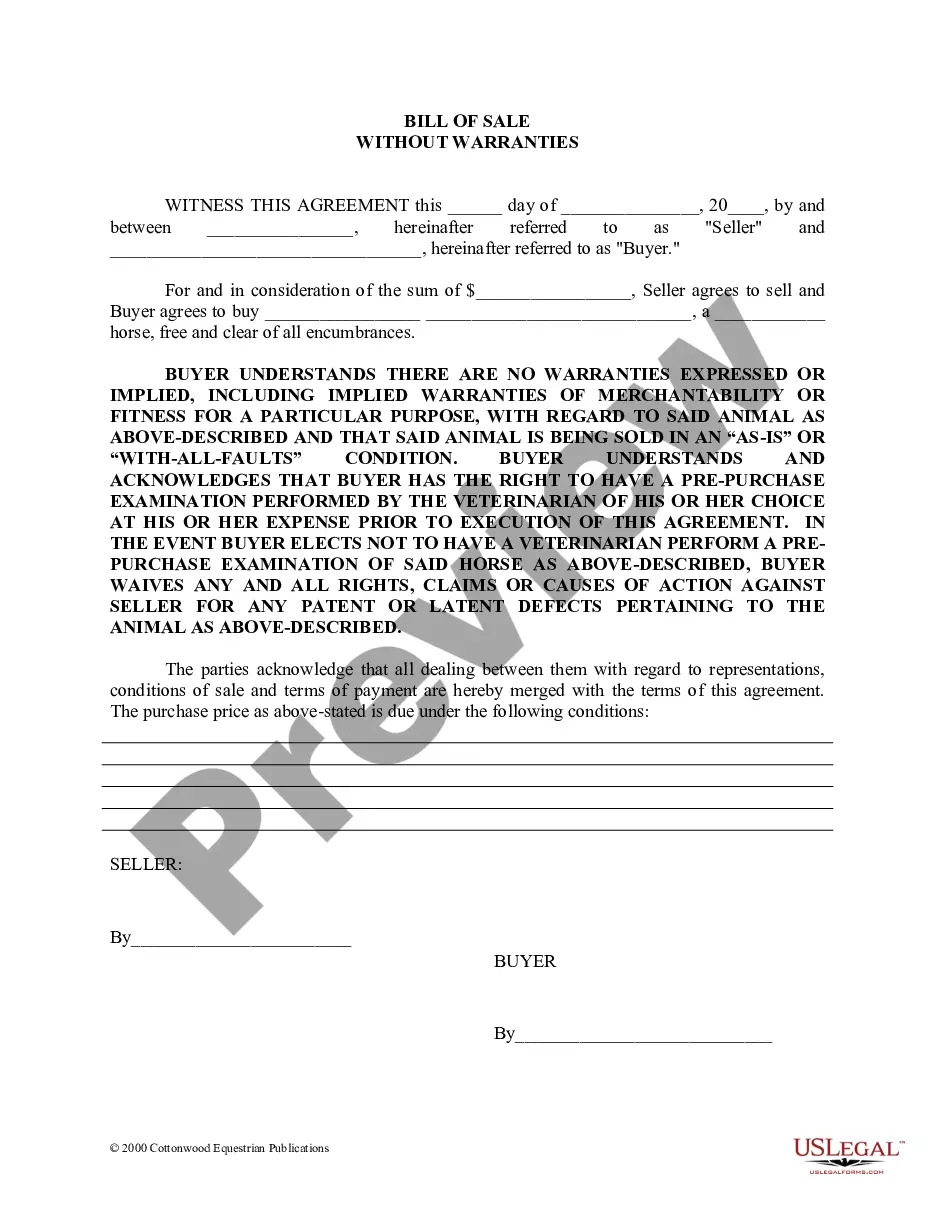

Description

How to fill out Houston Texas Contrato De Fideicomiso Irrevocable En Beneficio De Cónyuge, Hijos Y Nietos?

Whether you plan to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Houston Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Houston Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Houston Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!