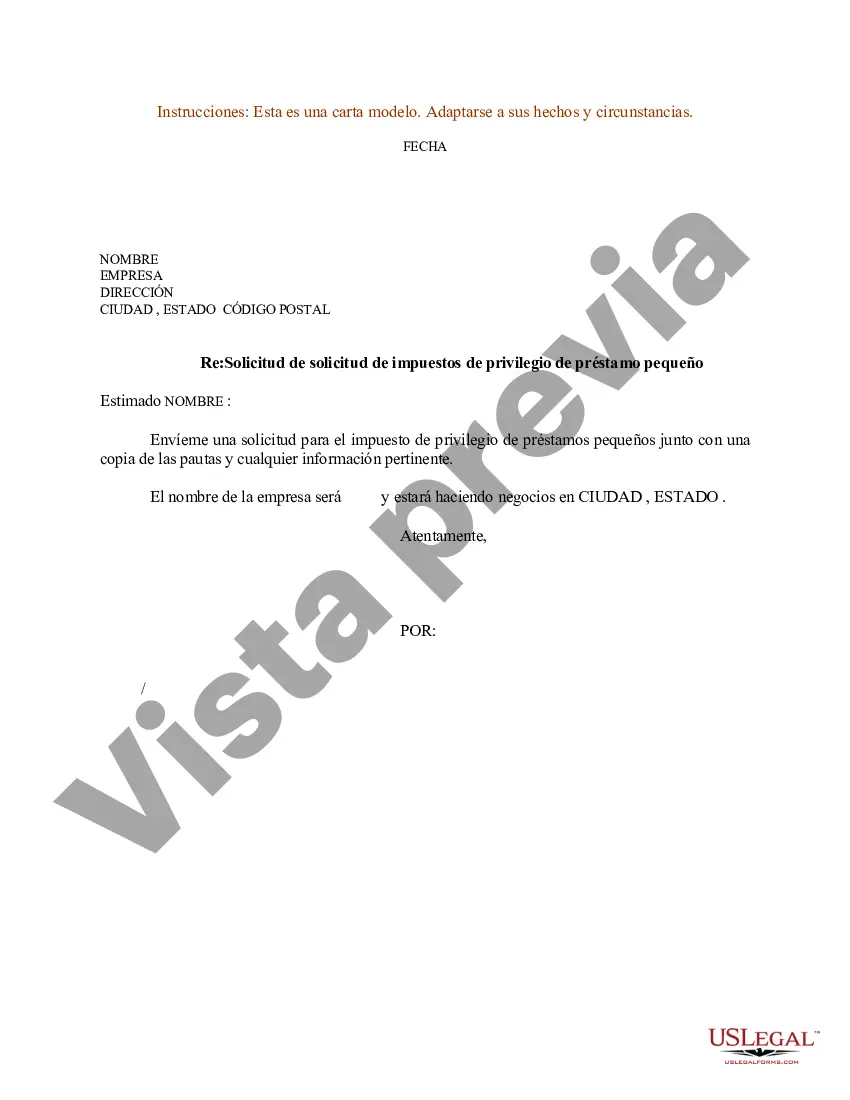

Subject: Request for Small Loan Privilege Tax Application — Franklin, Ohio Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to request a Small Loan Privilege Tax Application for our business located in Franklin, Ohio. We have recently expanded our operations and require financial assistance to fulfill our growth plans. Our company, [Company Name], based in Franklin, Ohio, is a small and aspiring enterprise specializing in [Briefly describe the nature of your business]. With steady progress over the years, we have identified several opportunities for expansion, introducing new products and services to meet the evolving demands of our customers. To support these ventures, we are seeking a small loan through the Franklin Municipal Government's Small Loan Privilege Tax Program. This program is specifically designed to assist local businesses like ours in achieving their growth objectives, providing financial resources at favorable terms which can be crucial for our success. In order to proceed further with our loan application, we kindly request the necessary forms and information required to apply for the Small Loan Privilege Tax Program. We would be grateful if you could provide us with the following documents: 1. Small Loan Privilege Tax Application Form: This is the primary form required to apply for the loan program. Kindly provide us with a copy or direct us to the appropriate online portal where we can access and submit the application form. 2. Instructions and Guidelines: To ensure we complete the application accurately, it would be immensely beneficial to receive a set of instructions and guidelines outlining the necessary steps, documents, and any specific requirements related to the Small Loan Privilege Tax Program. 3. Supporting Documentation: Please provide us with a checklist of the supporting documents required to accompany our loan application. This will help us gather and organize the necessary paperwork efficiently. 4. Deadline and Submission Channels: If there is a deadline to submit the completed application, kindly specify it so that we can ensure timely processing. Additionally, please inform us of the preferred method for submitting the application. Whether it is through email, online submission, or physical delivery, we will abide by the specified procedure. We understand that your office may receive numerous loan applications, and we appreciate your due diligence in processing them. We assure you that our loan will be utilized for the intended purposes, ensuring sustainable growth for both our business and the local economy as a whole. Furthermore, we are eager to move forward with our Small Loan Privilege Tax Application and would be grateful for your prompt response in providing the requested documentation. If there are any fees or charges associated with the process, kindly inform us in advance so that we can make the necessary arrangements. Thank you for your attention to this matter. Should you require any further information or have any queries, please do not hesitate to reach out to us at [Contact Information]. We look forward to hearing from you soon and remain committed to contributing towards the economic prosperity of Franklin, Ohio. Yours sincerely, [Your Name] [Your Title/Position] [Company Name] [Contact Information]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Ejemplo de carta de solicitud de solicitud de impuestos de privilegio de préstamo pequeño - Sample Letter for Request for Small Loan Privilege Tax Application

Description

How to fill out Franklin Ohio Ejemplo De Carta De Solicitud De Solicitud De Impuestos De Privilegio De Préstamo Pequeño?

Draftwing paperwork, like Franklin Sample Letter for Request for Small Loan Privilege Tax Application, to take care of your legal affairs is a difficult and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can get your legal issues into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms crafted for various scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Franklin Sample Letter for Request for Small Loan Privilege Tax Application template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as simple! Here’s what you need to do before downloading Franklin Sample Letter for Request for Small Loan Privilege Tax Application:

- Ensure that your template is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

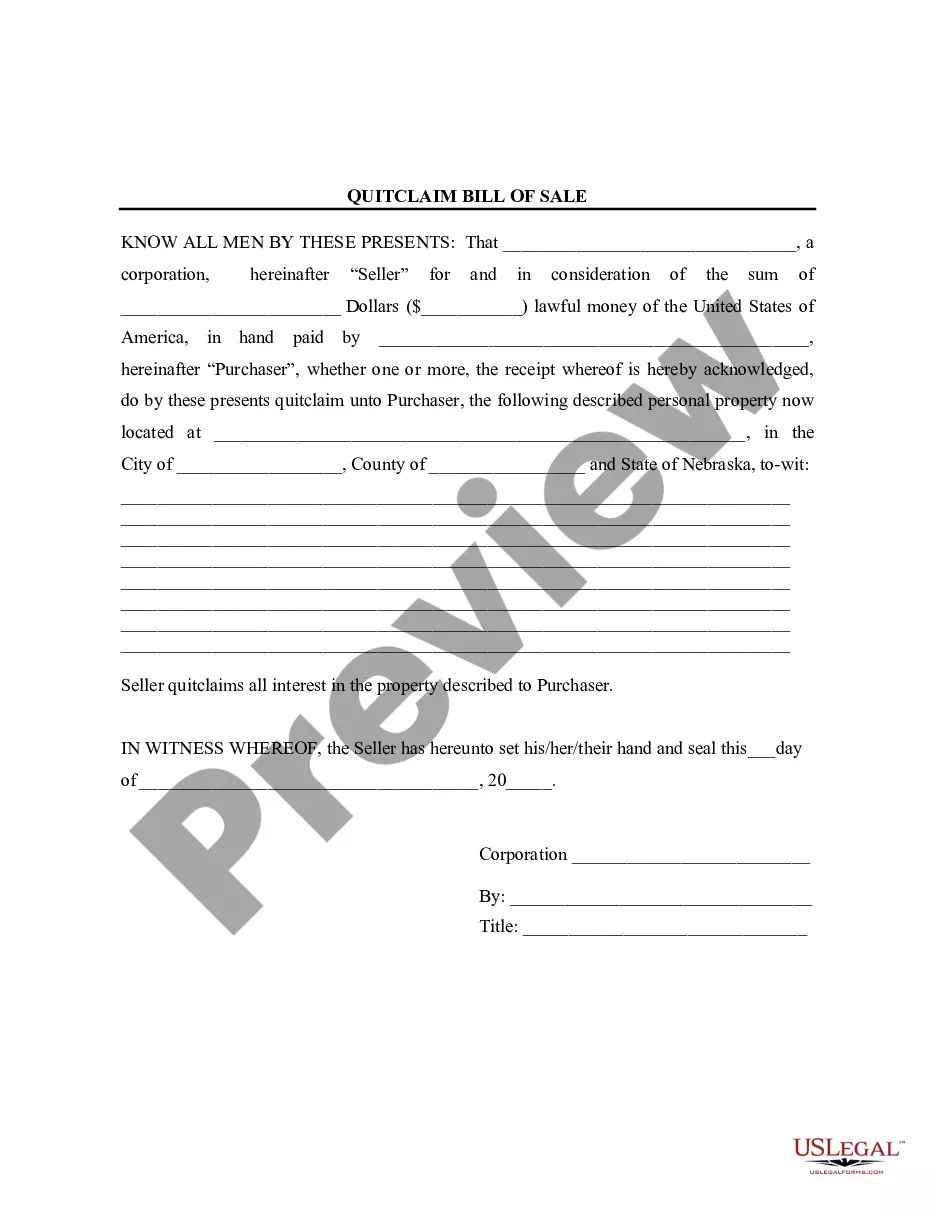

- Discover more information about the form by previewing it or reading a quick intro. If the Franklin Sample Letter for Request for Small Loan Privilege Tax Application isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our service and download the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s easy to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Pedir un prestamo puede ser todo un reto para inmigrantes sin un numero de Seguro Social. Si esta es tu situacion, debes solicitar un numero ITIN (o Numero de Identificacion Individual de Contribuyente) al IRS.

Requisitos tipicos de documentacion para prestamos personales Comprobante de tu identidad. Primero que nada, tienes que demostrar a los prestamistas que eres quien dices ser.Comprobante de domicilio.Comprobante de ingreso.Gastos mensuales constantes.Tu puntaje de credito.El proposito para el prestamo personal.

¿Como saber si califico para un prestamo? Solicita el historial crediticio. ¿Como saber si aplicas para un credito?Tener un historial crediticio.No estar en la lista de los centrales de riesgo (la lista negra de Infocorp)Tener ingresos fijos y comprobados.Estar dentro del rango de edad que pide la financiera.

Requisitos para obtener un prestamo personal Historial y puntaje crediticio: Es necesario contar con historial crediticio y suelen solicitar mas de 600 puntos. Garantia de ingresos: Los prestamistas solicitaran que tengas un ingreso minimo anual y deberas presentar documentacion que lo avale.

Requisitos para obtener un prestamo personal Historial y puntaje crediticio: Es necesario contar con historial crediticio y suelen solicitar mas de 600 puntos. Garantia de ingresos: Los prestamistas solicitaran que tengas un ingreso minimo anual y deberas presentar documentacion que lo avale.

¿Como saber si califico para un prestamo? Solicita el historial crediticio. ¿Como saber si aplicas para un credito?Tener un historial crediticio.No estar en la lista de los centrales de riesgo (la lista negra de Infocorp)Tener ingresos fijos y comprobados.Estar dentro del rango de edad que pide la financiera.

Antes de conceder un prestamo, las entidades financieras suelen exigir una serie de requisitos y garantias para comprobar la solvencia del cliente y verificar la capacidad de endeudamiento. Entre ellos, ser mayor de edad, la existencia de otros prestamos anteriores y tener solvencia e ingresos estables.

¿Como saber si califico para un prestamo? Solicita el historial crediticio. ¿Como saber si aplicas para un credito?Tener un historial crediticio.No estar en la lista de los centrales de riesgo (la lista negra de Infocorp)Tener ingresos fijos y comprobados.Estar dentro del rango de edad que pide la financiera.

Por fortuna, hay mas de un modo de obtener una tarjeta de credito sin un numero de seguro social.... Solicite un numero de identificacion individual del contribuyente (ITIN)Elija bancos que acepten un ITIN o una identificacion alternativa.Revise su credito.Solicite una tarjeta de credito.