The Maricopa Arizona Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legally binding document that provides specific instructions on how assets and property should be managed and distributed to ensure the financial security of the named beneficiaries. This trust agreement is designed to offer protection against creditors and potential estate taxes, while also allowing the granter (the individual who creates the trust) to retain control and enjoy certain benefits during their lifetime. One type of Maricopa Arizona Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is the "spousal lifetime access trust" (SLAT). This trust allows a married couple to transfer assets into the trust to benefit their spouse, children, and grandchildren, while also taking advantage of the gift and estate tax exemptions. By establishing a SLAT, the granter can provide financial security for their family members while minimizing estate taxes. Another type of Maricopa Arizona Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is the "qualified personnel residence trust" (PRT). With a PRT, the granter transfers their primary residence or vacation home into the trust, allowing them to pass ownership of the property to their spouse, children, or grandchildren while avoiding excessive estate taxes. This type of trust is particularly beneficial for individuals with significant real estate holdings. Benefits of creating a Maricopa Arizona Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren include: 1. Asset protection: By placing assets and property in an irrevocable trust, they are shielded from potential creditors or lawsuits, providing increased protection for beneficiaries. 2. Tax efficiency: Irrevocable trusts can help minimize estate taxes by removing assets from the granter's taxable estate. This allows individuals to transfer wealth to their loved ones without incurring hefty tax burdens. 3. Control and flexibility: Despite being irrevocable, the trust can still allow the granter to retain certain control and benefits during their lifetime, such as the ability to reside in a property transferred into the trust or receive income generated by the trust's assets. 4. Preserving family harmony: By clearly outlining the distribution of assets and property among spouses, children, and grandchildren, a trust agreement can prevent potential disputes and ensure the wishes of the granter are respected, thereby promoting family harmony. In summary, the Maricopa Arizona Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren offers a comprehensive estate planning solution by providing legal protection, tax efficiency, and control over the distribution of assets to ensure the financial security of loved ones. Different types of this trust, such as the SLAT and PRT, cater to specific needs and circumstances, allowing individuals to tailor their estate plans accordingly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Contrato de Fideicomiso Irrevocable en Beneficio de Cónyuge, Hijos y Nietos - Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

How to fill out Maricopa Arizona Contrato De Fideicomiso Irrevocable En Beneficio De Cónyuge, Hijos Y Nietos?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Maricopa Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Maricopa Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Maricopa Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren:

- Make sure you have opened the proper page with your regional form.

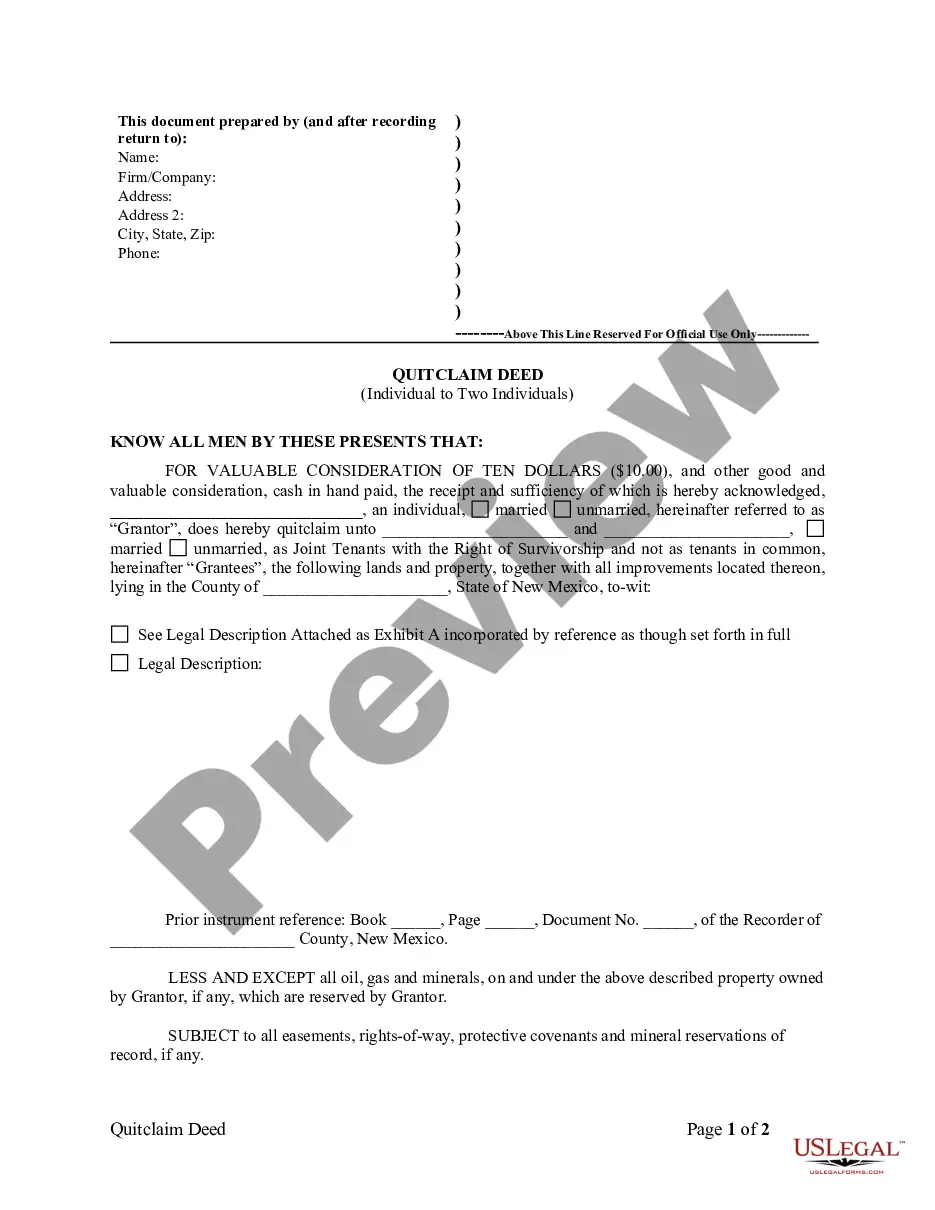

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Maricopa Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!