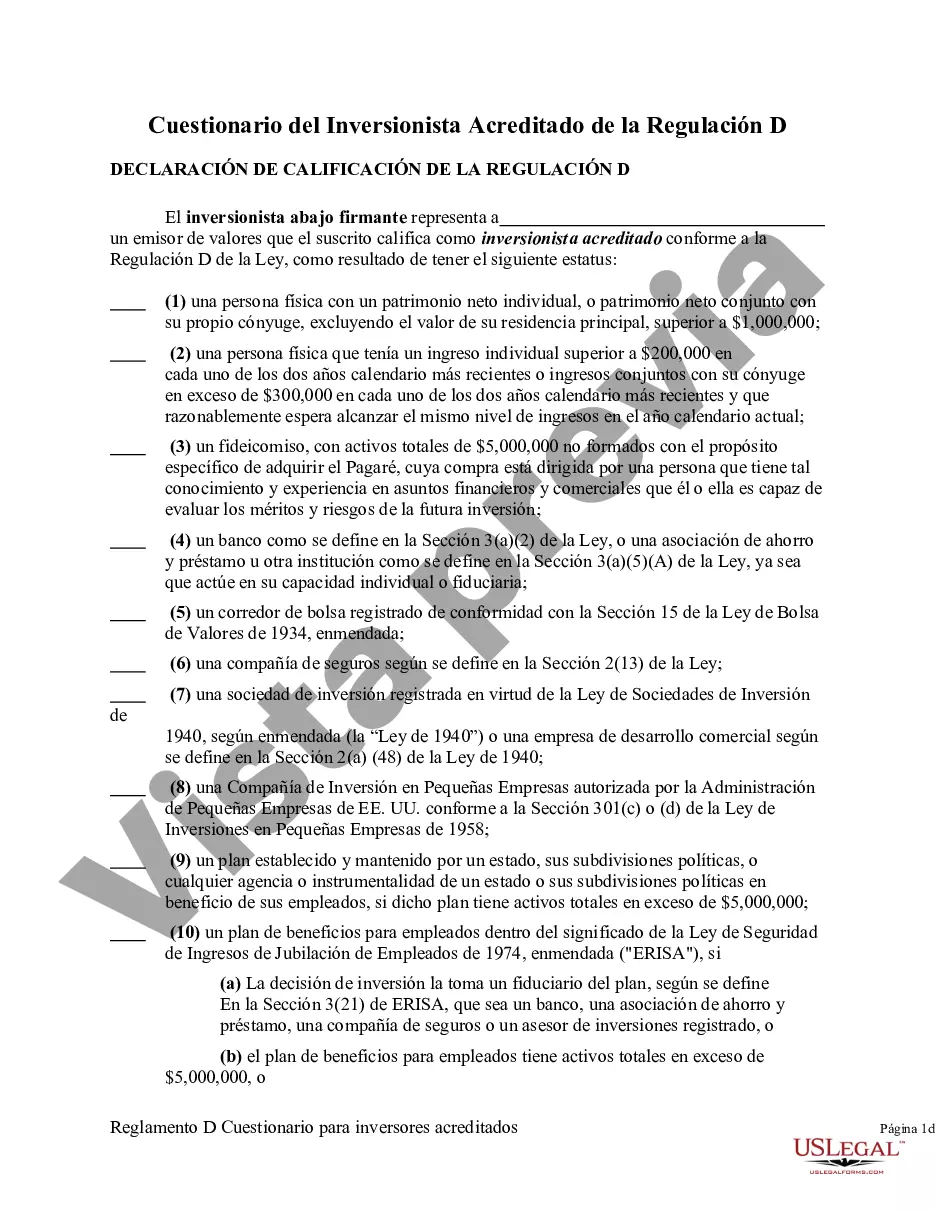

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

Cook Illinois Regulation D Accredited Investor Questionnaire is a document designed to gather information from potential investors who want to participate in private securities offerings pursuant to Regulation D of the Securities Act. This questionnaire assists in determining whether an individual or entity qualifies as an Accredited Investor, which is a crucial requirement for investing in certain private placements. The Cook Illinois Regulation D Accredited Investor Questionnaire aims to evaluate the financial sophistication and suitability of investors to participate in unregistered offerings. By gathering comprehensive data, this questionnaire ensures compliance with Securities and Exchange Commission (SEC) regulations and protects both the investor and the issuer. The questionnaire may vary slightly depending on the specific offering or issuer but generally covers a wide range of relevant information. It includes personal details, such as the investor's name, address, contact information, and social security number or employer identification number. Additionally, it collects financial data, such as annual income, net worth, and investment experience, to determine the investor's eligibility. Cook Illinois Regulation D Accredited Investor Questionnaire often includes multiple sections, delving further into specific qualifications. These sections may cover the investor's employment history, education, professional certifications, and involvement in financial or investment-related activities. The questionnaire may also request information regarding any affiliations with financial industry professionals or regulatory bodies. Some Cook Illinois Regulation D Accredited Investor Questionnaires may include additional sections to assess the investor's risk tolerance, investment objectives, and understanding of the potential risks associated with private placement investments. These sections provide a more comprehensive picture of the investor's financial goals and suitability for the investment opportunity at hand. While there may not be different types of Cook Illinois Regulation D Accredited Investor Questionnaires, the content and structure might be adjusted to suit the specific issuer's requirements and investment offering. The questionnaire's purpose remains consistent across variations, focusing on gathering essential information to verify the investor's accreditation status and suitability for participation in private securities offerings. In summary, the Cook Illinois Regulation D Accredited Investor Questionnaire is a critical tool for issuers seeking to comply with SEC regulations. It captures relevant information from potential investors related to their financial status, background, and investment experience. This comprehensive assessment helps determine an investor's eligibility and suitability for participation in private placement opportunities pursuant to Regulation D.Cook Illinois Regulation D Accredited Investor Questionnaire is a document designed to gather information from potential investors who want to participate in private securities offerings pursuant to Regulation D of the Securities Act. This questionnaire assists in determining whether an individual or entity qualifies as an Accredited Investor, which is a crucial requirement for investing in certain private placements. The Cook Illinois Regulation D Accredited Investor Questionnaire aims to evaluate the financial sophistication and suitability of investors to participate in unregistered offerings. By gathering comprehensive data, this questionnaire ensures compliance with Securities and Exchange Commission (SEC) regulations and protects both the investor and the issuer. The questionnaire may vary slightly depending on the specific offering or issuer but generally covers a wide range of relevant information. It includes personal details, such as the investor's name, address, contact information, and social security number or employer identification number. Additionally, it collects financial data, such as annual income, net worth, and investment experience, to determine the investor's eligibility. Cook Illinois Regulation D Accredited Investor Questionnaire often includes multiple sections, delving further into specific qualifications. These sections may cover the investor's employment history, education, professional certifications, and involvement in financial or investment-related activities. The questionnaire may also request information regarding any affiliations with financial industry professionals or regulatory bodies. Some Cook Illinois Regulation D Accredited Investor Questionnaires may include additional sections to assess the investor's risk tolerance, investment objectives, and understanding of the potential risks associated with private placement investments. These sections provide a more comprehensive picture of the investor's financial goals and suitability for the investment opportunity at hand. While there may not be different types of Cook Illinois Regulation D Accredited Investor Questionnaires, the content and structure might be adjusted to suit the specific issuer's requirements and investment offering. The questionnaire's purpose remains consistent across variations, focusing on gathering essential information to verify the investor's accreditation status and suitability for participation in private securities offerings. In summary, the Cook Illinois Regulation D Accredited Investor Questionnaire is a critical tool for issuers seeking to comply with SEC regulations. It captures relevant information from potential investors related to their financial status, background, and investment experience. This comprehensive assessment helps determine an investor's eligibility and suitability for participation in private placement opportunities pursuant to Regulation D.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.