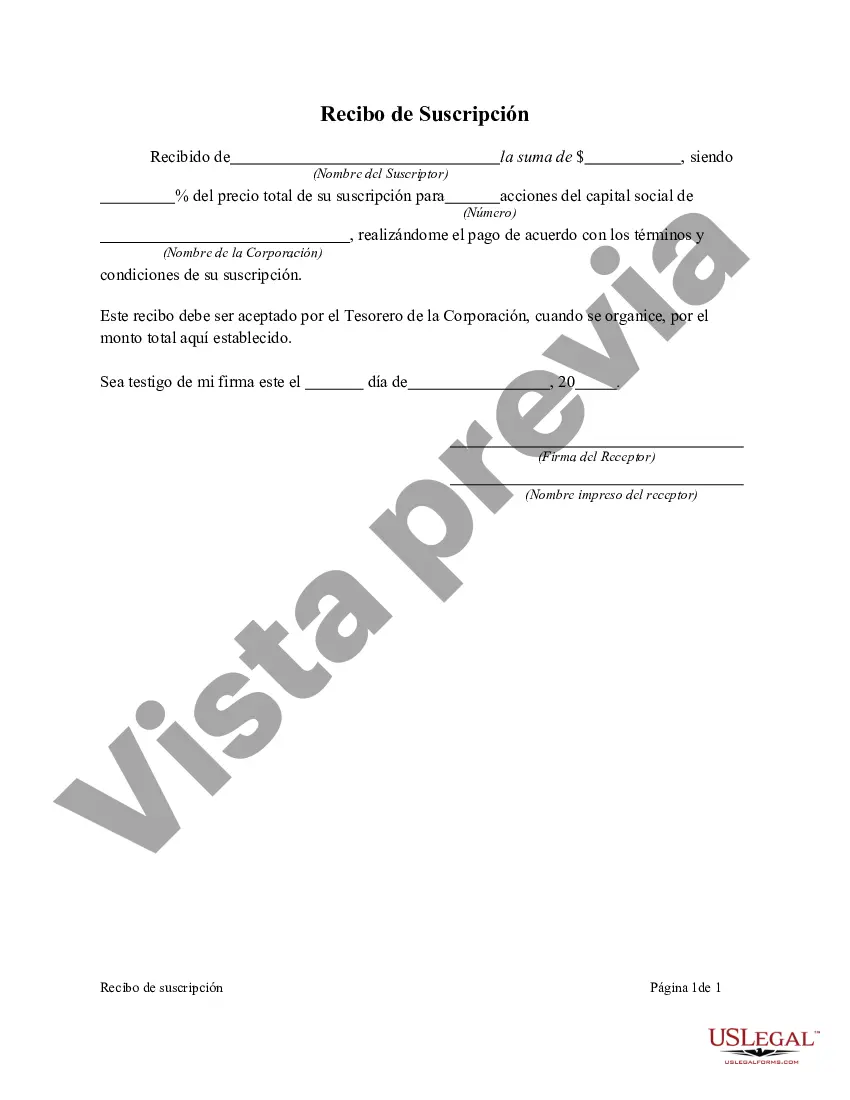

Dallas Texas Subscription Receipts are financial documents that are commonly used in investment transactions. These receipts are issued as evidence of payment for a subscription to purchase securities or shares of a specific company or fund located in Dallas, Texas. They are usually issued by a broker or intermediary on behalf of the issuer to investors who have committed to purchasing these securities. Dallas Texas Subscription Receipts serve as a temporary placeholder for the actual securities until the completion of certain conditions or events. These conditions may include regulatory approvals, completion of a business transaction, or meeting specific performance milestones. Once these conditions are met, the subscription receipt can be exchanged for the underlying securities, such as common shares or units in a trust. There are a few different types of Dallas Texas Subscription Receipts that can be found in the financial market. Some common types include: 1. Equity Subscription Receipts: These receipts are associated with the purchase of equity securities, such as common shares, preferred shares, or units in a trust. Investors subscribe to these receipts with the expectation of receiving ownership rights in the form of the underlying equity securities upon fulfillment of the required conditions. 2. Debt Subscription Receipts: Unlike equity subscription receipts, these receipts are associated with the purchase of debt securities. Investors subscribe to these receipts with the expectation of receiving fixed income payments from the issuer, such as interest payments, upon successful completion of the conditions. 3. Convertible Subscription Receipts: These receipts offer investors the option to convert their subscription receipts into a different type of security, usually common shares, at a predetermined conversion ratio. This allows investors to benefit from the potential upside of the issuer's equity without initially purchasing the actual shares. 4. Venture Capital Subscription Receipts: These receipts are commonly used in venture capital transactions, where investors subscribe to support early-stage companies or startups. In such cases, the funds raised through subscription receipts help the company to achieve certain milestones, and upon achievement of these milestones, the receipts are converted into equity securities. Dallas Texas Subscription Receipts provide flexibility and convenience to both issuers and investors. They allow issuers to raise capital upfront while investors benefit from potential price appreciation and other market gains before the completion of the necessary conditions. This investment instrument helps to facilitate capital flow in the Dallas, Texas region and promotes economic growth and development.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Recibo de Suscripción - Subscription Receipt

Description

How to fill out Dallas Texas Recibo De Suscripción?

If you need to find a trustworthy legal paperwork provider to obtain the Dallas Subscription Receipt, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed template.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support team make it easy to get and execute various papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to look for or browse Dallas Subscription Receipt, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Dallas Subscription Receipt template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes this experience less costly and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Dallas Subscription Receipt - all from the convenience of your home.

Sign up for US Legal Forms now!