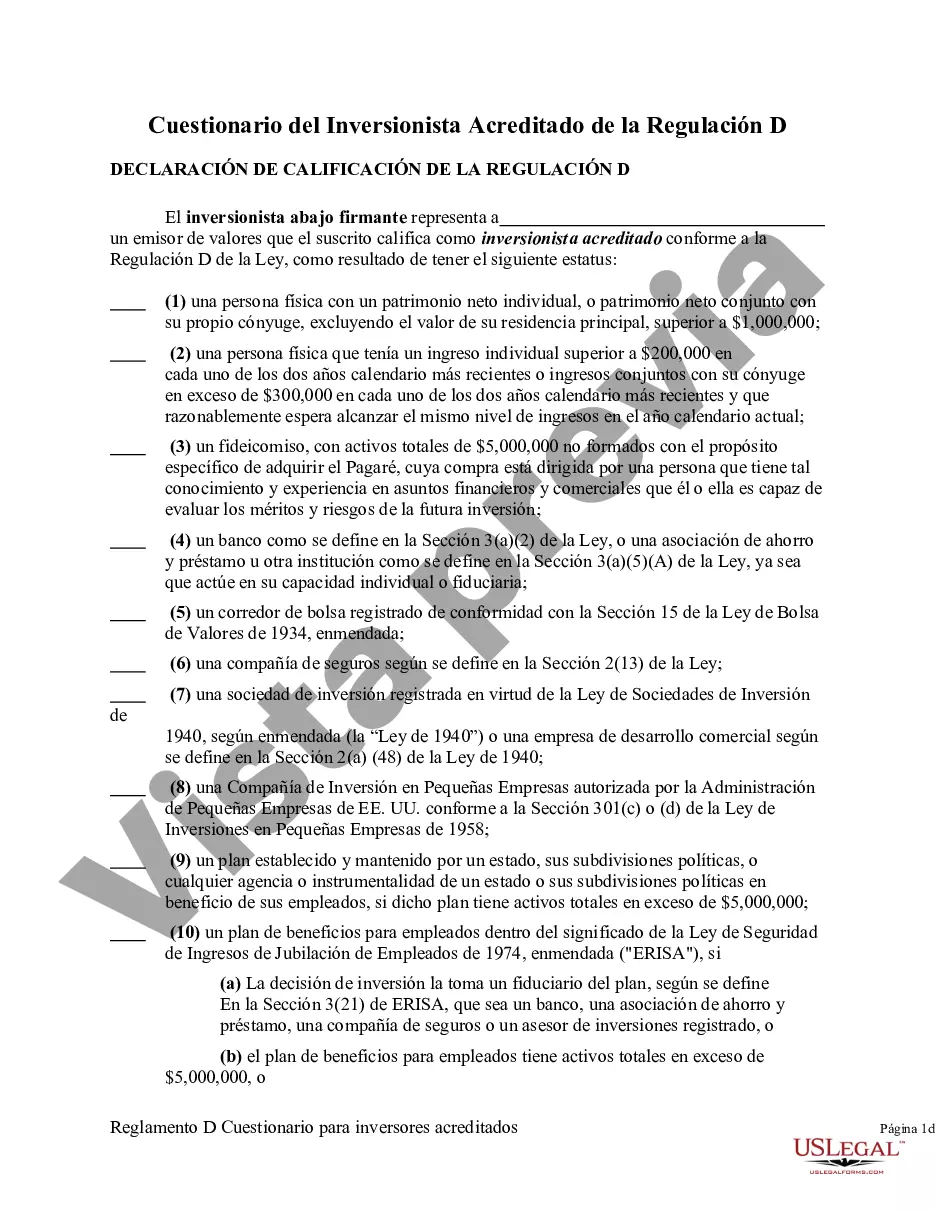

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

Fairfax, Virginia Regulation D Accredited Investor Questionnaire: A Comprehensive Overview In Fairfax, Virginia, the Regulation D Accredited Investor Questionnaire holds significant importance for individuals seeking to invest in private securities offerings. The questionnaire serves as a vital tool for issuers to determine the eligibility of potential investors under the provisions of Regulation D, a set of exemptions specified by the U.S. Securities and Exchange Commission (SEC). This detailed description will outline the purpose, significance, and various types of Fairfax Virginia Regulation D Accredited Investor Questionnaires, using relevant keywords. The primary aim of the Fairfax, Virginia Regulation D Accredited Investor Questionnaire is to establish whether an individual satisfies the criteria outlined in Rule 501 of Regulation D, thereby qualifying as an accredited investor. Accredited investors are individuals or entities with a high net worth or sufficient income, deemed to possess the financial sophistication necessary to face the risks associated with private placements or other unregistered securities offerings. The questionnaire is designed to gather crucial information about the potential investor's financial standing, experience, and investment goals. It typically includes sections focusing on the investor's net worth, annual income, knowledge of investment matters, and professional background. These inquiries enable issuers to assess whether an individual meets the thresholds set by Regulation D's "accredited investor" definition. Different Types of Fairfax Virginia Regulation D Accredited Investor Questionnaire: 1. Individually-based questionnaire: This version of the questionnaire is tailored for individual investors, providing them with the opportunity to qualify as accredited investors on the basis of their personal finances, income, and investment knowledge. 2. Entity-based questionnaire: Designed for entities such as corporations, partnerships, limited liability companies (LCS), or trusts, this questionnaire assesses the organization's financial resources, net assets, and other pertinent information to determine if they meet the accredited investor criteria. 3. Spousal-combined questionnaire: In situations where a married couple intends to invest jointly, a spousal-combined questionnaire is utilized to consider the combined finances, shared income, and joint investment experience of both individuals. 4. Sophistication questionnaire: In certain cases, investors may possess significant financial knowledge or experience, despite not meeting the net worth or income thresholds defined by Regulation D. A sophistication questionnaire helps assess an investor's expertise and understanding of the risks involved, enabling the issuer to determine if they qualify as an accredited investor. It is important to note that while the Fairfax Virginia Regulation D Accredited Investor Questionnaire serves as an essential tool for compliance and due diligence purposes, issuers may incorporate additional supplementary documents, such as financial statements, tax returns, or verification letters from accountants, to verify the submitted information. In conclusion, the Fairfax Virginia Regulation D Accredited Investor Questionnaire plays a crucial role in establishing the eligibility of potential investors seeking to participate in private securities offerings. By gathering comprehensive information about an investor's financial status, experience, and knowledge, this questionnaire enables issuers to ensure compliance with the SEC's requirements and make informed decisions regarding the suitability of an investor for private investment opportunities.Fairfax, Virginia Regulation D Accredited Investor Questionnaire: A Comprehensive Overview In Fairfax, Virginia, the Regulation D Accredited Investor Questionnaire holds significant importance for individuals seeking to invest in private securities offerings. The questionnaire serves as a vital tool for issuers to determine the eligibility of potential investors under the provisions of Regulation D, a set of exemptions specified by the U.S. Securities and Exchange Commission (SEC). This detailed description will outline the purpose, significance, and various types of Fairfax Virginia Regulation D Accredited Investor Questionnaires, using relevant keywords. The primary aim of the Fairfax, Virginia Regulation D Accredited Investor Questionnaire is to establish whether an individual satisfies the criteria outlined in Rule 501 of Regulation D, thereby qualifying as an accredited investor. Accredited investors are individuals or entities with a high net worth or sufficient income, deemed to possess the financial sophistication necessary to face the risks associated with private placements or other unregistered securities offerings. The questionnaire is designed to gather crucial information about the potential investor's financial standing, experience, and investment goals. It typically includes sections focusing on the investor's net worth, annual income, knowledge of investment matters, and professional background. These inquiries enable issuers to assess whether an individual meets the thresholds set by Regulation D's "accredited investor" definition. Different Types of Fairfax Virginia Regulation D Accredited Investor Questionnaire: 1. Individually-based questionnaire: This version of the questionnaire is tailored for individual investors, providing them with the opportunity to qualify as accredited investors on the basis of their personal finances, income, and investment knowledge. 2. Entity-based questionnaire: Designed for entities such as corporations, partnerships, limited liability companies (LCS), or trusts, this questionnaire assesses the organization's financial resources, net assets, and other pertinent information to determine if they meet the accredited investor criteria. 3. Spousal-combined questionnaire: In situations where a married couple intends to invest jointly, a spousal-combined questionnaire is utilized to consider the combined finances, shared income, and joint investment experience of both individuals. 4. Sophistication questionnaire: In certain cases, investors may possess significant financial knowledge or experience, despite not meeting the net worth or income thresholds defined by Regulation D. A sophistication questionnaire helps assess an investor's expertise and understanding of the risks involved, enabling the issuer to determine if they qualify as an accredited investor. It is important to note that while the Fairfax Virginia Regulation D Accredited Investor Questionnaire serves as an essential tool for compliance and due diligence purposes, issuers may incorporate additional supplementary documents, such as financial statements, tax returns, or verification letters from accountants, to verify the submitted information. In conclusion, the Fairfax Virginia Regulation D Accredited Investor Questionnaire plays a crucial role in establishing the eligibility of potential investors seeking to participate in private securities offerings. By gathering comprehensive information about an investor's financial status, experience, and knowledge, this questionnaire enables issuers to ensure compliance with the SEC's requirements and make informed decisions regarding the suitability of an investor for private investment opportunities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.