The sale of any ongoing business, even a sole proprietorship, can be a complicated transaction. The buyer and seller (and their attorneys) must consider the law of contracts, taxation, real estate, corporations, securities, and antitrust in many situations. Depending on the nature of the business sold, statutes and regulations concerning the issuance and transfer of permits, licenses, and/or franchises should be consulted. If a license or franchise is important to the business, the buyer generally would want to make the sales agreement contingent on such approval. Sometimes, the buyer will assume certain debts, liabilities, or obligations of the seller. In such a sale, it is vital that the buyer know exactly what debts he/she is assuming.

In any sale of a business, the buyer and the seller should make sure that the sale complies with any Bulk Sales Law of the state whose laws govern the transaction. A bulk sale is a sale of goods by a business which engages in selling items out of inventory (as opposed to manufacturing or service industries). Article 6 of the Uniform Commercial Code, which has been adopted at least in part by all states, governs bulk sales. If the sale involves a business covered by Article 6 and the parties do not follow the statutory requirements, the sale can be void as against the seller's creditors, and the buyer may be personally liable to them. Sometimes, rather than follow all of the requirements of the bulk sales law, a seller will specifically agree to indemnify the buyer for any liabilities that result to the buyer for failure to comply with the bulk sales law.

Of course the sellerýs financial statements should be studied by the buyer and/or the buyerýs accountants. The balance sheet and other financial reports reflect the financial condition of the business. The seller should be required to represent that it has no material obligations or liabilities that were not reflected in the balance sheet and that it will not incur any obligations or liabilities in the period from the date of the balance sheet to the date of closing, except those incurred in the regular course of business.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

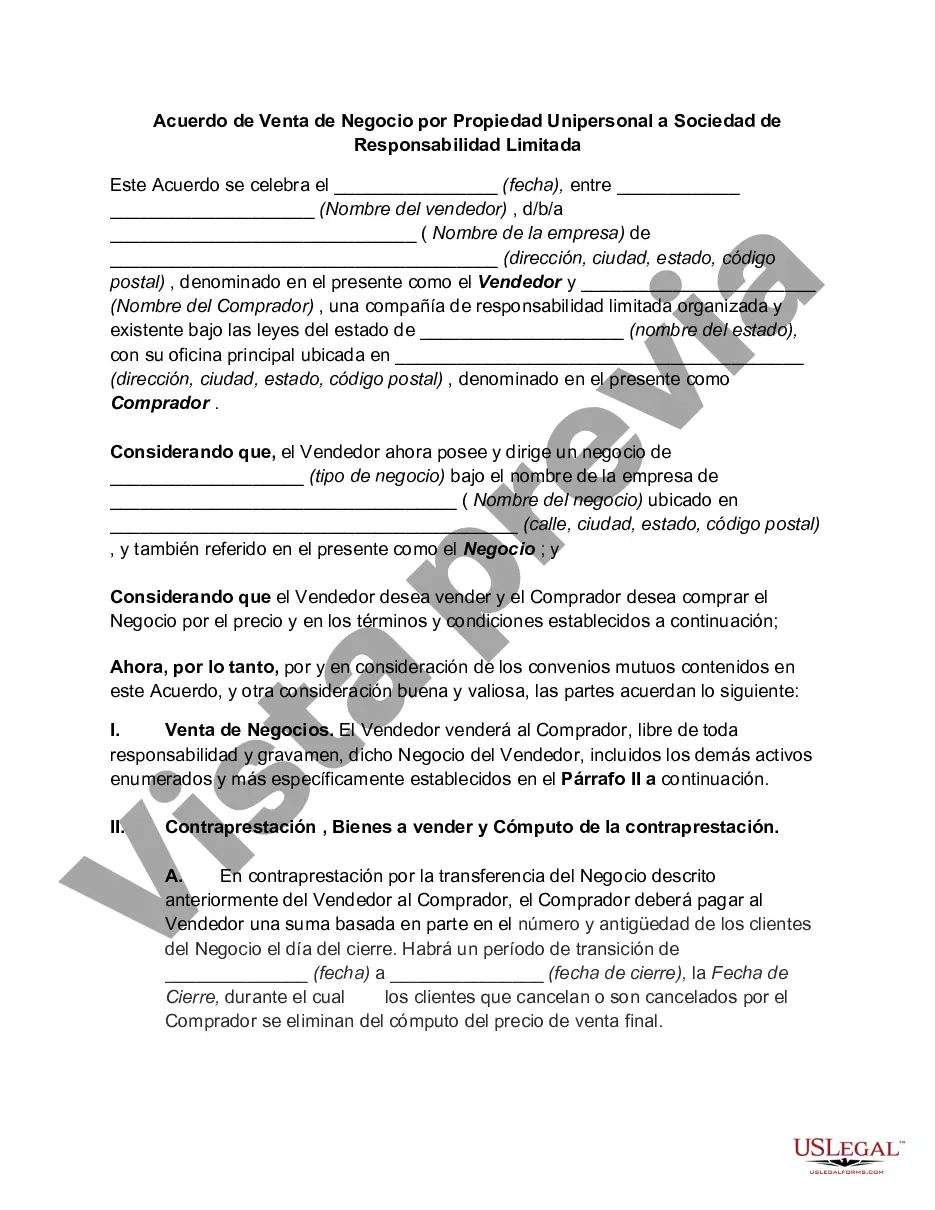

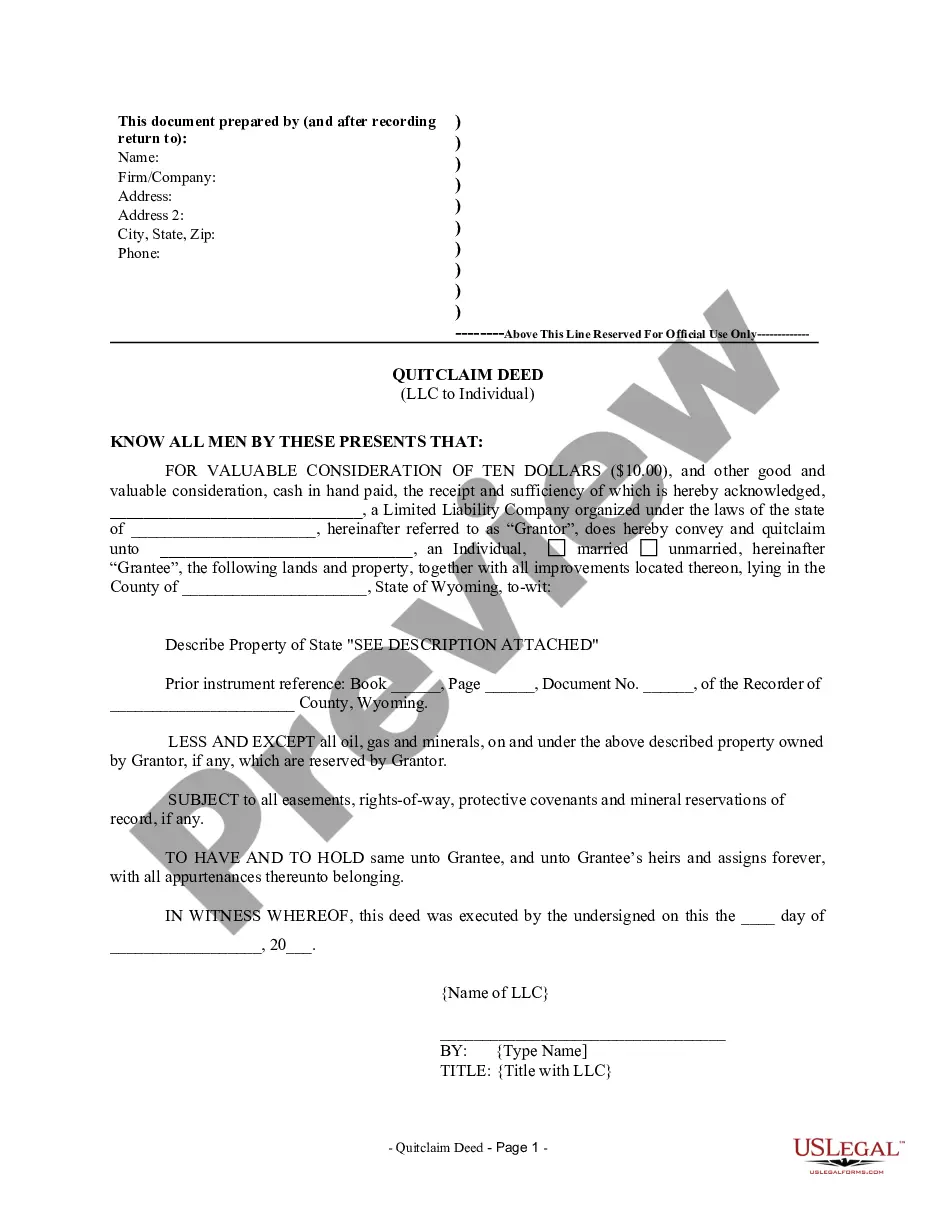

The Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship to Limited Liability Company is a legal document that outlines the terms and conditions for the sale of a business owned and operated by a sole proprietor to a limited liability company (LLC). This agreement signifies the transfer of ownership and assets from the sole proprietor to the LLC, establishing a new structure for the business going forward. Key components of the Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship to Limited Liability Company include a detailed description of the assets being transferred, the purchase price or compensation structure, and any contingencies or conditions that must be met for the sale to be completed. It also includes provisions for the allocation of liabilities, any warranties or representations made by the sole proprietor, and the rights and responsibilities of both parties during and after the transition. There can be different types of Fairfax Virginia Agreements for Sale of Business by Sole Proprietorship to Limited Liability Company, depending on the specific circumstances and terms negotiated by the parties involved. Some variations may include: 1. Asset Purchase Agreement: This type of agreement focuses on the purchase of specific assets of the business, such as equipment, inventory, intellectual property, and goodwill. The LLC acquires these assets, while the sole proprietor retains any liabilities and obligations not explicitly assumed by the LLC. 2. Stock Purchase Agreement: In this scenario, the sole proprietor operates the business as a corporation or holds shares in a corporation. The agreement outlines the purchase of shares of the corporation by the LLC, transferring ownership and control of the business. 3. Merger Agreement: This type of agreement typically applies when the sole proprietorship and LLC decide to combine their businesses, forming a new entity. The agreement outlines the terms of the merger, including the allocation of assets, liabilities, and ownership percentages in the new entity. It is crucial for both the sole proprietor and the LLC to seek legal counsel and carefully draft the Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship to Limited Liability Company to protect their rights and interests. This agreement serves as a critical document to ensure a smooth and legally sound transition of the business while mitigating potential disputes or issues that may arise during or after the sale.The Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship to Limited Liability Company is a legal document that outlines the terms and conditions for the sale of a business owned and operated by a sole proprietor to a limited liability company (LLC). This agreement signifies the transfer of ownership and assets from the sole proprietor to the LLC, establishing a new structure for the business going forward. Key components of the Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship to Limited Liability Company include a detailed description of the assets being transferred, the purchase price or compensation structure, and any contingencies or conditions that must be met for the sale to be completed. It also includes provisions for the allocation of liabilities, any warranties or representations made by the sole proprietor, and the rights and responsibilities of both parties during and after the transition. There can be different types of Fairfax Virginia Agreements for Sale of Business by Sole Proprietorship to Limited Liability Company, depending on the specific circumstances and terms negotiated by the parties involved. Some variations may include: 1. Asset Purchase Agreement: This type of agreement focuses on the purchase of specific assets of the business, such as equipment, inventory, intellectual property, and goodwill. The LLC acquires these assets, while the sole proprietor retains any liabilities and obligations not explicitly assumed by the LLC. 2. Stock Purchase Agreement: In this scenario, the sole proprietor operates the business as a corporation or holds shares in a corporation. The agreement outlines the purchase of shares of the corporation by the LLC, transferring ownership and control of the business. 3. Merger Agreement: This type of agreement typically applies when the sole proprietorship and LLC decide to combine their businesses, forming a new entity. The agreement outlines the terms of the merger, including the allocation of assets, liabilities, and ownership percentages in the new entity. It is crucial for both the sole proprietor and the LLC to seek legal counsel and carefully draft the Fairfax Virginia Agreement for Sale of Business by Sole Proprietorship to Limited Liability Company to protect their rights and interests. This agreement serves as a critical document to ensure a smooth and legally sound transition of the business while mitigating potential disputes or issues that may arise during or after the sale.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.