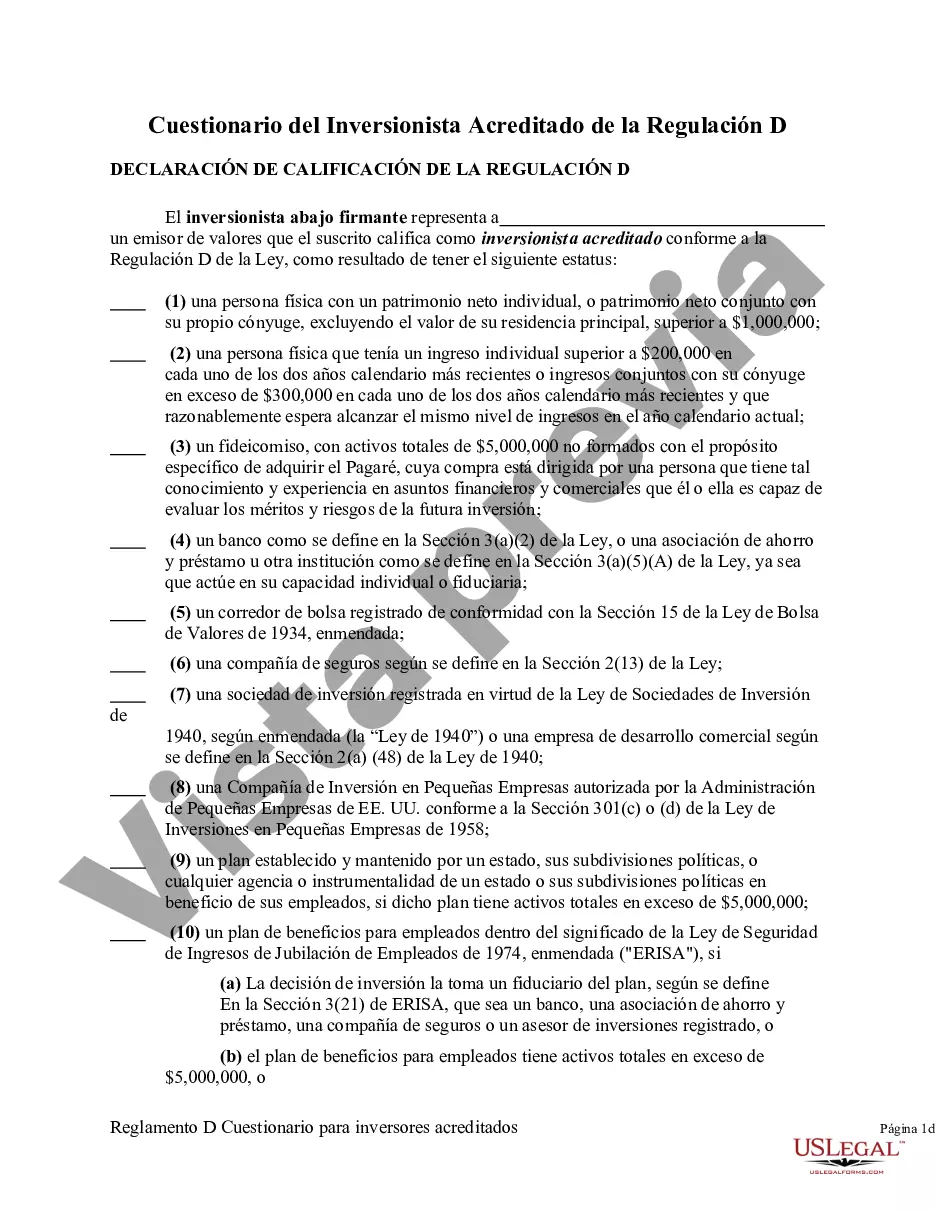

The information contained in this Questionnaire is being furnished by a potential investor in order to determine whether the prospective investor qualifies as an accredited investor as defined in Regulation D of the Securities Act of 1933.

Regulation D creates an exemption that permits sales of securities without registration with the U.S. Security and Exchange Commission. However, Sellers are required to file a Form D informational statement about the sale. The definition of accredited investor is important regarding this exemption as far as a limitation on the number of shareholders allowed (i.e., 35). Accredited investors do not have to be counted as far as the 35 limitation is concerned. An accredited investor includes any investor who at the time of the sale falls into any of the following categories: " a private business development firm; " directors, officers, and general partners of issuer; " banks; " purchasers of $150,000 or more of the securities; " natural persons with a net worth greater than $1,000,000; or " persons with an income of greater than or equal to $200,000 per year.

San Antonio Texas Regulation D Accredited Investor Questionnaire is a detailed questionnaire designed to determine an individual's eligibility to invest in private securities offerings under Regulation D of the Securities and Exchange Commission (SEC) in San Antonio, Texas. This questionnaire aims to confirm if an individual meets the specific financial criteria required to be considered an accredited investor. Keywords: San Antonio Texas, Regulation D, accredited investor, questionnaire, private securities offerings, eligibility, SEC, financial criteria. Types of San Antonio Texas Regulation D Accredited Investor Questionnaires: 1. Individual Accredited Investor Questionnaire: This questionnaire is specifically designed for individuals who want to invest in private securities offerings, such as private placements, hedge funds, or venture capital funds. It assesses an individual's financial status, including income, net worth, and investment experience, to verify if they meet the required to be accredited investor criteria. 2. Entity Accredited Investor Questionnaire: This type of questionnaire is applicable to entities, such as corporations, partnerships, or limited liability companies, that intend to invest in private securities offerings. It evaluates the entity's financial standing, assets, liabilities, and governance structure to determine if it satisfies the accreditation standards set forth by Regulation D. 3. Real Estate Accredited Investor Questionnaire: This questionnaire is specifically tailored for individuals or entities interested in investing in real estate funds or opportunities. It focuses on evaluating an investor's experience in real estate investments, knowledge of the market, and financial capability to participate in real estate-related securities offerings. 4. Venture Capital Accredited Investor Questionnaire: This type of questionnaire is targeted at individuals or entities interested in investing in startup companies or early-stage ventures. It assesses an investor's expertise in evaluating high-risk investments, knowledge of the venture capital industry, and financial capacity to engage in investments specifically in the startup ecosystem. These variations of San Antonio Texas Regulation D Accredited Investor Questionnaires ensure that the specific requirements and characteristics of different investment opportunities are considered when determining an individual or entity's accreditation status. It helps protect both the investors and the issuers by ensuring that only eligible investors participate in these private securities offerings.San Antonio Texas Regulation D Accredited Investor Questionnaire is a detailed questionnaire designed to determine an individual's eligibility to invest in private securities offerings under Regulation D of the Securities and Exchange Commission (SEC) in San Antonio, Texas. This questionnaire aims to confirm if an individual meets the specific financial criteria required to be considered an accredited investor. Keywords: San Antonio Texas, Regulation D, accredited investor, questionnaire, private securities offerings, eligibility, SEC, financial criteria. Types of San Antonio Texas Regulation D Accredited Investor Questionnaires: 1. Individual Accredited Investor Questionnaire: This questionnaire is specifically designed for individuals who want to invest in private securities offerings, such as private placements, hedge funds, or venture capital funds. It assesses an individual's financial status, including income, net worth, and investment experience, to verify if they meet the required to be accredited investor criteria. 2. Entity Accredited Investor Questionnaire: This type of questionnaire is applicable to entities, such as corporations, partnerships, or limited liability companies, that intend to invest in private securities offerings. It evaluates the entity's financial standing, assets, liabilities, and governance structure to determine if it satisfies the accreditation standards set forth by Regulation D. 3. Real Estate Accredited Investor Questionnaire: This questionnaire is specifically tailored for individuals or entities interested in investing in real estate funds or opportunities. It focuses on evaluating an investor's experience in real estate investments, knowledge of the market, and financial capability to participate in real estate-related securities offerings. 4. Venture Capital Accredited Investor Questionnaire: This type of questionnaire is targeted at individuals or entities interested in investing in startup companies or early-stage ventures. It assesses an investor's expertise in evaluating high-risk investments, knowledge of the venture capital industry, and financial capacity to engage in investments specifically in the startup ecosystem. These variations of San Antonio Texas Regulation D Accredited Investor Questionnaires ensure that the specific requirements and characteristics of different investment opportunities are considered when determining an individual or entity's accreditation status. It helps protect both the investors and the issuers by ensuring that only eligible investors participate in these private securities offerings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.