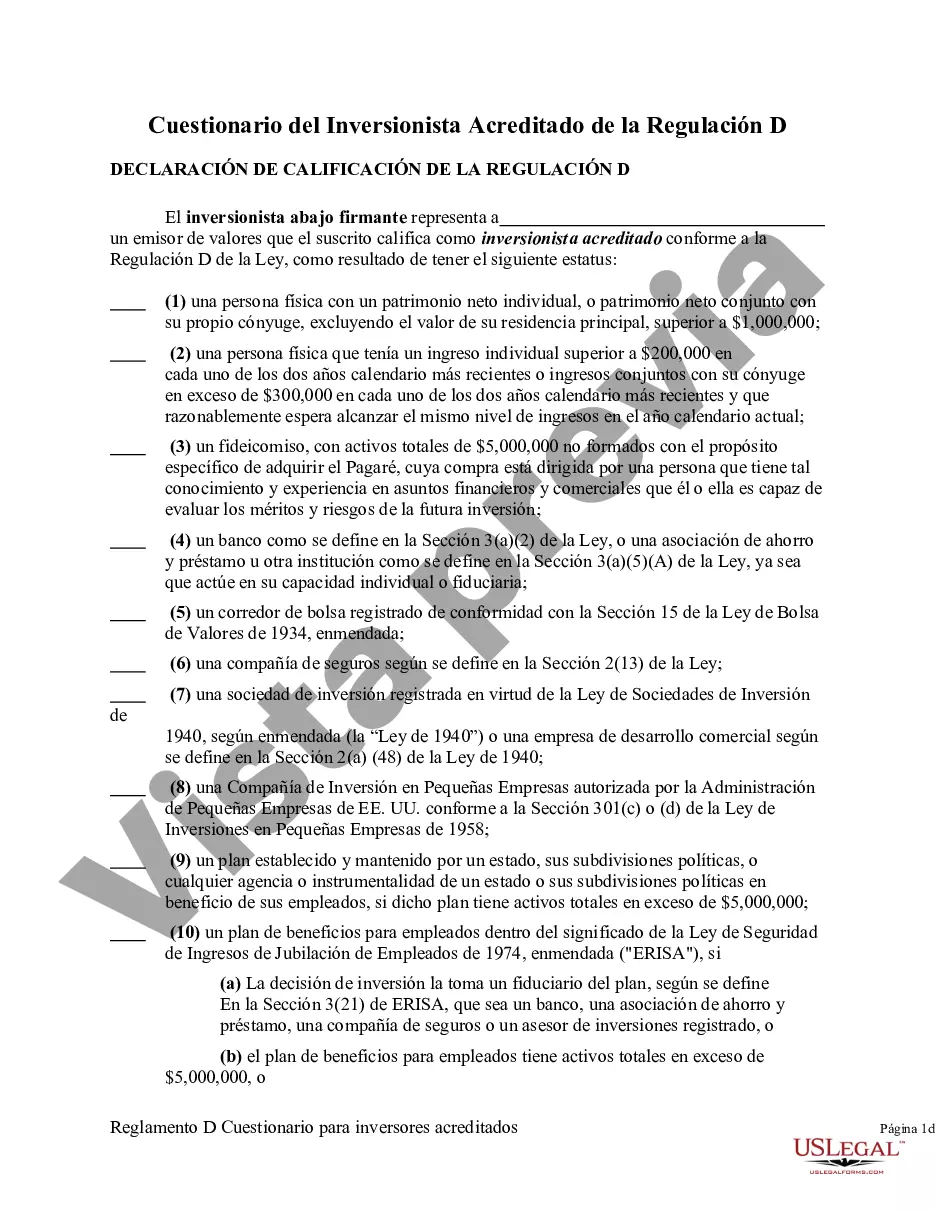

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

The Alameda California Regulation D Accredited Investor Questionnaire is a comprehensive document designed to assess an individual's eligibility to invest in certain private offerings under Regulation D, as established by the U.S. Securities and Exchange Commission (SEC). This questionnaire specifically applies to residents and prospective investors in Alameda, California, ensuring compliance with both federal and local investment regulations. The purpose of the Alameda California Regulation D Accredited Investor Questionnaire is to determine whether an individual meets the required criteria to be considered an accredited investor, as defined in Rule 501 of Regulation D. Accredited investors are typically high-net-worth individuals or institutional investors who possess the financial knowledge and capacity to understand and bear the risks associated with private investment opportunities. This questionnaire covers various aspects of an investor's financial status, including their income, net worth, investment experience, and professional expertise. By gathering this information, issuers of private offerings can evaluate whether potential investors possess the necessary qualifications to participate in opportunities with higher risk profiles and limited regulatory oversight. Different variations or types of Alameda California Regulation D Accredited Investor Questionnaires may exist, depending on the issuer or organization administering the document. These variations may involve slight modifications to certain sections or include additional questions tailored to specific investment types or offerings. Some common keywords associated with the Alameda California Regulation D Accredited Investor Questionnaire include: 1. Regulation D: Refers to the SEC's exemption rules under the Securities Act of 1933 that govern private offerings and facilitate capital formation. 2. Accredited Investor: An individual or entity meeting specific income or net worth thresholds established by the SEC for participation in private investments. 3. SEC: The U.S. Securities and Exchange Commission is a federal regulatory agency overseeing capital markets and protecting investors. 4. Private Offering: A securities offering made to a limited number of qualified individuals or institutional investors outside public exchanges. 5. Investment Eligibility: The criteria an investor must meet to participate in certain investment opportunities, typically defined by the offering issuer and regulatory bodies. 6. Financial Status: The current financial position of an individual, including income, net worth, and investment portfolio. 7. Investment Experience: Refers to an individual's prior involvement in securities investments, understanding of risks, and familiarity with investing strategies. 8. Professional Expertise: The specialized knowledge or qualifications an investor possesses, such as industry-specific expertise or licenses, that may impact their eligibility for certain investments. It's important to note that while this description provides a general overview, the specific contents and requirements of the Alameda California Regulation D Accredited Investor Questionnaire may vary depending on the issuer or organization using it. It is crucial for potential investors and issuers to carefully review and complete the questionnaire to ensure compliance with applicable regulations.The Alameda California Regulation D Accredited Investor Questionnaire is a comprehensive document designed to assess an individual's eligibility to invest in certain private offerings under Regulation D, as established by the U.S. Securities and Exchange Commission (SEC). This questionnaire specifically applies to residents and prospective investors in Alameda, California, ensuring compliance with both federal and local investment regulations. The purpose of the Alameda California Regulation D Accredited Investor Questionnaire is to determine whether an individual meets the required criteria to be considered an accredited investor, as defined in Rule 501 of Regulation D. Accredited investors are typically high-net-worth individuals or institutional investors who possess the financial knowledge and capacity to understand and bear the risks associated with private investment opportunities. This questionnaire covers various aspects of an investor's financial status, including their income, net worth, investment experience, and professional expertise. By gathering this information, issuers of private offerings can evaluate whether potential investors possess the necessary qualifications to participate in opportunities with higher risk profiles and limited regulatory oversight. Different variations or types of Alameda California Regulation D Accredited Investor Questionnaires may exist, depending on the issuer or organization administering the document. These variations may involve slight modifications to certain sections or include additional questions tailored to specific investment types or offerings. Some common keywords associated with the Alameda California Regulation D Accredited Investor Questionnaire include: 1. Regulation D: Refers to the SEC's exemption rules under the Securities Act of 1933 that govern private offerings and facilitate capital formation. 2. Accredited Investor: An individual or entity meeting specific income or net worth thresholds established by the SEC for participation in private investments. 3. SEC: The U.S. Securities and Exchange Commission is a federal regulatory agency overseeing capital markets and protecting investors. 4. Private Offering: A securities offering made to a limited number of qualified individuals or institutional investors outside public exchanges. 5. Investment Eligibility: The criteria an investor must meet to participate in certain investment opportunities, typically defined by the offering issuer and regulatory bodies. 6. Financial Status: The current financial position of an individual, including income, net worth, and investment portfolio. 7. Investment Experience: Refers to an individual's prior involvement in securities investments, understanding of risks, and familiarity with investing strategies. 8. Professional Expertise: The specialized knowledge or qualifications an investor possesses, such as industry-specific expertise or licenses, that may impact their eligibility for certain investments. It's important to note that while this description provides a general overview, the specific contents and requirements of the Alameda California Regulation D Accredited Investor Questionnaire may vary depending on the issuer or organization using it. It is crucial for potential investors and issuers to carefully review and complete the questionnaire to ensure compliance with applicable regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.