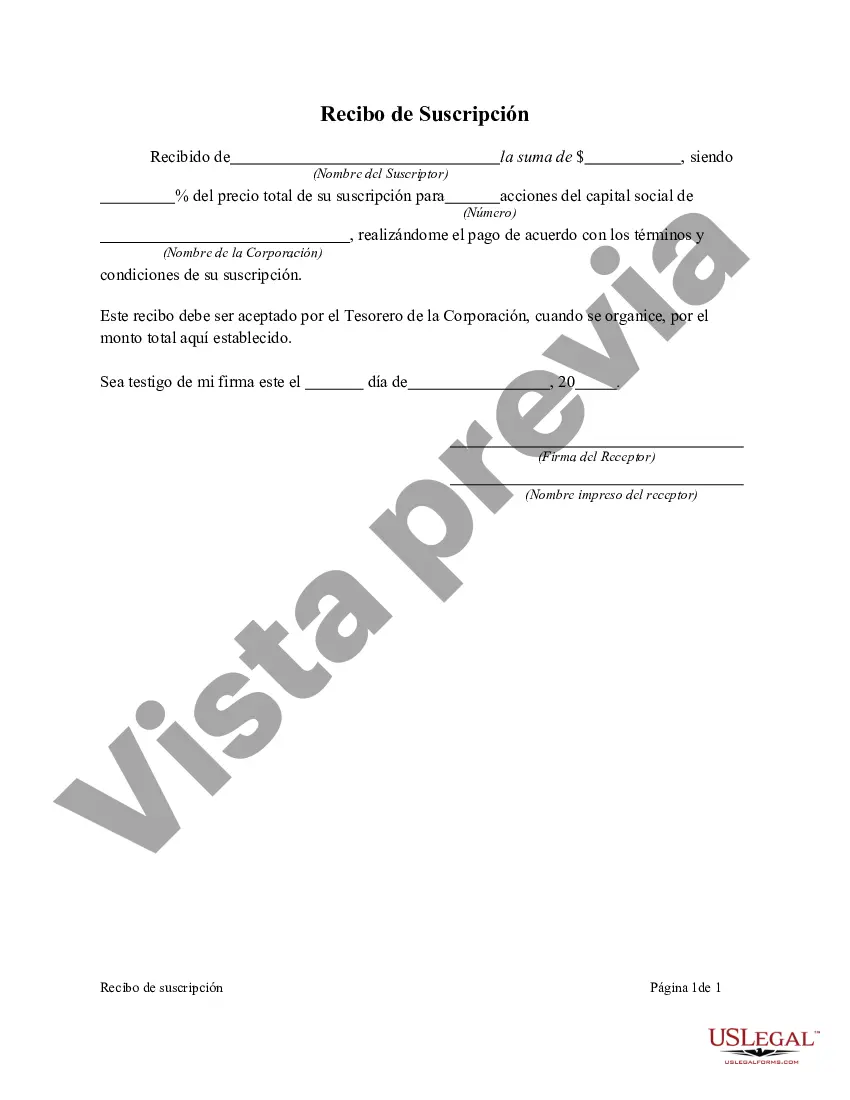

Bronx New York Subscription Receipt is a financial instrument used in the context of real estate offerings and public offerings in the Bronx, New York. It is a temporary document issued to investors as evidence of their commitment to subscribe or purchase securities (such as shares or units) in a specific real estate project or public offering within the Bronx. Subscription receipts act as placeholders for the actual securities until the offering is completed or specific conditions are met. They serve to provide investors with some level of assurance that their investment has been acknowledged and that the securities will be issued once the offering is finalized. These receipts can take different forms depending on the offering type and the rules governing it. Some common types of Bronx New York Subscription Receipts include: 1. Real Estate Subscription Receipts: These pertain specifically to real estate projects in the Bronx, New York. Investors who wish to invest in properties within the Bronx can subscribe to a real estate subscription receipt, indicating their interest in purchasing a share or unit in the project. Once the offering is concluded or defined conditions are met, the subscription receipt can be exchanged for actual shares or units in the property, granting the investors legal ownership. 2. Public Offering Subscription Receipts: These receipts are commonly used in public offerings where companies issue new shares or units to the public for financing their projects or expansion. Investors interested in participating in the offering can subscribe to a public offering subscription receipt, which represents their intention to purchase the shares or units once the offering is fully subscribed and completed. Similar to real estate subscription receipts, these can be exchanged for actual securities upon meeting specific conditions. Bronx New York Subscription Receipts provide several advantages to both investors and issuers. For investors, they offer a level of security by ensuring that their investment is acknowledged and allocated. Once the offering is completed, investors can swiftly convert their subscription receipts into actual securities. For issuers, these receipts allow them to gauge investor interest and raise funds without the immediate need to issue the securities, providing flexibility during the offering process. In conclusion, Bronx New York Subscription Receipts serve as temporary evidence of an investor's commitment to purchase securities within real estate projects or public offerings in the Bronx. They come in different forms based on the offering type, such as real estate subscription receipts and public offering subscription receipts. These receipts offer benefits to investors and issuers alike, streamlining the investment process and providing a level of security until the final securities are issued.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Recibo de Suscripción - Subscription Receipt

Description

How to fill out Bronx New York Recibo De Suscripción?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Bronx Subscription Receipt, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Consequently, if you need the current version of the Bronx Subscription Receipt, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Bronx Subscription Receipt:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Bronx Subscription Receipt and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!