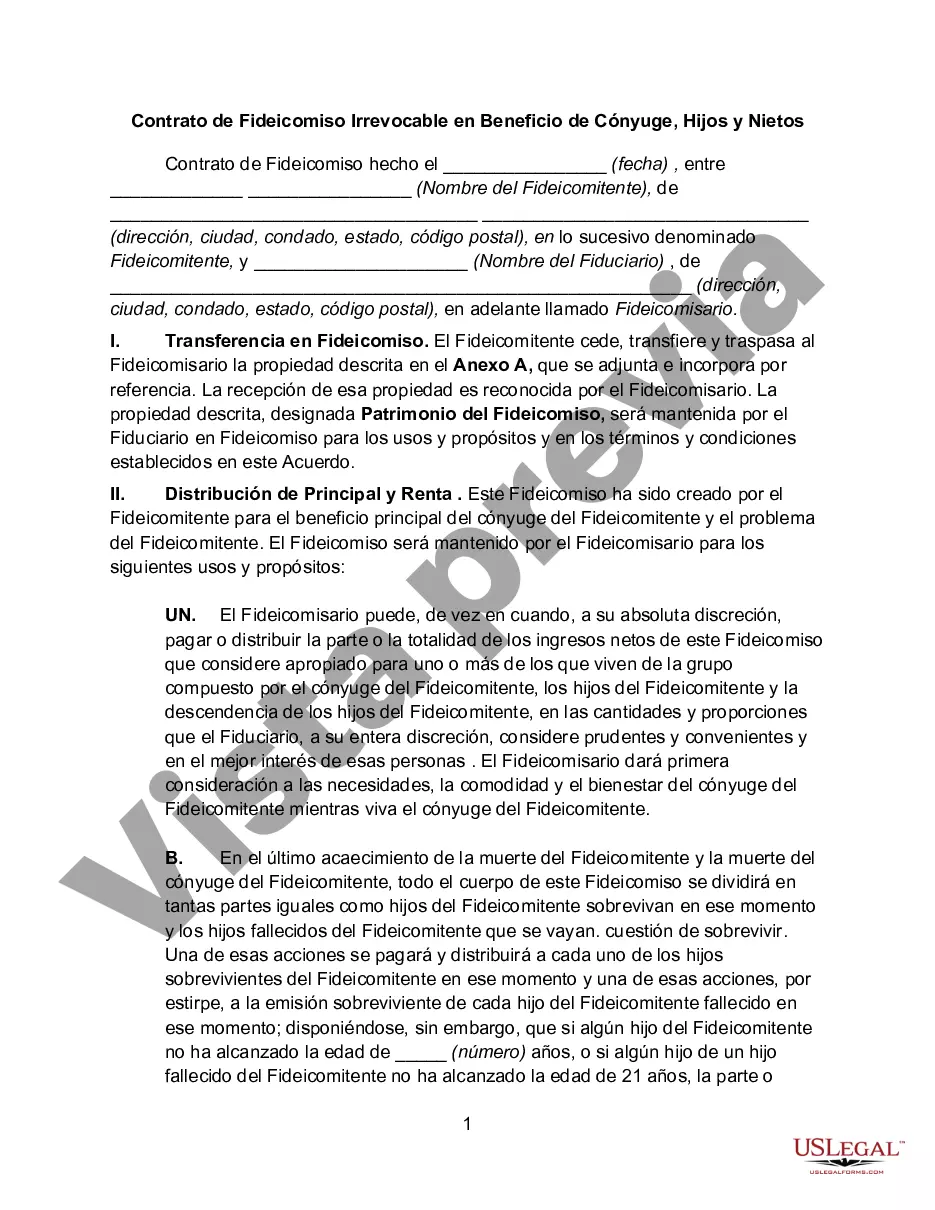

The Orange California Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal document that establishes a trust for the specific purpose of providing financial security and protection for the designated beneficiaries. This type of trust offers several advantages over other forms of estate planning, including asset protection, tax benefits, and control over the distribution of assets. One type of Orange California Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is the Lifetime Asset Protection Trust. This trust allows individuals to transfer their assets into a trust, removing them from their taxable estate. This type of trust provides protection against creditor claims and potential bankruptcy, ensuring that the assets remain intact for the benefit of the beneficiaries. Another commonly used type of trust is the Generation-Skipping Trust. This trust allows individuals to pass their assets directly to their grandchildren, skipping a generation and potentially reducing estate taxes. By utilizing this type of trust, individuals can preserve wealth for future generations while still providing for their immediate family. The Orange California Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren can also include provisions for the management and distribution of assets. The trustee, who is responsible for administering the trust, can be given discretionary powers to distribute income or principal to the beneficiaries based on their needs or specific circumstances. This flexibility allows for personalized planning to meet the unique needs of each family. Furthermore, the trust agreement may include provisions for the appointment of successor trustees, should the original trustee become unable or unwilling to carry out their duties. This ensures continuity and proper management of the trust over time. Overall, the Orange California Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a powerful estate planning tool that offers numerous benefits and opportunities for the preservation and distribution of wealth. It provides peace of mind, ensuring that loved ones are taken care of and assets are protected for generations to come.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Contrato de Fideicomiso Irrevocable en Beneficio de Cónyuge, Hijos y Nietos - Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren

Description

How to fill out Orange California Contrato De Fideicomiso Irrevocable En Beneficio De Cónyuge, Hijos Y Nietos?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Orange Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any tasks related to document execution simple.

Here's how to locate and download Orange Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren.

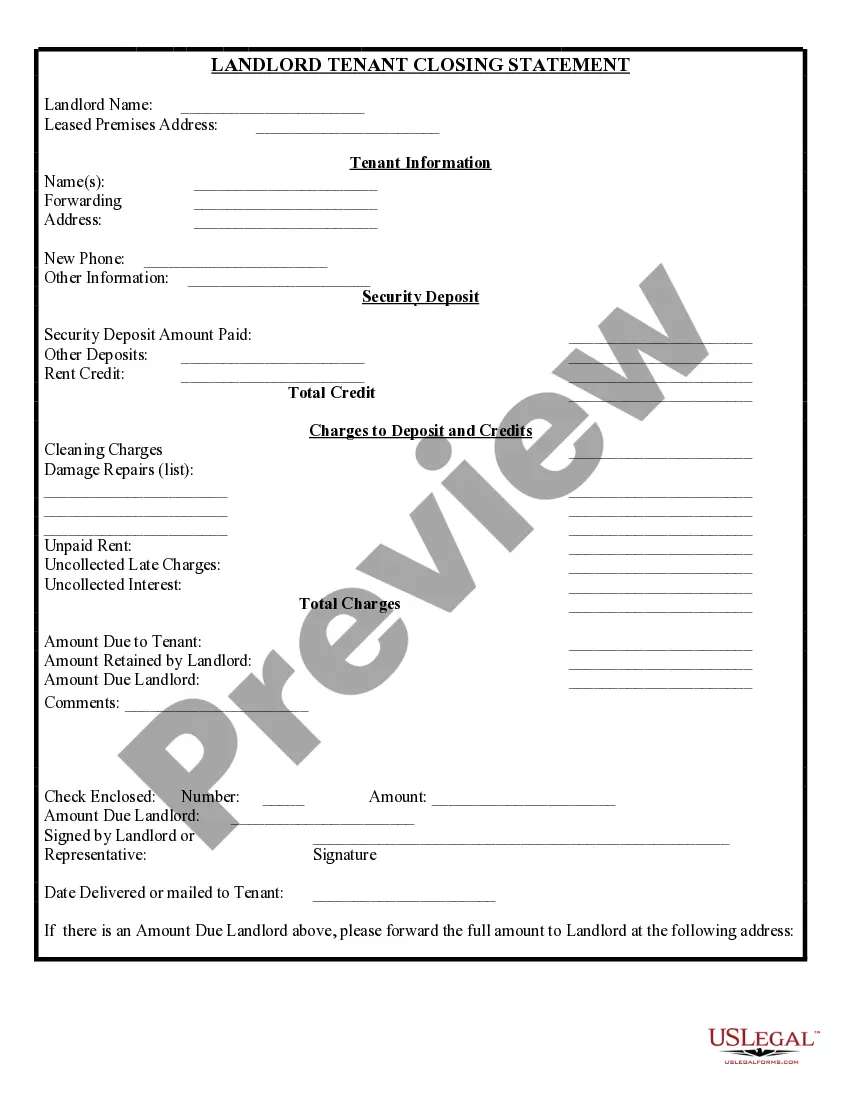

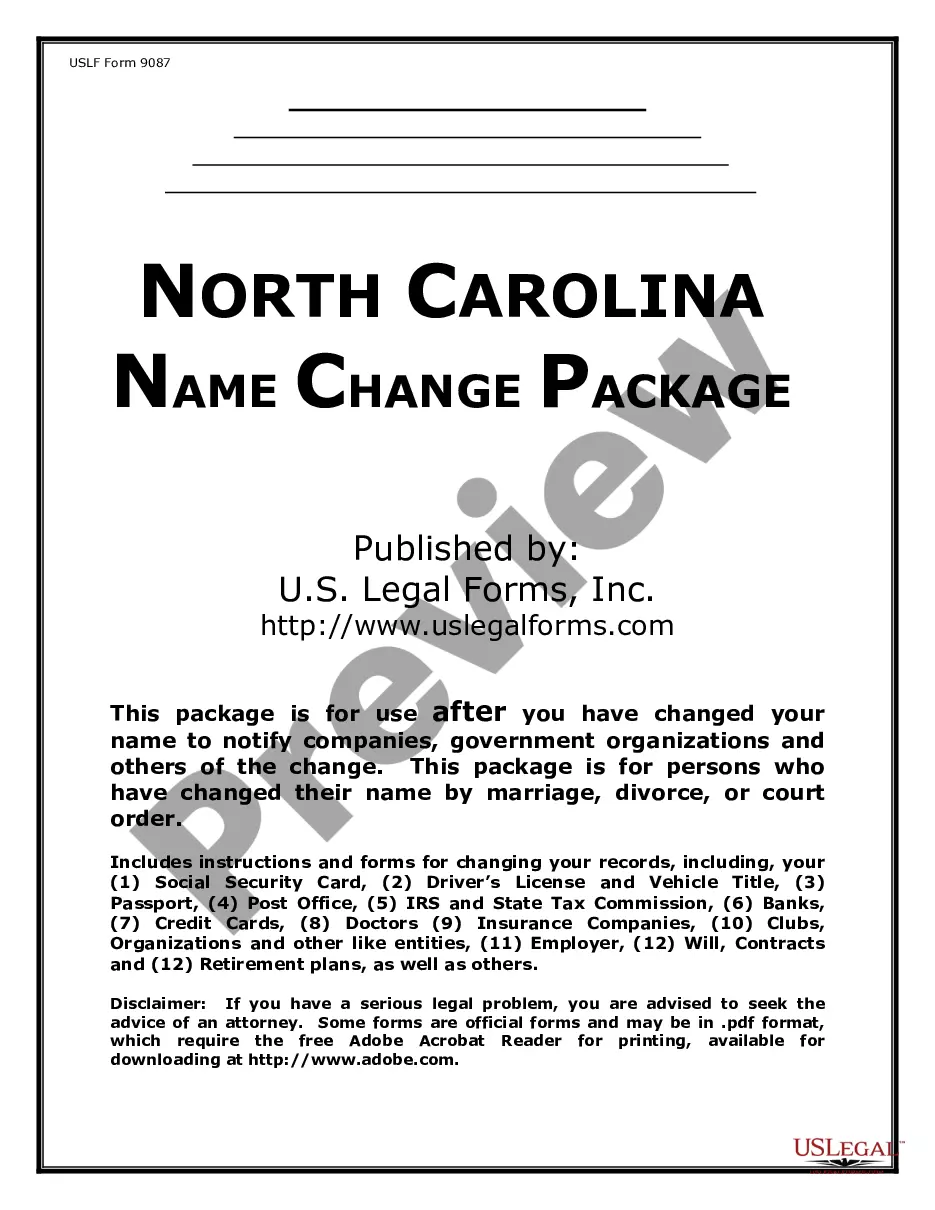

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Check the similar document templates or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Orange Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Orange Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to deal with an extremely difficult case, we recommend getting a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and get your state-specific paperwork effortlessly!