The Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal document created to protect and allocate assets for the future benefit of family members in Middlesex County, Massachusetts. This trust offers several variations tailored to the specific needs and preferences of individuals. It is essential to understand the different types of Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren to determine which one aligns with your objectives: 1. The Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren: This is a standard version of the trust that provides asset protection and allows for the distribution of assets to your spouse, children, and grandchildren according to your stipulated terms. It offers flexibility in determining how assets are managed, invested, and ultimately passed on to future generations. 2. The Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Minor Children and Grandchildren: This type of trust is specifically designed to protect the interests of minor children and grandchildren. It ensures that their financial needs are taken care of by appointing a trustee to manage the assets until the beneficiaries reach a designated age or milestone specified in the trust document. 3. The Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Special Needs Children and Grandchildren: This trust is created to support individuals with special needs, taking into account their unique circumstances and requirements. The trustee is responsible for managing the assets and ensuring that the beneficiaries' needs are met while preserving their eligibility for government assistance programs. 4. The Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren with Charitable Provisions: This trust allows you to combine charitable giving with asset protection for your loved ones. It allocates a portion of the trust's assets for charitable purposes, such as donations to specific causes or the establishment of charitable foundations. 5. The Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren with Generation-Skipping Transfer Tax Planning: This trust provides a tax-efficient way to transfer assets to future generations while minimizing the impact of estate taxes. It allows you to allocate assets to grandchildren or even great-grandchildren, bypassing the potential tax burden that would occur if the assets were transferred directly. In conclusion, the Middlesex Massachusetts Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren offers various options to protect and secure assets for the benefit of your loved ones. By selecting the appropriate type of trust agreement, you can ensure that your family's financial well-being is safeguarded according to your specific objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Contrato de Fideicomiso Irrevocable en Beneficio de Cónyuge, Hijos y Nietos - Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

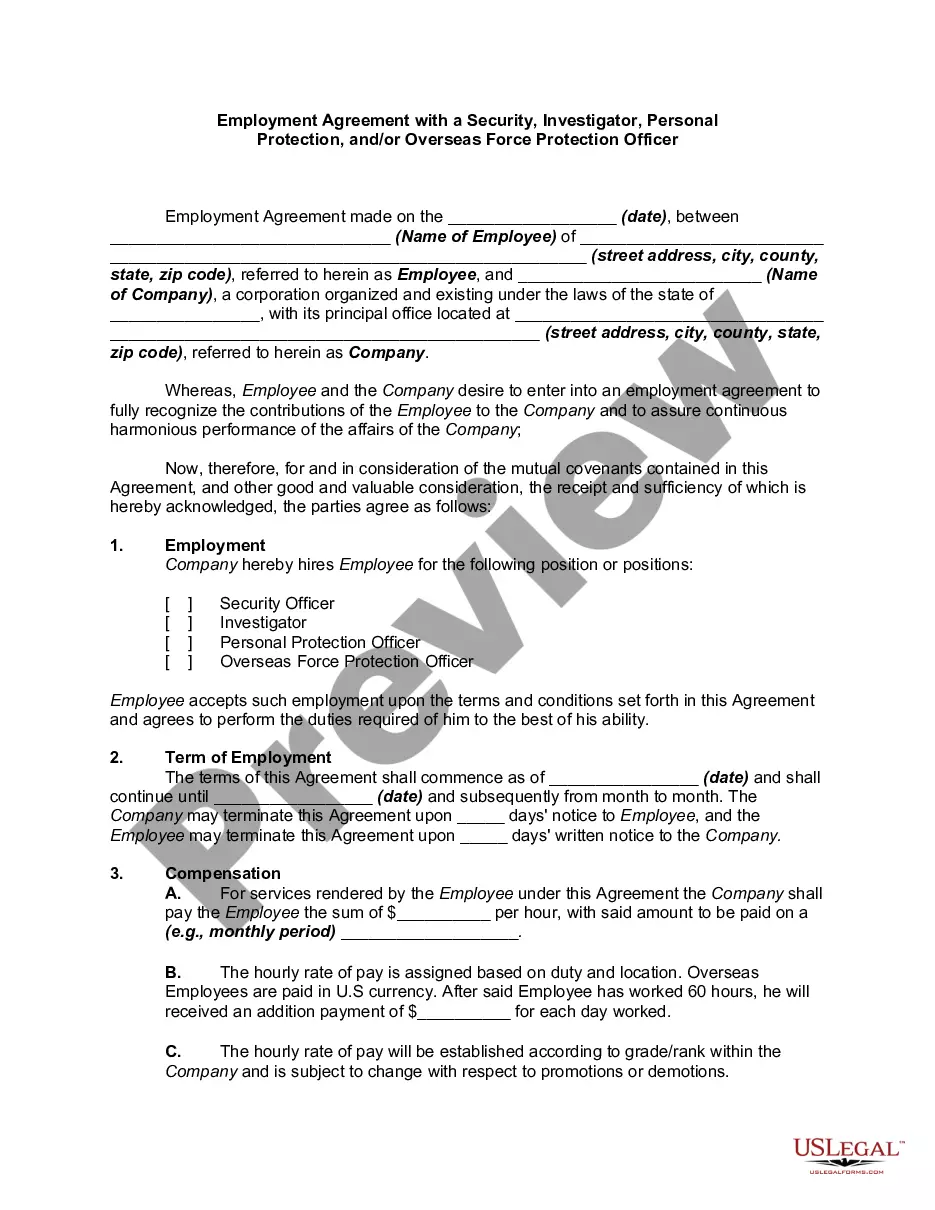

Description

How to fill out Middlesex Massachusetts Contrato De Fideicomiso Irrevocable En Beneficio De Cónyuge, Hijos Y Nietos?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your county, including the Middlesex Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren.

Locating forms on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Middlesex Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to get the Middlesex Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren:

- Ensure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Middlesex Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!