Travis Texas Subscription Receipt is a financial instrument used in certain investment transactions, particularly in the Canadian capital markets. It allows investors to subscribe for shares of a corporation on a conditional basis, pending the completion of a specific event or transaction. In simple terms, a Travis Texas Subscription Receipt represents a commitment from investors to purchase shares at a future date, subject to the fulfillment of certain conditions. These conditions typically include the completion of an acquisition, merger, or another predetermined milestone defined by the company issuing the receipts. Travis Texas Subscription Receipts are often used in financing arrangements where a company plans to raise capital to fund a specific transaction. They provide a means for investors to invest in a company while mitigating some risks associated with the transaction. This financial instrument offers several benefits to both investors and companies. For investors, Travis Texas Subscription Receipts allow them to participate in potentially lucrative transactions while limiting their risk exposure. If the conditions of the subscription receipt are not met, investors can typically redeem their receipts for a refund of their principal investment. For companies, Travis Texas Subscription Receipts provide a way to secure financing for complex transactions without requiring immediate share issuance. This allows them to complete the transaction first, and then issue shares to investors, which can enhance their ability to negotiate favorable terms. It is important to note that Travis Texas Subscription Receipts can come in different types, depending on the terms and conditions set by the issuing company. Some common variations include: 1. Basic Subscription Receipts: These are the standard form of Travis Texas Subscription Receipts, entitling the holder to purchase shares upon the fulfillment of the predetermined conditions. 2. Hold back Subscription Receipts: These receipts are often used when a portion of the subscription price is held back until certain post-closing conditions or milestones are met. Hold back subscription receipts provide additional protection to investors by ensuring that the conditions are met and the transaction is successful before completing the investment. 3. Es crowed Subscription Receipts: In certain cases, where regulatory approval is required, Travis Texas Subscription Receipts may be placed in escrow until the necessary approvals are obtained. This ensures compliance with legal and regulatory requirements before the investors' funds are fully committed. In summary, Travis Texas Subscription Receipts are conditional investment instruments that allow investors to commit capital to a company for specific transactions. They provide a means to raise funds while reducing risk exposure for both investors and companies. The different types of Travis Texas Subscription Receipts, including basic, hold back, and BS crowed, cater to various transaction-specific requirements and provide additional safeguards for investors.

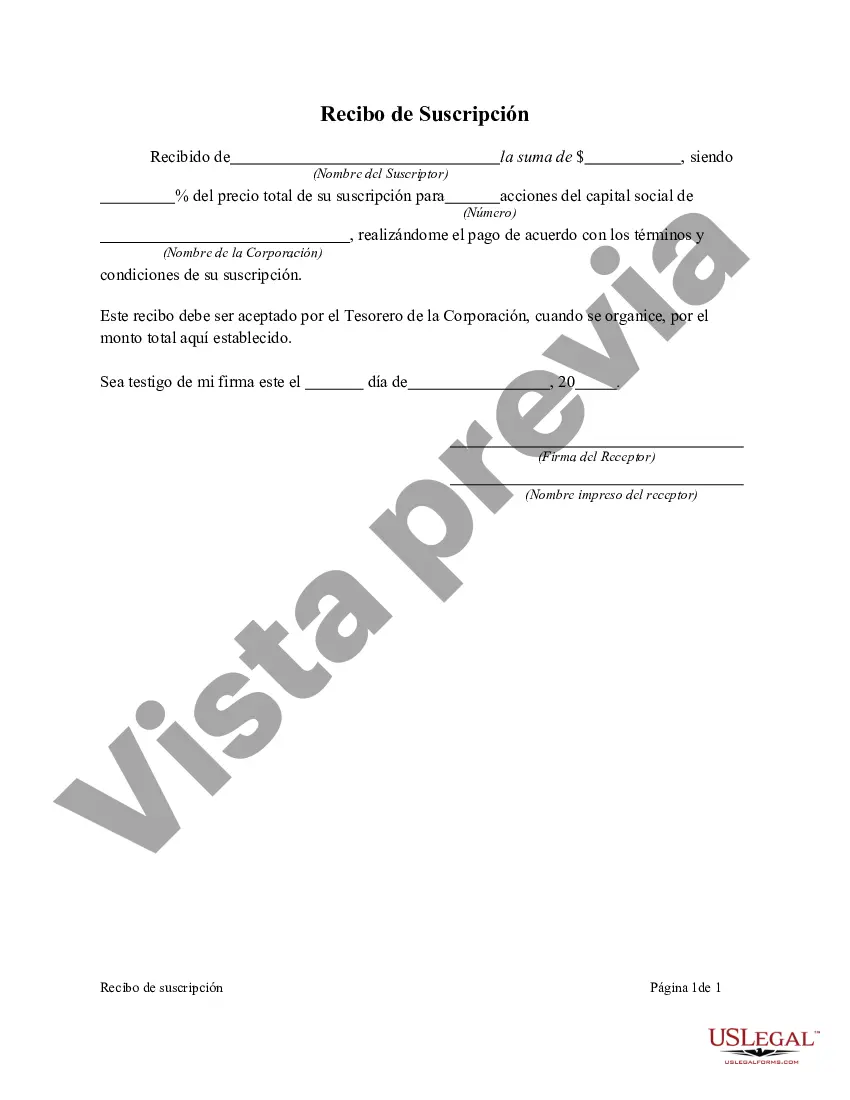

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Recibo de Suscripción - Subscription Receipt

Description

How to fill out Travis Texas Recibo De Suscripción?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are grouped by state and area of use, so picking a copy like Travis Subscription Receipt is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to get the Travis Subscription Receipt. Follow the guide below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Travis Subscription Receipt in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!