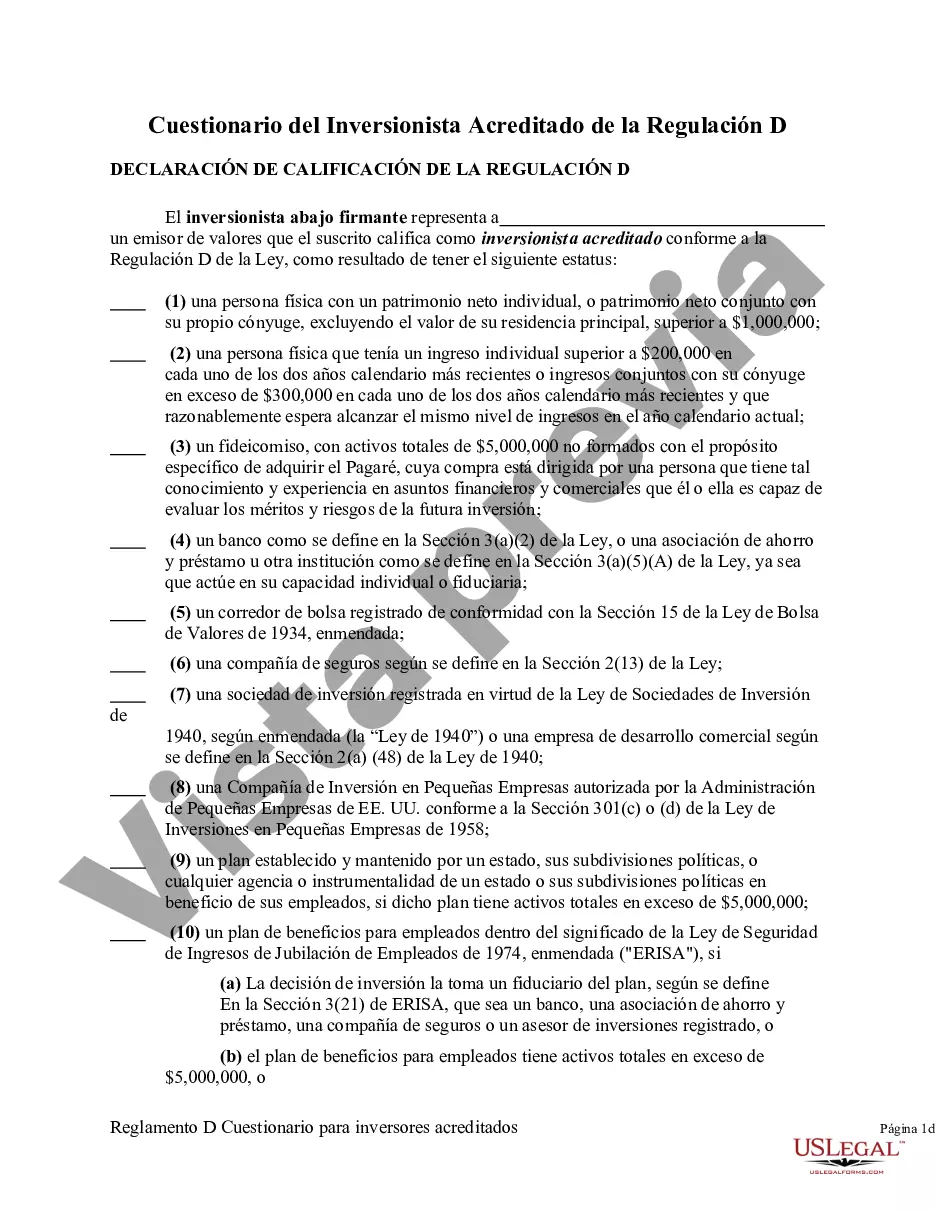

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

Title: Exploring Hennepin, Minnesota's Regulation D Accredited Investor Questionnaire: A Comprehensive Overview Introduction: Hennepin, Minnesota, offers Regulation D Accredited Investor Questionnaires for individuals seeking to invest in private offerings while ensuring compliance with regulatory requirements. This article provides an in-depth description of these questionnaires, including different types available within Hennepin. 1. Definition of Regulation D: Regulation D, established by the U.S. Securities and Exchange Commission (SEC), provides exemptions to certain securities offerings designed for accredited investors. Hennepin, Minnesota, adheres to these regulations when offering investment opportunities. 2. The Role of Accredited Investor Questionnaires: Accredited Investor Questionnaires serve as a verification tool to determine an individual's eligibility to participate in private offerings under Regulation D. These questionnaires assist issuers in ensuring compliance and avoiding legal complexities. 3. Key Components of Hennepin Minnesota's Accredited Investor Questionnaire: — Personal Information: The questionnaire requires investors to provide personal details such as name, contact information, residential address, social security number, and occupation. — Income Verification: Investors are required to disclose their annual income along with supporting documentation, such as tax returns, W-2 forms, or bank statements. — Net Worth Assessment: The questionnaire evaluates an investor's net worth, including assets such as real estate, investments, bank accounts, and liabilities like mortgages and loans. — Experience in Investment: Individuals may be asked to provide information on their previous investment experience, including knowledge of risks associated with private offerings. 4. Types of Hennepin Minnesota's Regulation D Accredited Investor Questionnaire: a) Individual Accredited Investor Questionnaire: This questionnaire focuses on individual investors who meet the required income or net worth thresholds. It assesses their financial qualifications based on personal income and assets. b) Entity Accredited Investor Questionnaire: Catering to entities like corporations, partnerships, or trusts, this questionnaire verifies their eligibility as accredited investors. It evaluates their financial standing and the extent of control they have over the investment decision-making process. c) Spousal Equivalency Accredited Investor Questionnaire: Designed to comprehend the investment capacity of married couples, this questionnaire considers jointly-held assets and income from both parties to determine eligibility as accredited investors. Conclusion: Hennepin, Minnesota's Regulation D Accredited Investor Questionnaires ensure adherence to SEC's regulations, protecting both investors and issuers. By carefully assessing an individual's financial qualifications and understanding their investment experience, these questionnaires play a vital role in enabling secure and compliant private offerings. Understanding the different types mentioned above is crucial in selecting the appropriate questionnaire based on the investor's circumstance.Title: Exploring Hennepin, Minnesota's Regulation D Accredited Investor Questionnaire: A Comprehensive Overview Introduction: Hennepin, Minnesota, offers Regulation D Accredited Investor Questionnaires for individuals seeking to invest in private offerings while ensuring compliance with regulatory requirements. This article provides an in-depth description of these questionnaires, including different types available within Hennepin. 1. Definition of Regulation D: Regulation D, established by the U.S. Securities and Exchange Commission (SEC), provides exemptions to certain securities offerings designed for accredited investors. Hennepin, Minnesota, adheres to these regulations when offering investment opportunities. 2. The Role of Accredited Investor Questionnaires: Accredited Investor Questionnaires serve as a verification tool to determine an individual's eligibility to participate in private offerings under Regulation D. These questionnaires assist issuers in ensuring compliance and avoiding legal complexities. 3. Key Components of Hennepin Minnesota's Accredited Investor Questionnaire: — Personal Information: The questionnaire requires investors to provide personal details such as name, contact information, residential address, social security number, and occupation. — Income Verification: Investors are required to disclose their annual income along with supporting documentation, such as tax returns, W-2 forms, or bank statements. — Net Worth Assessment: The questionnaire evaluates an investor's net worth, including assets such as real estate, investments, bank accounts, and liabilities like mortgages and loans. — Experience in Investment: Individuals may be asked to provide information on their previous investment experience, including knowledge of risks associated with private offerings. 4. Types of Hennepin Minnesota's Regulation D Accredited Investor Questionnaire: a) Individual Accredited Investor Questionnaire: This questionnaire focuses on individual investors who meet the required income or net worth thresholds. It assesses their financial qualifications based on personal income and assets. b) Entity Accredited Investor Questionnaire: Catering to entities like corporations, partnerships, or trusts, this questionnaire verifies their eligibility as accredited investors. It evaluates their financial standing and the extent of control they have over the investment decision-making process. c) Spousal Equivalency Accredited Investor Questionnaire: Designed to comprehend the investment capacity of married couples, this questionnaire considers jointly-held assets and income from both parties to determine eligibility as accredited investors. Conclusion: Hennepin, Minnesota's Regulation D Accredited Investor Questionnaires ensure adherence to SEC's regulations, protecting both investors and issuers. By carefully assessing an individual's financial qualifications and understanding their investment experience, these questionnaires play a vital role in enabling secure and compliant private offerings. Understanding the different types mentioned above is crucial in selecting the appropriate questionnaire based on the investor's circumstance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.